This is not the time to get too greedy, so be transparent with your best carriers and create a mutually beneficial plan.

Prices have gone up. And up. That nasty word, “inflation”, has materialized with a vengeance, and it has impacted the transportation industry. With a shifting market across both the demand and supply sides, there are fundamental questions that many managers and leaders are asking:

Are these prices going to stabilize?

Are we in for further volatility?

What do I need to know about shifting market rates and actual operating costs?

And how does all of this affect my business strategy?

Drivers are still in high demand, allowing them to successfully convert inflation into higher wages, even as the overall workforce’s wages have struggled to keep pace. In turn, demand has risen, as people have spent their accumulated savings from the past few years, including making larger purchases that were either delayed or not possible during the pandemic. As always, there are a range of wild cards (see the table below for details) that could tilt prices in either direction.

Before further examining the price side of the equation, let’s turn our attention to the operating costs and evaluate the updated trucking price floor.

With a shifting market across both the demand and supply sides, there are fundamental questions that many managers and leaders are asking.

A note before proceeding

The below analysis is for national average pricing for traditional fifty-three-foot tractor-trailer moves. Regional—most certainly specific lanes—can vary wildly in price depending on the supply-demand equation and local fuel prices. Expect to see higher prices for refrigerated, flatbed, and other more specialized equipment within the industry, as well.

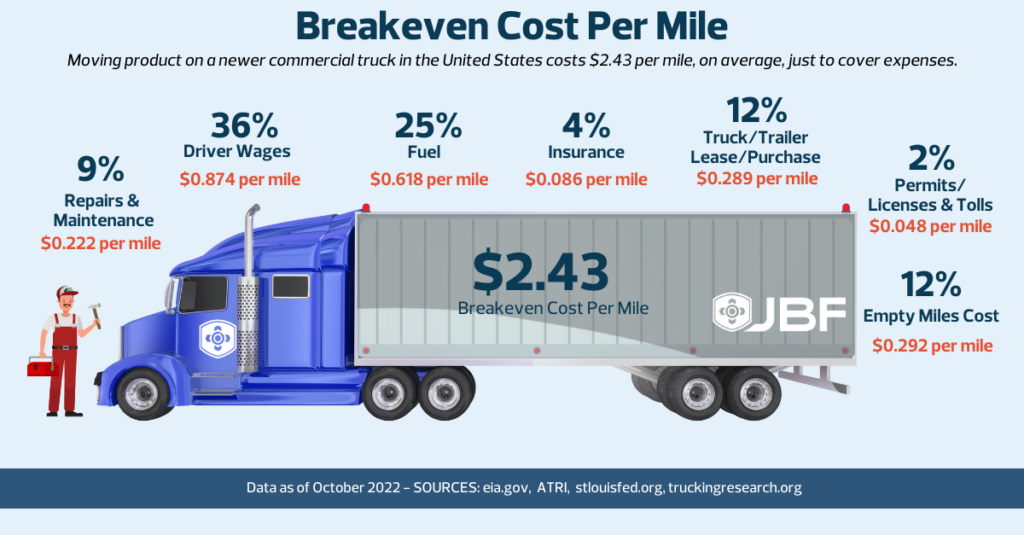

In the end though, the overall pricing is limited by costs and thus the ability to generate a long-term profit. And, yes, to almost no one’s surprise, the breakeven costs have gone up from the $2.17 average that we predicted back in October 2021.

A CLOSER LOOK AT THE DATA

Values for 2022 in this article used the 2022 ATRI data as a starting point, which is the latest available data at the time of publication.

Breakeven Price Per Mile (2022/2023 Update): $2.430

Empty Miles Cost: $0.292 / 12% (based on Empty Miles Percentage of 12%, which is generous)

Total Costs Per Mile: $2.138 (low national average estimate for newer equipment) | ATRI 2021 = $1.855 (mostly attributable to fuel differences)

Fuel Costs - $0.618 / 25% of total cost (based on $4.02 per gallon @ 6.5 mpg as of 05/08/2023

Truck & Trailer Lease/Purchase - $0.289 / 12% (based on ATRI 2021 price of $0.279 and adjusted up 3.7% for recent inflation based on Producer Price Index for Heavy Duty Truck and Trailer Manufacturing, January 2021 to March 2023)

Repair & Maintenance - $0.222 / 9% (increased 3% from 2021 ATRI data, including cost of Tires)

Insurance - $0.086 / 4% (no change from 2021)

Permits, Licenses, Tolls - $0.048 / 2% (no change from 2021)

Driver Wages & Benefits - $0.874 / 36% (Both increased by 8% from 2021 ATRI data)

Data sources: eia.gov, ATRI, stlouisfed.org, truckingresearch.org

The headline takeaway from this cost analysis update is that in the past eighteen months or so, we have seen a 12% increase in the breakeven truckload cost for anyone using newer equipment.

In general, increased wages and rising diesel fuel prices are the main contributors to recent increases in operating costs. As older equipment is sunset, the operating costs for carriers and owner-operators—and thus market rates for shippers moving product on commercial tractor-trailers—will continue to rise.

The following is from our assessment in 2021, which has proven all too true:

“On the whole, it seems unlikely that the decreasing factors will win against the tide of increasing costs. And with inflation still making its presence felt, the days of less than $2.00 per mile all-in truckload rates will become nothing more than a fond memory.”

That being said, market spot rates are currently near $2.00 on average on May 10th, 2023.

If you decouple the driver wages and benefits from the breakeven cost per mile, you get approximately $1.55 per mile. This is assuming zero driver pay for larger carriers and zero profit for owner-operators. In reality, there is still plenty of older equipment on the road and owner-operators are likely willing to take temporary pay cuts.

With those assumptions, the spot rate market is unlikely to go below $1.80 average before large portions of the industry are massively disrupted, including owner-operators and smaller regional carriers leaving the industry entirely. The result would be reduced capacity and a quick rise in prices. The one caveat here is that diesel fuel prices could drop dramatically, with a realistic maximum decrease is only $0.20 per mile—resulting in short-term minimum sport rate pricing of $1.60 per mile.

Overall, though future cost increases will likely not be as fast as the past three years, there are a few wild cards that could swing the operating costs trend either up or down.

The headline takeaway from this cost analysis update is that in the past eighteen months or so, we have seen a 12% increase in the breakeven truckload cost for anyone using newer equipment.

Factors Impacting Costs

Items that could INCREASE costs:

- Aging equipment has to be replaced—and the replacement rate accelerates

- Taxes—could see higher gasoline and/or road taxes

- Production shifting back to United States, thus reducing overall miles for finished goods—this has materialized in certain sectors of the economy

- Driver shortages continue to get even worse

- Owner-operators close down their business due to non-profitable market rates

- Ocean, rail, and intermodal rates continue to rise, which brings up truckload rates

- Demand for durable goods continues to grow, outpacing supply

- Regulatory mandates, such as increased

- Global events (large-scale military conflict, pandemic, etc.)

- Technology upgrades—investment in technology with upfront costs and long-term benefits

- Additional gas and/or usage taxes for infrastructure

Items that could DECREASE costs:

- New wave of drivers joins the workforce

- Electrification of tractors decreases demand for diesel fuel

- Domestic inventory continues to shift closer to end consumers

- More production shifts back to United States, thus reducing overall miles for finished goods

- More effective TMS planning reducing empty miles and increasing cube/weight efficiency

- Recession drives down overall production and demand for goods

- Consumer demand shifts towards services that require fewer durable goods

- Regulatory mandates, such as an increase in DOT driver hours or maximum gross vehicle weights

This is not the time to get too greedy, so be transparent with your best carriers and create a mutually beneficial plan.

Now for the important question

What can be done to mitigate potential price increases?

There are multiple ways to counteract the rising costs of transportation, especially as current market spot rates approach $2.00 per mile. For companies with a solid working relationship with their carriers, it is a good time to negotiate short-term rate reductions that align with the market—but be cognizant of your carriers’ operating costs. You do not want to alienate them and lose the capacity, so have a plan to deal with price increases when market rates inevitably rise again.

This is not the time to get too greedy, so be transparent with your best carriers and create a mutually beneficial plan.

If you have access to a private fleet and/or dedicated contract carriage, targeted lane selection for your dedicated drivers can lead to significant savings.

The key is to identify the high-demand lanes, leverage your fleet assets to service them, and save the common carriers for lower-priced lanes. While this may sound simple, in practice, it takes a robust planning process—preferably combined with a well-designed Transportation Management System solution—to take advantage of the constantly shifting rates landscape. More advanced systems can dynamically take advantage of mode selection, zone skipping, and multi-trip routing, while simultaneously maximizing fleet utilization.

Every company has a unique combination of challenges and opportunities.

If your business could use extra support in identifying where to spend your limited time and money, reach out to a trusted partner and have them take an objective look at your current situation.

With the reality of greater than $2.00 per mile truckload transportation here to stay, a fresh view of your people, technology, processes, and policies could generate substantial improvements to your business.

About the Author

Chris Doersen is an Executive Principal overseeing the Solutions Team at JBF Consulting. Chris’ talent is in leading diverse teams to create valuable and implementable solutions for complex supply chain networks.

He has 21+ years of experience working with large inbound and outbound supply chains in North America, Europe, and Brazil across a multitude of industries, including Automotive, Pharmaceutical, Retail, Consumer Packaged Goods, Food & Beverage, Appliance, Metals, and more. His functional expertise is in logistics management systems, network design tools, advanced transportation optimization, and continuous improvement processes.

In addition to being a certified Project Management Professional (PMP) and a Six Sigma Green Belt, Chris earned his BS in Marketing from The Ohio State University.