Commercial Trucking Operating Costs Mid-Year 2024-Q3 Update

Truckload costs and the associated market prices are—for three years in a row now—still at or near the lowest threshold that the market can support. Last year we predicted a gradual rise in truckload rates due to demand increasing incrementally and capacity slowly-but-surely keeping pace. Rates have remained relatively stable, with reduced fuel prices playing against rising Driver wages and equipment costs.

We see the current situation as a turning point, where total costs have jumped to record highs and any significant increase in fuel will drive truckload prices upward, as Carriers and Owner Operators are not in a position to absorb even moderate increases in costs.

On the positive side, the market has managed to prevent this downward pricing pressure from having a major impact on the supply side of the equation via Owner Operator and Carrier attrition. This does pose some risk though, as the overall supply of Drivers and equipment is relatively balanced to current demand and not necessarily robust enough to handle a major surge in volume.

For shippers, this market fragility continues to favor partners that are willing to reward high-performing Carriers and that pay Private Fleet Drivers reasonable wages. If inflation does manage to normalize in the coming months, then it will be a much smoother conversation when asking those stakeholders to hold steady on prices and wages over the short term.

Truckload Market Overview – September 2024

There is a lot to unpack from the updated numbers, and below are the highlights that you need to know for this update.

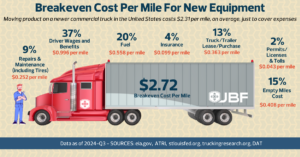

Truckload Breakeven Price Per Mile is now at $2.72—a 4.4% increase from our estimate in September of 2023.

- Our updated Total Costs Per Mile estimate when using new equipment is $2.31. This year we have increased our previously generous 12% empty miles to 15%, which more accurately reflects the overall volume of freight moving and the associated difficulty finding matching loads.

- Current market Contract Rates have been moving the other direction, declining slowly over the past year and hovering around $2.40 per mile. The continued convergence of Contract and Spot Rates reflects the breakeven operating costs for more stable lanes, where the cost of empty miles can often be mitigated. Even excluding empty miles, Contract Rates below $2.30 per mile are unlikely—which indicates that we are quickly approaching the price bottom for Contract Rates.

Several cost factors have changed in the past year, led by decreasing fuel costs and increasing Driver wages, lease/purchase prices, and maintenance.

- This is the first year that we are seeing Driver wages and benefits push to $1.00 per mile of cost. Pricing pressure that kept Driver wages down in 2023 could only last so long. Reduced costs associated with fuel may have also played a part, providing an opportunity to increase wages without increasing total costs or raising prices too much.

- Speaking of fuel, compared to last year at this time, prices were around $0.13 per mile more. While predicting fuel prices is tricky, we are expecting increases in the coming months, especially if interest rate cuts help jump start the economy and OPEC makes cuts on the supply side.

Even accounting for the drop in fuel prices, Spot Rates have held fast at or above the $2.00 per mile mark.

- A more realistic short-term floor for the Spot market is $1.85 per mile at current fuel prices. With wages and benefits being $1.00 of the cost equation, Spot Rates could theoretically drop closer to $1.70 per mile, but that implies Owner Operators are sacrificing wages and benefits and/or operating equipment closer to the replacement age (7.5 years / approximately 675,000 miles according to the ATRI 2023 respondents).

- Overall, much like last year, prices have little room to go lower, with many Driver/Carriers likely operating at no profit or even taking marginal losses on Spot moves to minimize empty miles—not necessarily a viable long-term operating model.

"Even excluding empty miles, Contract Rates below $2.30 per mile are unlikely—which indicates that we are quickly approaching the price bottom for Contract Rates."

What Can be Done to Mitigate Potential Price Increases?

Now some important questions for shippers: What should you focus on with the current market? Is there a way to mitigate potential price increases?

Keeping a healthy balance of Contract versus Spot Rates is critical. With a convergence in these prices, we recommend expanding your percentage of Contract Rates to hedge against rising costs across the market. Especially for companies with a solid working relationship with their carriers, it is a great time to negotiate long-term Contract Rates that align with the reduced market—again, on aggregate these prices appear to be reaching a minimum market point.

In the short-term there is minimal benefit to push hard on reduced rates, as the risk of alienating any key Carriers and losing capacity outweighs squeezing a few more cents out of your cost per mile. Especially with likely market price increases on the horizon, this is not the time to get too greedy, so continue communicating with your best carriers and establish a plan going into 2025.

"Keeping a healthy balance of Contract versus Spot Rates is critical. With a convergence in these prices, we recommend expanding your percentage of Contract Rates to hedge against rising costs across the market."

As before, if you have access to a private fleet and/or dedicated contract carriage, targeted lane selection for your dedicated drivers can lead to significant savings. The key is to identify the high-demand lanes, leverage your fleet assets to service them, and use a combination of Contract and Spot Rates where the market supports lower-priced lanes.

While this may sound simple, in practice, it takes a robust planning process—preferably combined with a well-designed Transportation Management System (TMS) solution—to take advantage of the constantly shifting rates landscape. With most signs pointing to incoming increases in prices, using a more advanced TMS can better take advantage of mode selection, zone skipping, and multi-trip routing, while simultaneously maximizing fleet utilization.

Every company has a unique combination of challenges and opportunities. If your business could use extra support in identifying where to spend your limited time and money, reach out to a trusted partner and have them take an objective look at your current situation.

With the changing truckload transportation landscape, a fresh view of your people, technology, processes, and policies by a trusted partner could generate substantial improvements to your business.

"For shippers, this market fragility continues to favor partners that are willing to reward high-performing Carriers and that pay Private Fleet Drivers reasonable wages."

A CLOSER LOOK AT THE DATA

Breakeven Price Per Mile (2024-Q3 Update): $2.718

Empty Miles Cost: $0.408 / 15% (based on Empty Miles Percentage of 15%, which has been increased from previous years to account for the growing empty miles due mainly to less overall freight moving)

Total Costs Per Mile: $2.310 (low national average estimate for newer equipment) | ATRI 2021 = $1.855 (mostly attributable to fuel differences) | ATRI 2022 = $2.251 (very similar to our recent calculation) | ATRI 2023 = $2.270 (also very similar to our September 2023 update, once adjusted for fuel)

Fuel Costs - $0.558 / 20% of total cost (based on $3.625 per gallon @ 6.5 mpg as of 09/02/2024)

Truck & Trailer Lease/Purchase - $0.363 / 13% (2023 ATRI value adjusted upwards by 0.8% for recent inflation based on Producer Price Index for Heavy Duty Truck and Trailer Manufacturing December 2023 [161.416] to July 2024 [162.754])

Repair & Maintenance - $0.252 / 9% (2023 ATRI values adjusted upwards by 1.5%, based on an approximated combination of the Producer Price Index and general wage increases in 2024; includes cost of Tires)

Insurance - $0.099 / 4% (no change to 2023 ATRI data)

Permits, Licenses, Tolls - $0.043 / 2% (no change to 2023 ATRI data)

Driver Wages & Benefits - $0.996 / 37% (ATRI data adjust upwards by 3.0% based on Bureau of Labor Statistics for ‘Transportation and material moving’ values from December 2023 [175.9] to June 2024 [181.1])

Data sources: eia.gov, ATRI, stlouisfed.org, truckingresearch.org, DAT.com

Factors Impacting Costs

Items that could INCREASE costs:

- Aging equipment has to be replaced—and the replacement rate accelerates

- Taxes—could see higher gasoline and/or road taxes

- Production shifting back to United States, thus reducing overall miles for finished goods—this has materialized in certain sectors of the economy

- Driver shortages continue to get even worse

- Owner-operators close down their business due to non-profitable market rates

- Ocean, rail, and intermodal rates continue to rise, which brings up truckload rates

- Demand for durable goods continues to grow, outpacing supply

- Regulatory mandates, such as increased

- Global events (large-scale military conflict, pandemic, etc.)

- Technology upgrades—investment in technology with upfront costs and long-term benefits

- Additional gas and/or usage taxes for infrastructure

Items that could DECREASE costs:

- New wave of drivers joins the workforce

- Electrification of tractors decreases demand for diesel fuel

- Domestic inventory continues to shift closer to end consumers

- More production shifts back to United States, thus reducing overall miles for finished goods

- More effective TMS planning reducing empty miles and increasing cube/weight efficiency

- Recession drives down overall production and demand for goods

- Consumer demand shifts towards services that require fewer durable goods

- Regulatory mandates, such as an increase in DOT driver hours or maximum gross vehicle weights

About the Author

Chris Doersen is an Executive Principal overseeing the Solutions Team at JBF Consulting. Chris’ talent is in leading diverse teams to create valuable and implementable solutions for complex supply chain networks.

He has 21+ years of experience working with large inbound and outbound supply chains in North America, Europe, and Brazil across a multitude of industries, including Automotive, Pharmaceutical, Retail, Consumer Packaged Goods, Food & Beverage, Appliance, Metals, and more. His functional expertise is in logistics management systems, network design tools, advanced transportation optimization, and continuous improvement processes.

In addition to being a certified Project Management Professional (PMP) and a Six Sigma Green Belt, Chris earned his BS in Marketing from The Ohio State University.