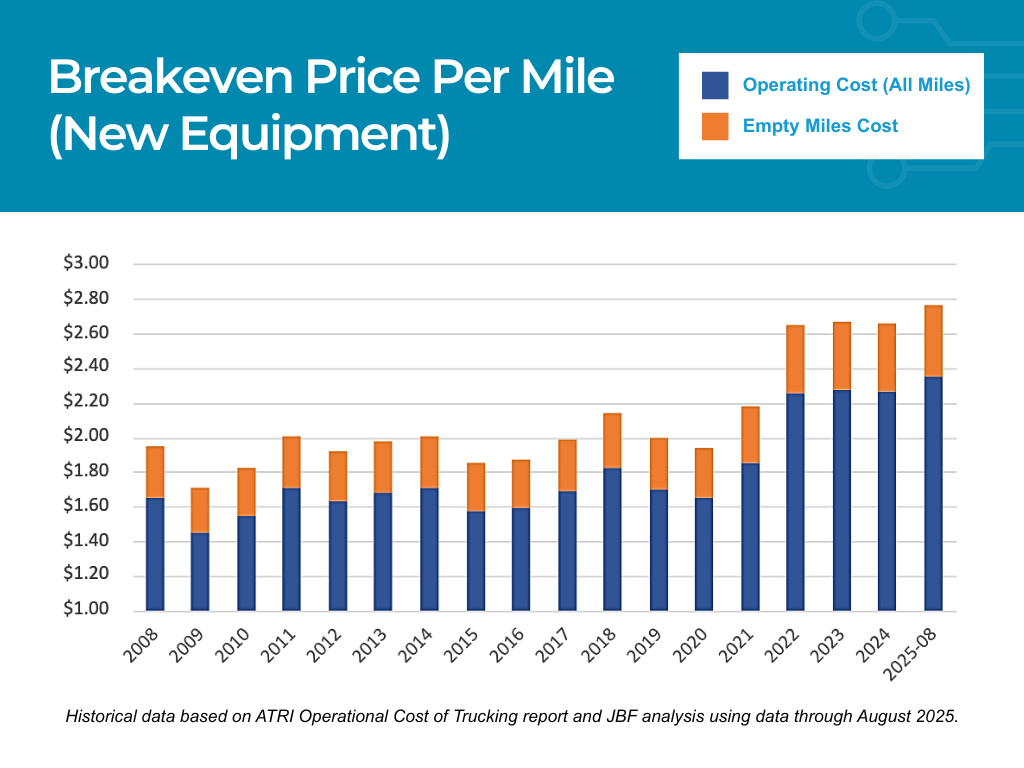

Truckload costs and the associated market prices are—for four years in a row now—still at or near the lowest threshold that the market can support. Last year we predicted that prices would move upwards significantly due to increasing demand, attrition of supply, replacement of older equipment, or a combination of all three. Instead, we have faced a delicate balancing act where each element has absorbed just enough impact from the others, so that the markets stay in relative equilibrium. But like an iceberg on the horizon, there is a world of risk hiding beneath stagnant top-level prices.

Total costs continue to set record highs, while market rates have, for the most part, remained steady. We are in a situation where a significant increase in any aspect of the cost structure will likely drive truckload prices upward. Carriers and Owner Operators are simply not able to absorb even moderate increases in costs, and thus the industry will have to raise rates, especially as older equipment continues to be sunset in favor of newer tractors and trailers.

As has been the case for well over a year now, any major downward pricing pressure will have an impact on the supply side of the equation, leading to increased Carrier attrition and pulling prices upward again. For Shippers, this market fragility continues to favor partners that are willing to reward high-performing Carriers and, where Private Fleets are involved, pay their Drivers reasonable wages, provide better-quality working conditions, and facilitate a favorable work-life balance.

"We are in a situation where a significant increase in any aspect of the cost structure will likely drive truckload prices upward."

With that, it is time to dig into the details around the updated 2025 numbers, highlight some of the key interactions with the current freight market, and address potential impacts related to overall economic trends.

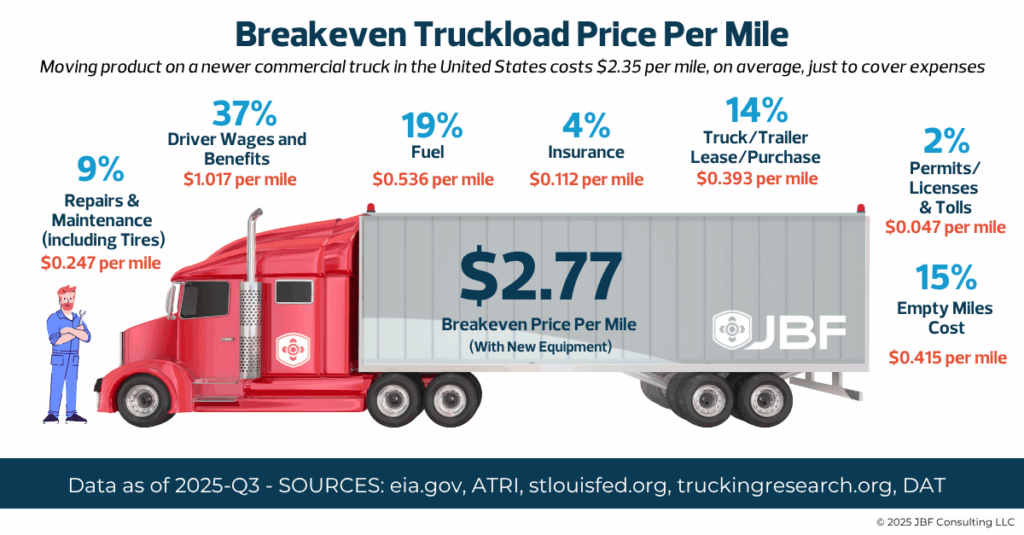

Truckload Breakeven Price Per Mile is now at $2.77—a year-over-year increase of only $0.05 (1.8%), a modest increase.

Our updated Total Costs Per Mile estimate when using new equipment is $2.35 when using newly purchased equipment. The additional $0.42 per mile for Breakeven Price covers the costs incurred when a Carrier is running empty miles, generating costs that need to be recovered via increased per mile rates.

The pricing increase associated with 15% empty miles is used to reflect the overall miles driven by Carriers, not just paid miles. Specifically, this value captures the pricing effect associated with running empty miles that are non-revenue generating. We have applied a single percentage based on typical fleet averages, though the difficulty finding matching loads can vary heavily depending on several factors, including geography, shipper relationships, closed loop & roundtrip arrangements, and more—finding perfectly matched loads is not an easy task!

In our last update, we noted that Contract Rates would be highly unlikely to dip below $2.30 per mile, given the increasing costs and pricing pressures from Spot Rates. Indeed, average Market Contract Rates dropped to around $2.40 per mile and have not budged much from that value since (https://www.dat.com/trendlines/van/national-rates).

Spot Rates have ticked up in the past few weeks, but they have remained close to $2.00 per mile on average since February of 2025.

Fuel consumption has been updated to 7.0 miles-per-gallon, more accurately reflecting current averages, which have improved as newer, more efficient equipment replaces older power units.

Insurance was bumped up a full 10% from the 2024 ATRI data due to recent trends. While this is a relatively small portion of total breakeven costs (only 4%), amid a market with low freight demand, large increases in premiums from insurance providers could well lead to additional Carrier attrition. We will be keeping a close eye on how the commercial vehicle insurance industry continues to change.

New vehicle costs are now 14% of the Breakeven Price per Mile when using newer equipment (17% of costs) and continue to rise amid tariffs, depressed freight market fundamentals, and general economic uncertainty.

Tariffs on steel, aluminum, and copper combined with domestic labor constraints, high costs, and infrastructure limits, have led to higher prices of new equipment. Additional tariffs on imported tractors will put even more upward pressure on prices, as domestic manufacturers are unlikely to expand production capabilities until demand for new vehicles rises significantly from current levels.

New vehicle orders are down approximately 40% year-over-year as of September. Fleets are delaying new orders, favoring used equipment and delaying expansion until market conditions show signs of stabilizing.

Impacted by the rising cost of new equipment, demand for used vehicles is primed to increase. This is another area we are monitoring closely, as a spike in demand for transportation services could easily send prices of both used and new equipment soaring—it often takes months to get new vehicles delivered once ordered, and there is only so much used supply to close the gap.

Other cost factors have moved very little compared to the values seen last year in September of 2024.

Driver wages and benefits ticked up slightly—and far less than in previous years—but remain at the new standard of greater than $1.00 per mile on average. Markets have finally caught up to the inflationary factors that drove Driver wages up over the last five years, though a spike in demand could lead to a new wave of wage increases, even though job postings have temporarily declined. Tariff uncertainties, rising insurance premiums, and depressed demand for transportation will keep wages in check for the foreseeable future.

Fuel prices are also very similar to this time last year. Predicting fuel prices is always tricky, and changes can happen very quickly. Volatility in the fuel market could be a catalyst for change, as a significant increase in fuel costs would likely reset transportation pricing expectations on the whole—resulting in permanently increased market rates, as there is near-zero room to decrease prices nor absorb additional fuel costs.

Spot Rates have held fast hovering around the $2.00 per mile mark with limited periods of higher prices. [1]

We noted in last year’s update that a realistic short-term absolute floor for the Spot market was $1.85 per mile. With wages and benefits being over $1.00 of the cost equation, Spot Rates could theoretically drop closer to $1.70 per mile, but that implies Owner Operators are sacrificing wages and benefits and/or operating equipment closer to the replacement age (7.3 years / approximately 588,000 miles according to the ATRI 2024 respondents).

Also according to the 2024 ATRI respondents, they have been increasing both annual mileage (almost 82,700 miles) and number of days equipment is being used (268 days), now for two years in a row. This further indicates that Carriers & Owner Operators are trying to get the most out of their existing equipment and avoid replacing any units that have been sunset.

Overall, much like last year, prices have little room to go lower, with many Drivers/Carriers continuing to operate with minimal profit or even at a loss. Put simply, this is not a viable long-term operating model, and we have been testing the market limits for close to two years now.

[1] https://www.dat.com/trendlines/van/national-rates

This year we are also including data from the 2025 NPTC Benchmarking Survey, where comparable Private & Contract Fleets are operating at a comparable cost of $2.39 per mile. [2] [3]

In general, Private & Dedicated Fleets total market share for outbound transportation has remained high (approximately 70%), as Shippers have stabilized their capacity amid relatively affordable for-hire rates.

The number of moves for Inbound has actually increased this year, with Private & Dedicated Fleets contributing nearly 50% of all moves. This could be a result of Shippers hedging against capacity constraints and the growing possibility of a spike in both for-hire Spot and Contract rates.

Once for-hire Carrier rates begin to (finally) rise again, Private Fleets will have more incentive to expand. Direct cost savings will join the more often cited reasons for having a Private Fleet: improved customer service, a hedge against for-hire Carrier rates, and better ability to react to changing operational demands.

[2] Benchmarking Report – National Private Truck Council; requires NPTC membership

[3] The above per mile rate excludes overhead and other miscellaneous costs that add a significant $0.54 per mile on average to Private & Contract Fleets total operating costs

What Now?

If you are a Shipper, it is important to understand that at some point either attrition, increased demand, or a combination of both will push up truckload prices—the ice hiding under the water will reveal itself. While determining the timing of the increase is difficult—we are dealing with higher-than-normal levels of uncertainty—there are several signs pointing to upcoming sustained increases over the next year, as noted above. What can you do to mitigate those potential price increases?

We said it last year, and it continues to hold true now: keep a healthy balance of Contract versus Spot Rates. With a convergence in these prices likely to be the first step when a market correction occurs, consider expanding your percentage of Contract Rates to hedge against rising costs in the Spot market and ensure that when it comes time to lock in more capacity, you are one of the first in line to lock in longer-term rates—and a prior level of commitment helps establish a solid working relationship with your Contract Carriers. Overall, the market still represents a solid opportunity to negotiate Contract Rates, especially as current prices are more likely to rise quickly than they are to drop further.

Shippers with existing Private Fleets should also evaluate increasing the size of their fleet. New equipment prices have been steadily rising. Now tariffs have the potential to accelerate that trend, which in turn will further drive up demand for more cost-effective used items. There is currently an opportunity to get ahead of the next lease/purchase wave while overall demand is still low, though it is tricky to tell how long that window will remain open.

An additional benefit if you have access to a Private and/or Dedicated Fleet, is leveraging those resource to service specific lanes. The key is to identify the higher-priced lanes and assign your fleet assets to service them, while using a combination of Contract and Spot Rates where the market supports lower-priced lanes.

"If you are a Shipper, it is important to understand that at some point either attrition, increased demand, or a combination of both will push up truckload prices."

Regardless of your current situation, improvements in technology, people, and processes can help set the foundation for policy and operational changes to avoid the worst of the icebergs headed our way. When swift change becomes necessary, you will need robust planning—combined with a well-designed Transportation Management System (TMS) solution—to take advantage of the constantly shifting landscape. With signs pointing to an inevitable increase in truckload prices and many annual planning cycles right around the corner, consider requesting budget for improving or selecting a TMS that fits your specific needs, whether those are taking advantage of mode selection, leveraging zone skipping, adapting to changes in Spot Rates, or maximizing your Private Fleet utilization.

Every company has a unique combination of challenges and opportunities. If your company could use extra support in identifying where to spend your precious time and money, reach out to a trusted partner and have them take an objective look at your current situation.

With the growing potential for swift and significant change in the transportation landscape, a fresh view of your people, technology, processes, data, and policies will prepare your business to embrace the transformation, rather than being left behind while reacting to new operational threats that were hiding just out of sight.

About the Author

Chris Doersen is a Principal of Client Engagement at JBF Consulting, bringing more than 20 years of experience designing, modeling, and implementing logistics solutions for complex transportation networks. He partners with global shippers to drive efficiency, optimize fleet and carrier operations, and enable technology adoption that delivers measurable impact. Chris has deep expertise with platforms including Blue Yonder, Descartes, Llamasoft, and Appian, and has led large-scale network design and TMS implementations for leading manufacturers and distributors. Known for his analytical rigor and operational insight, Chris helps organizations turn transportation strategy into sustained results.

JBF Consulting helps shippers unlock cost savings, improve visibility, and build scalable logistics technology strategies. Contact us today to learn how our proven approach can deliver measurable benefits for your organization.

FAQs

While freight rates have remained mostly flat, total operating costs for carriers are at record highs. Factors include rising insurance premiums, tariffs on vehicle materials (steel, aluminum, copper), and the high cost of new and used equipment. Carriers have little room left to absorb these costs, meaning any further increase in expenses could quickly push rates upward.

As of Q3 2025, the breakeven cost per mile is $2.77, which includes an estimated $2.35 in total costs when using new equipment plus an additional $0.42 to account for non-revenue “empty miles.” This modest 1.8% increase from last year reflects the tight margins under which carriers operate.

Tariffs on imported tractors and key materials have made new vehicles more expensive, now representing 14% of breakeven costs. New truck orders are down about 40% year-over-year, pushing fleets to rely on older or used equipment. As a result, demand and prices for used trucks are expected to climb as capacity tightens.

Shippers should maintain a balanced mix of Contract and Spot Rates to hedge against volatility. Investing in a Transportation Management System (TMS) can improve agility and efficiency when market shifts occur. Additionally, shippers with Private Fleets should consider expanding their capacity before equipment and fuel prices rise further.

Companies should focus on strengthening their people, technology, and processes to adapt quickly when the market shifts. Partnering with logistics consultants like JBF Consulting can help identify cost-saving opportunities, optimize fleet utilization, and implement scalable technology solutions that prepare businesses for the next wave of industry change.