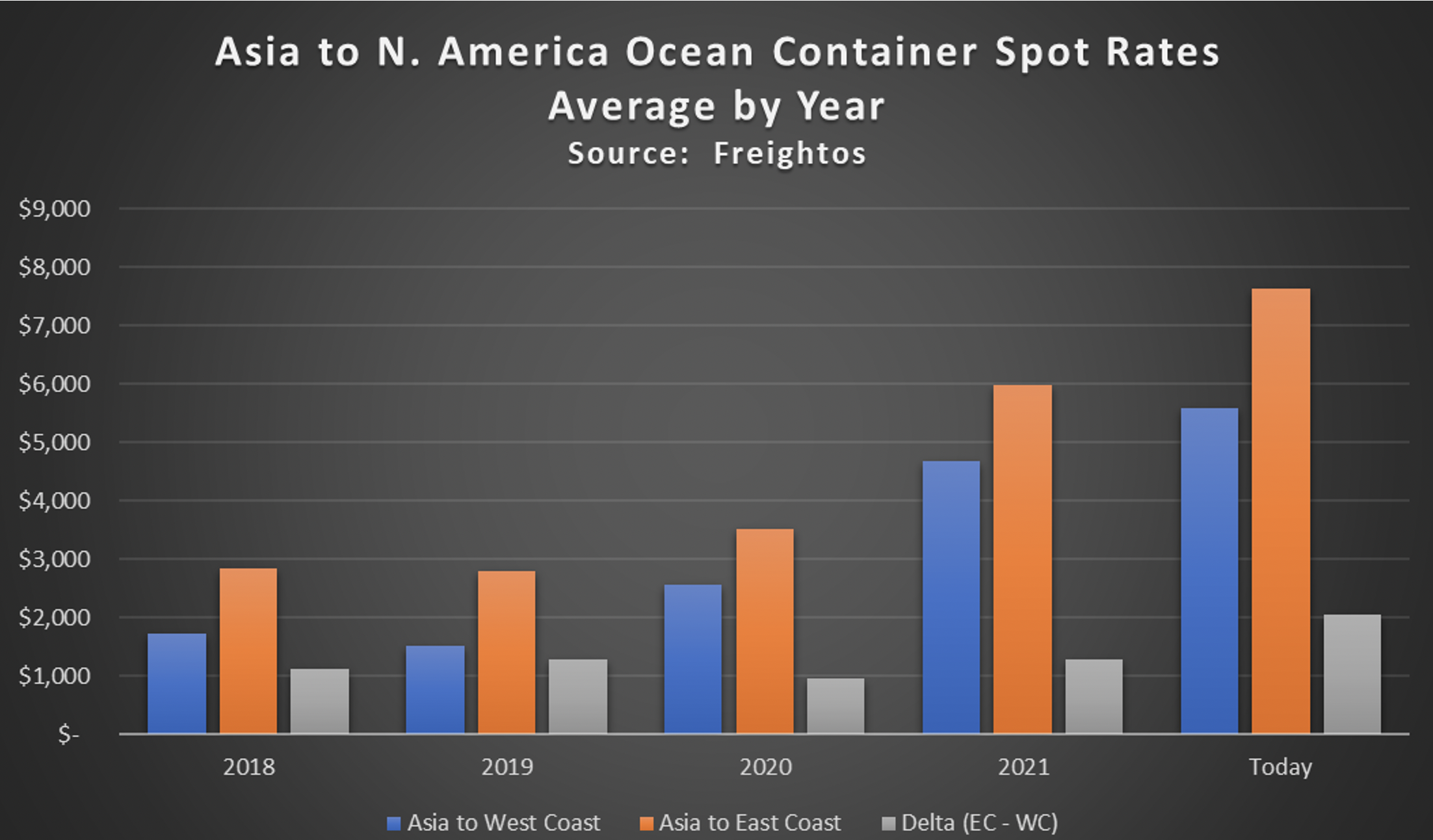

OCEAN CONTAINER RATES (Asia to US)

Spot Rates - FEU Container Rates: Asia to US East & West Coast

Source: Freightos

Ocean spot rates continue to set records. Asia to west coast trade lane spot rates averaged $5575, while the east coast trade lanes were just over $7600 / FEU according to Freightos’ data from May 21, 2021. This was the first weekly spot rate reading where shipping to the East Coast was $2000 or more above the Asia to west coast trade lanes.

Asia to North America Ocean Container Spot Rates

Source: Freightos

However, simply paying the spot charges won’t get you a container. Additional premium surcharges are being applied that may increase the costs by $5000/FEU or more.

Additional challenges abound including reduced, but still excessive port congestion, exceedingly poor on-time performance and a growing container shortage driven by unprecedented demand for primarily Asian-born products.

DIESEL

Diesel Price

Source: EIA

After a brief pause in April, diesel has resumed its upward trajectory with national prices for the week of May 24th at $3.25 / gallon, according to the Energy Information Administration (EIA). This is an increase of .88 / gallon since November 2nd. Diesel has now risen 25 of the last 29 weeks and is at its highest point since November 2018.

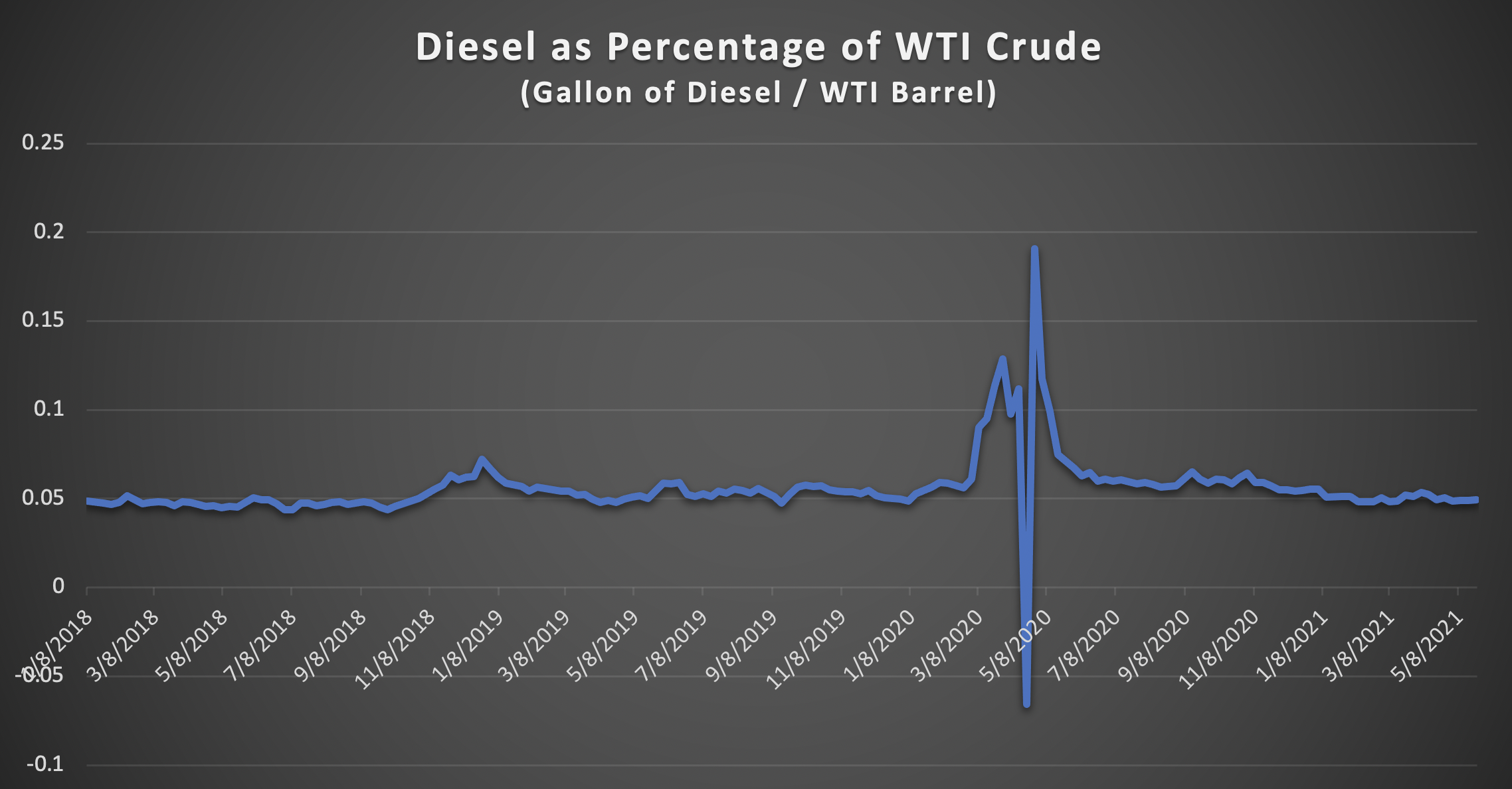

Diesel as Percentage of WTI Crude

Ignoring last spring’s anomaly, diesel prices have historically been ~5% of the price of WTI oil.

Analysts are expecting oil to trend higher as the global economy recovers and summer driving season kicks into gear. This implies that we could see diesel hitting $4.00 / gallon if WTI rises to $80, as some analysts are predicting.

DAT DRY VAN

Contract Van Rates and Spot Van Rates

Source: DAT

The latest data from DAT has May 2021 dry van contract rates up to $2.68 / mile, with spot rates (excluding broker markups) at $2.60. Refrigerated and flatbed rates are both near $3.10 / mile.

While rates are at historic highs, DAT has seen a recent decline in the loads to truck ratio. If this trend continues, it should eventually correlate to lower costs for shippers as carriers begin competing for loads.

However, the recent governmental stimulus, the continued replenishment of depleted inventories, and the expected economic growth will continue to keep rates elevated, albeit at perhaps slightly lower levels.

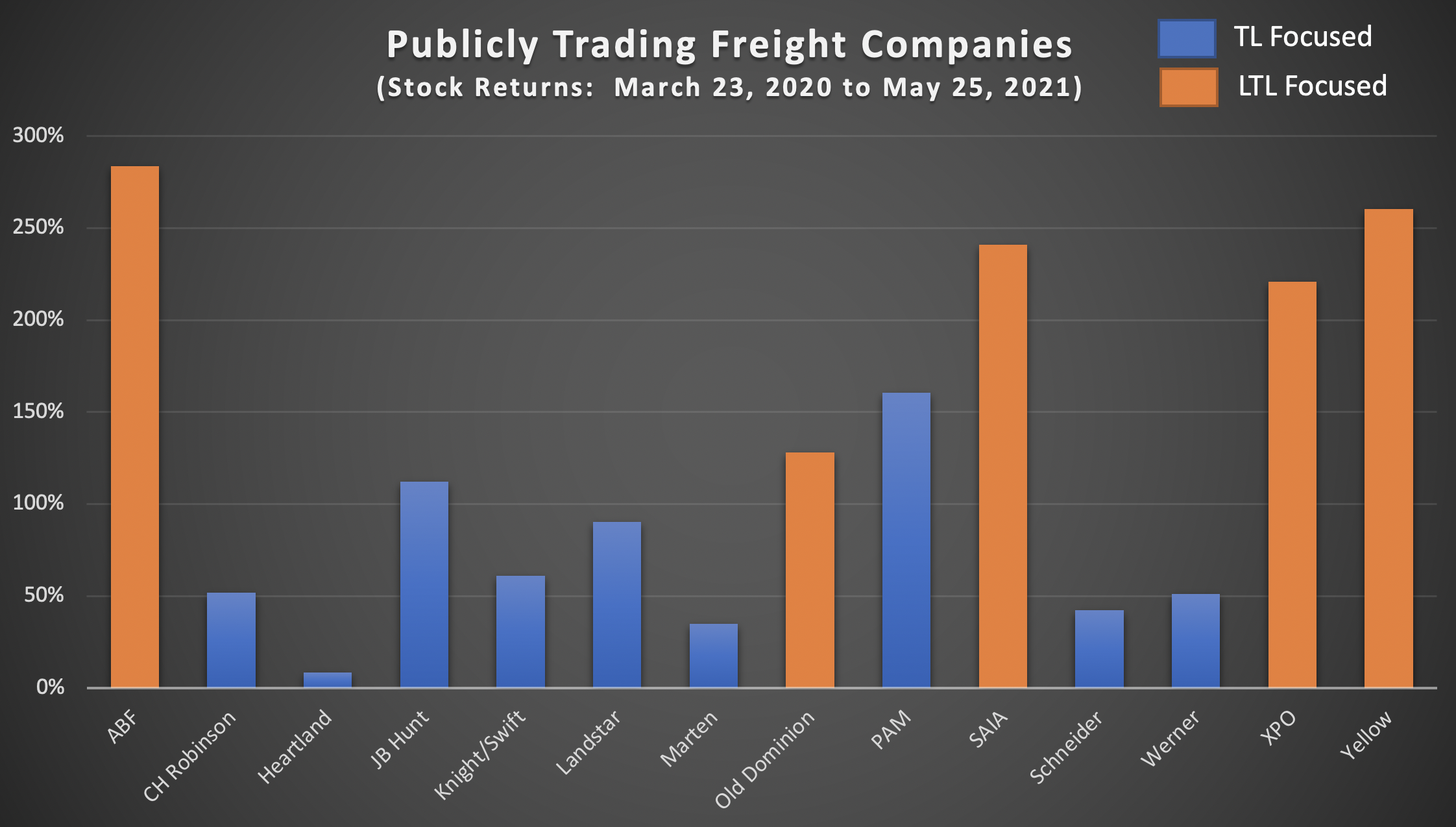

Publicly Traded Freight Companies

Another positive factor to consider is the financial returns we are seeing from the publicly traded TL and LTL carriers.

Over the past 14 months, these carriers have seen significant upswings in their share prices and financial well being, especially in the LTL sector. Lower operating ratios enable carriers to invest more in assets and labor, which will ultimately serve as a brake on the seemingly one-way direction of freight rates.

Sources referenced in this post: Freightos, US Energy Information Administration, DAT, Freightwaves, WTI

RELATED READING

Transport-Centric Macroeconomic Metrics: May 3, 2021 Update

Transport-Centric Macroeconomic Metrics: March 21, 2021 Update

Transport-Centric Macroeconomic Metrics: February 18, 2021 Update

Transport-Centric Macroeconomic Metrics: January 20, 2021 Update

Transport-Centric Macroeconomic Metrics: February 28, 2022 Update

About the Author

Mike Mulqueen is the Executive Principal of Strategy & Innovation at JBF Consulting. Mike is a leading expert in logistics solutions with over 30 years managing, designing and implementing freight transport technology. His functional expertise is in Multi-modal Transportation Management, Supply Chain Visibility, and Transportation Modeling. Mike earned his master’s degree in engineering and logistics from MIT and BS in business and marketing from University of Maryland.

About JBF Consulting

Since 2003, we’ve been helping shippers of all sizes and across many industries select, implement and squeeze as much value as possible out of their logistics systems. We speak your language — not consultant-speak – and we get to know you. Our leadership team has over 100 years of logistics and TMS implementation experience. Because we operate in a niche — we’re not all things to all people — our team members have a very specialized skill set: logistics operations experience + transportation technology + communication and problem-solving skills + a bunch of other cool stuff.