In this 2-Part series, JBF Consulting explores the impact of excessive loading times on shippers and carriers and the benefits of addressing this issue.

In Part 1, we looked at detention from a truckload (TL) carrier’s perspective, specifically in terms of the financial impact.

In Part 2, we will examine the issue from a shipper’s perspective, highlighting why the issue persists and what shippers can do to address excessive detention in their distribution center (DC) and yard operations.

Thesis

- Distribution Center operations that result in excessive loading/unloading times are a drag on carrier revenue and profitability

- The financial mechanism used by carriers to penalize shippers (i.e. detention charges) does not recover the totality of revenue lost by carriers

- Carriers respond to excessive detention with both higher rates and increased tender rejections

- In over-the-road truckload (TL) transportation, the buyer/seller relationship strongly favors the buyer due to the fragmented and commoditized nature of freight transport. Carriers that raise their rates are easily replaced with lower-cost carriers

- The inability of shippers to quantify the financial impact of detention leads to inaction

- This inaction leads to higher freight costs for individual shippers and the shipping community as a whole

Overview

As we saw in Part 1 of this series, excessive dwell time is a significant drag to carrier operations. It negatively impacts not only revenue but also safety and driver attrition. Therefore, a logical question when discussing detention is that if the problem is so severe, why has it not been addressed? After all, many brilliant minds have worked on an array of supply chain and logistics problems over the past 30 years. Innovations abound in pricing/demand shaping, inventory optimization, transportation planning, artificial intelligence, and robotics—to name just a few areas, however, too often we cannot efficiently load and unload TL carriers in our yards.

In this article, we discuss:

- The cost of detention beyond transactional accessorial penalities

- The reasons why shippers often do not take it upon themselves to address the issue

- Approaches that shippers should consider to address the issue, thereby gaining competitive advantage

Shipper Impact on Base Rates

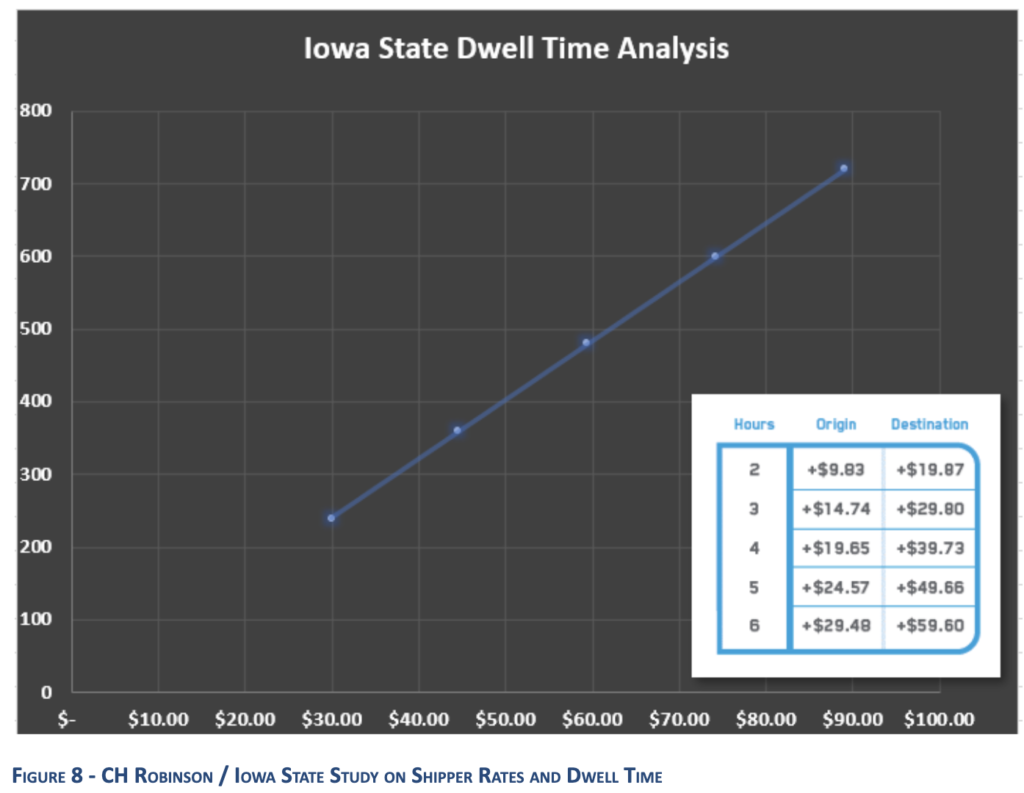

A recent study by CH Robinson and Iowa State University seems to confirm the obvious: the cost of carrier detention will be passed back to the shipper and not just in detention fees (see figure 8). Their analysis looked at over 300,000 loads and found that shippers with long dwell times paid more in their base rates than comparative shippers with shorter dwell times. The higher rates were in addition to any detention fees that were applied. A few points of specific interest from the study include:

- Every hour of dwell time across the shipper/receiver locations increases base rates by approximately 1.3%

- Detention at the destination is more costly than detention at the origin

- Base rates are impacted by both the average dwell time as well as the variability of dwell time at a facility

So, Why Does the Problem Persist?

Reason #1 – The majority of the EXPLICIT costs fall to carriers and not shippers

Shippers, not carriers, need to address the problem, but they are not incentivized to do so. When it comes to truckload transport, the power dynamic between the buyer (shipper) and the supplier (carrier) is heavily in favor of the buyer. Key characteristics of describe the power dynamic, as described by Michael Porter’s 5 Forces, show why this is the case:

- There are many potential carriers for a shipper to select from

- The cost of replacing a carrier is low

- Carriers are primarily differentiated by cost

- The service is largely commoditized

- There is no labor solidarity amongst the carriers. The market is extremely fragmented, with no ability to systemically orchestrate selling power

- There is virtually no chance that a carrier can “forward integrate” and thereby disintermediate the shipper

Therefore, when the carrier requests additional compensation to recover lost revenues, they are easily replaced by other carriers who may price their services ignorant of the shipping and receiving practices of the buyer.

Reason #2 – Shippers lack the tools to collect this data and make an informed change

For those who understand the value of becoming a “Shipper of Choice,” the tools necessary to understand where change needs to occur are often lacking.

Visibility from when a driver checks in to when they leave the yard is a key factor in calculating dwell times. There are many tasks for the driver to perform once he/she is at the shipper facility, which incrementally add up to long wait times. Understanding where the bottlenecks are is critical to developing a more streamlined process. Steps to avoid bottlenecks include:

- An efficient check-in process, including providing the correct identification and documentation for the pickup or delivery

- Clear direction on how long the driver may need to wait and where to pull aside

- Guidance on where a driver needs to take the trailer and the best possible path to do so

- Details on which dock or yard spot to unload the trailer

- Information on what amenities are available for the driver while the trailer is being loaded/unloaded

- Seamless check-out process

Reason #3 – Shippers are unable to determine how much excess detention truly costs; therefore, business cases understate the value of a Detention Reduction Initiative

The explicit cost that a shipper sees for poor loading/unloading operations is in their detention accessorial fees. A shipper can easily sum up these costs as they are line items on their freight invoices. However, those fees do not represent the totality of the cost that the shipper incurs, as we have discussed. Unfortunately, distilling the total cost of inefficient operations is difficult since TL pricing is complex and dependent on many factors, including:

- The lane in question and how that relates to vehicle utilization. For instance, how many empty miles will typically be required to pick up a load at the shipper, and then how many empty miles to reposition after unloading at the receiver

- The buyer’s payment terms

- The buyer’s fuel surcharge program

- The buyer’s accessorial schedule/charges

- The buyer’s shipping/receiving operating hours

- The buyer’s required operating procedures

Additionally, TL pricing is highly correlated to the macroeconomic environment. Periods of fast economic growth typically lead to network-wide capacity constraints and higher rates, while economic slowdowns cause a contraction in freight volumes with correspondingly lower rates. This further muddies the water and makes quantifying the impact of detention harder to confidently calculate.

Therefore, when building a business case to address detention, explicit costs (i.e. detention fees) are weighed more heavily by a shipper than implied savings that may not be captured for years. In fact, most stakeholders will not include the potential of lower rates sometime in the future in a business case aside from capturing it as a “soft” benefit. As such, the problem often goes unaddressed since the underestimated ROI of the initiative does not justify the funding.

While the costs are hard to quantify and decouple from other factors, they are undoubtedly there. Rick Jordon, Senior Managing Director at FTI Consulting stated it succinctly.

“Carriers are getting more sophisticated and more focused on profitability, utilizing tools, and metrics built on detention statistics. This data factors into bidding strategies and how the carrier will prioritize loads when capacity is tight.”

-Rick Jordon, Senior Managing Director at FTI Consulting

Reason #4 – Addressing detention will not yield immediate results

If a shipper or receiver has a reputation for inefficient loading/unloading practices, their reputation will not be rehabilitated quickly. Carriers will factor that shipper’s reputation into their rates until they build up enough history to know that the problems have been successfully resolved. As a result, there are long delays in benefits being recognized.

To be clear, focusing on the problem will enable the shipper to reduce a portion of their detention accessorial fees, but the majority of value will not be seen right away. Policy changes, better technology, and more efficient processes can minimize the frequency of dwell time, but the resulting cost structures can take years to unwind within an established relationship.

Approaches to Mitigate

In freight logistics, there is a constant tension between shippers and their transportation service providers. Negotiations tend to be adversarial and predicated on the belief – by both parties – that they represent a zero-sum game. What is good for the carrier must necessarily be bad for the shipper and vice-versa.

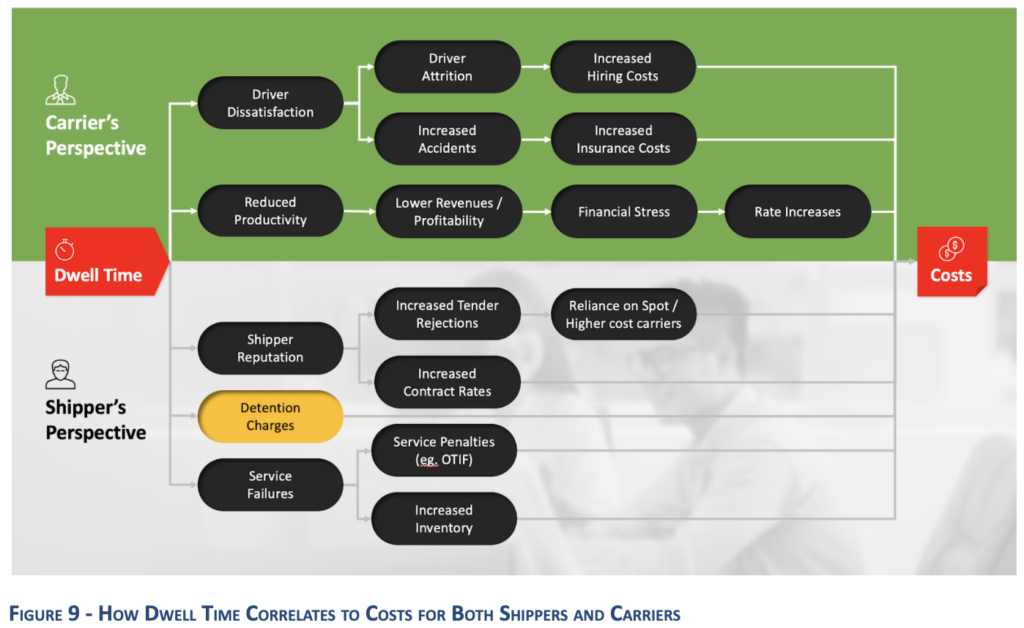

However, both shippers and carriers will benefit from initiatives that seek to minimize detention. While the individual benefits differ between shippers and carriers, the commonality is that a reduction in detention time has the net impact of increasing asset and labor productivity, which will drive down costs for both parties, as we can see in Figure 9.

Essentially, lowering detention time is a win-win opportunity. It offers the ability for carriers to increase the productivity of their assets, improve safety, and heighten the morale of their drivers. Similarly, shippers benefit through lower contract rates, higher tender acceptance rates, and lower exposure to the volatile spot markets. It is also important to note that while efficient yard operations are beneficial to shippers at all times, they become critically important during periods of tight capacity when carriers have many options.

Our Approach

JBF Consulting recommends shippers take a serious look at detention and its impact on their carriers and rates. Reducing detention can be done in a variety of ways and will depend on the identified root cause(s).

The first step is to determine if you have a problem by assessing your operations:

- What are the annual detention fees you pay to your carriers? In the past few years, have these costs been increasing or decreasing

- When meeting with your carriers, what is their perception of your loading/unloading operations? Do they view you as a “Shipper of Choice?”

- If you are shipping from your suppliers or to your customers, how are their loading and unloading operations?

- How do your rates compare to other similar shippers?

- Do you have mechanisms in place to capture the average amount of time it takes to complete each step in the loading/unloading process? These would include steps such as:

Gate Check-In

Wait time prior to load/unload

Physical loading/unload time

Paperwork preparation

Gate check-out

- When detention occurs, what step in the process is typically the bottleneck

- Data analysis should include not just average times for each step, but a quantification of the variability of those times

- If a detention accessorial fee is requested by a carrier, do you have the means to check internal systems to validate/invalidate the request?

Attributes of well-performing yards vary, but commonalities include:

- Operational KPIs are captured that measure average and variability in carrier dwell time and provide insights into continuous improvement opportunities

- DC labor staffing that is aligned to inbound and outbound freight volumes

- The implementation of a drop trailer program. This is typically limited to the larger, core carriers used by a shipper, but they provide flexibility to the DC while also reducing carrier dwell time

- The use of a dock scheduling solution that can serve to even out the flow of trailers over a day and align that flow with loading/unloading capacity (e.g. dock doors and labor)

- A yard management solution that can prioritize which trailers are processed based on wait times and detention fee impacts

- Dynamic in-transit appointment scheduling used in the event a carrier is running late or early

Summary

For carriers, excessive detention is a significant hindrance to profitability. For many shippers, however, detention is not a significant cost item, and, therefore, not a top-of-mind issue worthy of addressing. Shippers that look at detention in this manner may be costing their organizations significantly more than they believe.

When pricing out a long-term contract or a spot quote, carriers consider the total cost of servicing a shipper. As such, they will apply premiums for those customers that negatively impact their bottom line. While detention fees may be a rounding error for many large shippers, I would urge them to consider the premiums they may be paying through higher contract rates, higher tender rejection percentages, and an increased reliance on the spot market.

For an assessment and more information as to how JBF Consulting can assist you with your transportation and logistics needs, please email us at info@jbf-consulting.com.

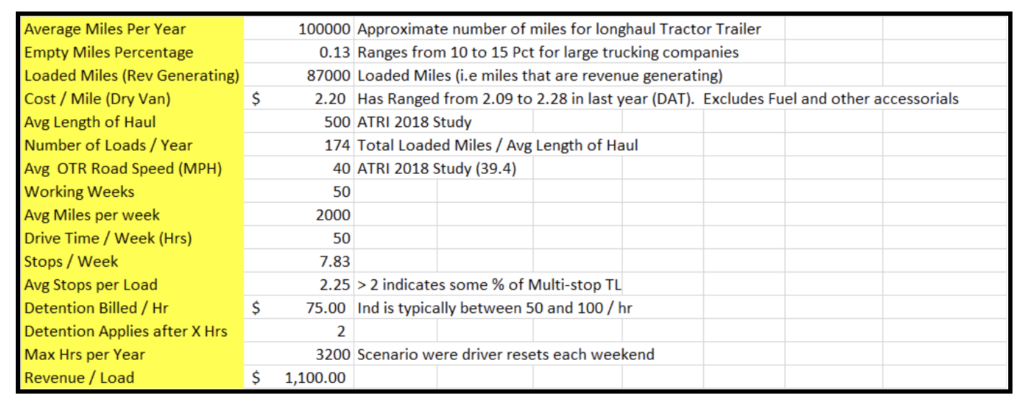

Appendix

Assumptions and variables used in the Detention Impact Model

Additional Resources

CH Robinson White Paper Do “Favored Shippers” Really Receive Better Pricing and Service?

ATRI Operational Costs of Trucking 2018

OOIDA 2019 Detention Time Survey

Uber Freight 2020 Facility Insights Report

About the Author

Mike Mulqueen is the Executive Principal of Strategy & Innovation at JBF Consulting. Mike is a leading expert in logistics solutions with over 30 years managing, designing and implementing freight transport technology. His functional expertise is in Multi-modal Transportation Management, Supply Chain Visibility, and Transportation Modeling. Mike earned his master’s degree in engineering and logistics from MIT and BS in business and marketing from University of Maryland.

About JBF Consulting

Since 2003, we’ve been helping shippers of all sizes and across many industries select, implement and squeeze as much value as possible out of their logistics systems. We speak your language — not consultant-speak – and we get to know you. Our leadership team has over 100 years of logistics and TMS implementation experience. Because we operate in a niche — we’re not all things to all people — our team members have a very specialized skill set: logistics operations experience + transportation technology + communication and problem-solving skills + a bunch of other cool stuff.