Over the past 35 years, I have had the good fortune to work with some of the largest and most sophisticated shippers and transportation service providers in the world. Many of these shippers and 3/4 PLs have first rate transportation operations that drive savings and value to their businesses and customers.

However, far too many shippers that have acquired and implemented TMS technology have not realized the full ROI estimated at the onset of the project.

They tell me that while they believe that their logistics technology initiative was “technically” successful, the benefits were harder to achieve and came at a higher price than they should have.

In many instances, the grand vision, which often includes the unification of all logistics processes under a single system, was never realized as the reality of just how hard it is to transform one's operations became apparent.

Over time, the system degrades into a large, unwieldy electronic clipboard where daily operations can be managed, but the value that drove the initial investment is largely incremental and not truly transformative, as had been envisioned.

Ultimately, the project team is disbanded before all phases are implemented and a large portion of the projected benefits are never realized.

This leads to the system being turned over to a “less than enthusiastic” user community.

Over time, the system degrades into a large, unwieldy electronic clipboard where daily operations can be managed, but the value that drove the initial investment is largely incremental and not truly transformative, as had been envisioned.

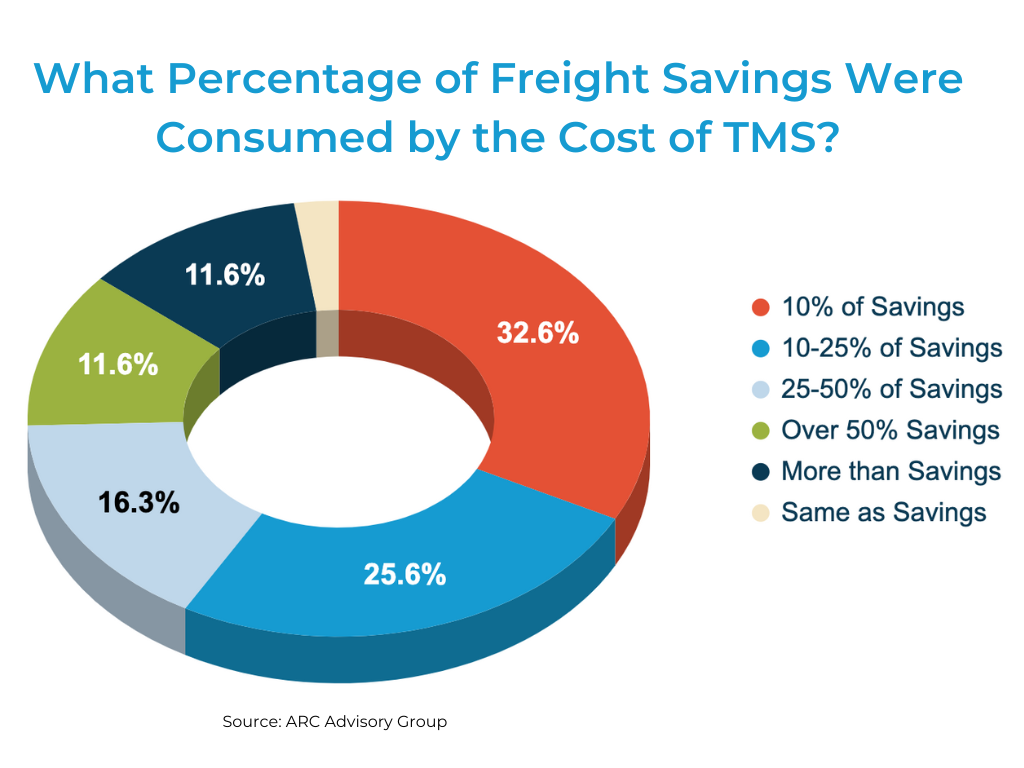

An ARC Advisory Group study bears this out. The study categorizes shippers into how much of their freight savings were consumed by the cost of the TMS.

On the positive side 86 percent of the shippers surveyed stated that their TMS project paid for itself. However, the cost for TMS software/subscription, services, and ongoing maintenance of the solution are anything but trivial.

Over 40 percent of respondents stated that those costs ate up more than 25 percent of the total savings generated by their TMS. I would guess that that number is higher than what was budgeted for the majority of these shippers.

Defining the "To-Be" State

So how do we avoid spending time, treasure, and talent on a technology and process refresh that fails to deliver the value that drove the investment in the initiative?

The first step necessary in reducing the odds of a middling TMS experience is to define the Desired End State (DES).

Clear Vision

Before embarking on a TMS project, organizations must first have a crystal clear vision of what they want to be when they grow up. The DES documents and prioritizes the needs of the transportation organization. Each transportation sub-process area is ranked in terms of the organization's current competency and the potential value that can be unlocked within that process through technology or process investments.

We estimate that 5-10% of a TMS project budget should be invested in defining the DES. Failure to do so will put the project at risk.

By quantifying the value for each sub-process, we identify if there is a compelling business case for the initiative. This is then used as an input into the implementation plan as client's typically want to quickly address the areas that have the biggest opportunities for improvement.

The DES also identifies logistics capabilities that, while not currently needed, will be required to support the long-term growth strategies of the organization, be they geographic expansion, acquisitions, or a focus on exploiting new sales channels.

We estimate that 5-10% of a TMS project budget should be invested in defining the DES. Failure to do so will lead to misaligned priorities and disappointing results.

Partner Selection

After the DES is completed, the next process is to evaluate and assess technology and/or managed service providers vis-a-vis your specific requirements.

There are three common pitfalls that companies should avoid when selecting their transportation technology partner.

Before embarking on a TMS project, organizations must first have a crystal clear vision of what they want to be when they grow up.

Common Mistakes

The first is that organizations have a natural predilection to sole-source technology from a single provider.

Just because you are using Company X for ERP (or CRM or Demand Planning, etc), does not necessarily mean that they are the best choice with regards to supporting your transportation needs. Historically, we have seen this bias most prevalent between TMS and WMS systems. This is primarily due to providers selling an “integrated” solution between the two systems which need to share a lot of information.

While there are certainly benefits to sole-sourcing, they must be weighed against the efficacy of the provider’s capabilities to solve the specific needs of the organization as laid out in the DES.

A second common mistake is over-reliance on analyst reports.

I find Gartner's widely read TMS Magic Quadrant to be invaluable, but it can also be subject to misinterpretation. It ranks TMS providers against one another in a single chart.

However, each shipper will have different needs and each technology provider has different strengths and weaknesses. Simply selecting a provider because they are highly ranked in the MQ or other generic analyst reports will likely result in disappointment.

JBF launched the JBF Sentiment Rating in 2022 providing assessment on various software solution providers as a means to provide shippers with additional selection context.

The last big mistake I see is that even sophisticated buyers fall for the Logo Slide.

Each technology provider has this slide as part of their sales deck and it shows all the companies that are using their software. The implicit message is "These companies have all done their due diligence and selected us. You should too!” Don't fall for it!

Look over the logos and focus on those organizations that look like you. Ask pointed questions as to what extent they are using the provider’s solution as well as their willingness to do reference calls, or better yet site visits.

The first step necessary in reducing the odds of middling TMS experience is to define the

Desired End-State (DES).

What Do Successful Organizations Do?

So, how do successful organizations manage this process?

Ensure Alignment

First, shippers need to ensure that there's a fundamental alignment between the business needs of your organization and the strategic direction of the potential partner. Like any relationship you are looking for one that is both long-term and mutually beneficial.

- Simply implementing a TMS on top of bad data and/or processes will lead to poor results

- Corporate policies that impact freight operations should be evaluated prior to the implementation

- Each shipper must define, quantify and measure objectives specific to their business

- KPIs that measure the efficacy of a TMS should exclude externalities that are out of the freight organization’s control (e.g. fuel).

Assess Financial Health

For publicly traded technology companies, I recommend reviewing their financial documents, specifically their 10Qs and 10Ks, which you can find the filings on the company website.

These lay out management’s vision for how the company expects to grow and will provide you a sense as how much the company will invest in the areas that you deem important.

For non-public companies, seek to fully understand their financial health and business strategies by speaking with their CEO or CFO.

Triangulate Information Gathering

I also recommend meeting with other constituents within the technology provider’s organization during the sales cycle. This includes product management, R&D, operations research, and customer support. These meetings are often enlightening as they provide a less guarded and more honest perspective than you get when speaking with polished sales professionals.

Additionally, perform a site visit to an existing customer that is similar your business. Don’t do a reference call with company management. Do an operations walk through with transportation operations.

Know Yourself

Most importantly however, the organizations that are successful have taken the time to perform an honest assessment of their own strengths and weaknesses. They know whether they have the competency, budget, and patience to support and maintain large-scale transformative change, or instead should focus on tactical improvements and/or outsourcing.

Either path is valid, but for each shipper, there is only one “best” path.

Conclusion

Transportation represents 3% - 6% of total sales for most shippers. This is a substantial expense to the business and is often an area ripe for savings.

Identifying the levers that drive realizable value to the business, and then thoughtfully selecting the right technology and/or managed service providers will help to ensure your organization's freight operations stand out in a world of mediocrity.

An earlier version of this article was originally published in Logistics Tech Outlook . We've updated this for 2023.

RELATED READING

First-Time TMS Implementation: Essential Organization Considerations for Transportation Leadership

The Three Big Challenges of Fleet Territory Planning

Take Command of Your Transportation Management System Data Beast

The Evolution of TMS Technology Over 20 Years from 2003 to 2023

Seamless Integration: Streamlining Operations With a Well-Matched WMS and TMS Solution

About the Author

Mike Mulqueen is the Executive Principal of Strategy & Innovation at JBF Consulting. Mike is a leading expert in logistics solutions with over 30 years managing, designing and implementing freight transport technology. His functional expertise is in Multi-modal Transportation Management, Supply Chain Visibility, and Transportation Modeling. Mike earned his master’s degree in engineering and logistics from MIT and BS in business and marketing from University of Maryland.

About JBF Consulting

Since 2003, we’ve been helping shippers of all sizes and across many industries select, implement and squeeze as much value as possible out of their logistics systems. We speak your language — not consultant-speak – and we get to know you. Our leadership team has over 100 years of logistics and TMS implementation experience. Because we operate in a niche — we’re not all things to all people — our team members have a very specialized skill set: logistics operations experience + transportation technology + communication and problem-solving skills + a bunch of other cool stuff.