BluJay Freight Market Index April 2020

Guest commentary by Mike Mulqueen, JBF Consulting

Analysis

The time period for this report will likely be remembered as the last “normal” quarter for a while. The impact of COVID-19 was not felt until March and initially, the result was a surge in freight volumes as consumers stocked up in preparation for quarantine. Prior to that, Q1 was shaping up to be a rather ordinary period. Rates and tender rejection rates rose slightly quarter over quarter and while not back to early 2019 levels, the metrics seemed to indicate that the shipper-carrier pendulum was moving back towards equilibrium after a 12- to 18-month period favoring shippers. The consensus opinion was that after two very tumultuous years, 2020 would be rather unremarkable with freight volumes and carrier capacity relatively well aligned.

How quickly things change. We now find ourselves in completely uncharted waters and freight transportation is in a highly vulnerable state.

The Sensitivity of Freight Transport to Economic Volatility

The Motor Carrier Act of 1980 has allowed Adam Smith’s invisible hand to guide the US freight markets for the last 40 years. This has enabled carriers, brokers and shippers to develop a complex, yet efficient system that synchronizes the movement of assets and freight in a manner that is quite remarkable. Low barriers to entry keep the TL market highly competitive as differentiation is still primarily, although not exclusively, accomplished through rates.

Like virtually all systems, the US TL freight system performs best in a predictable environment where un-forecasted variability is minimized. Carriers carefully tune their networks and allocate their assets based on historical and forecasted lane demand. This tuning is quite sensitive and unpredicted variability can have an extremely negative impact on the efficacy of the system. For example, the capacity crunch we saw during the tail-end of 2017 and into 2018 was largely driven by better than expected US GDP growth. While there were other factors, including the ELD mandate, relatively modest, but unanticipated increases to freight demand caused a capacity shortage that drove rates significantly higher. The system adjusted to the market conditions by increasing capacity and in fact, overshot demand. This led to 800 carrier bankruptcies in 2019 and significant rate reductions. The market has time and again proven it adjusts to market forces, however, the adjustment is neither immediate nor without consequence.

Industry Impact of COVID-19

Now consider the level of disruption we are experiencing today.

- Q2 GDP is forecast to drop 30-50% in Q2 according to economists.

- Approximately 22 million Americans have filed unemployment claims in the last four weeks as one in seven workers have lost their jobs.

- Unemployment is expected to reach 20% to 30% in the coming months.

- 95% of Americans are under a “Shelter in Place” order.

The massive economic impact is just now being fully realized. As the US freight system has proven to be very sensitive to comparatively minor disruptions, it is hard to guess what the tsunami of bad economic news will ultimately mean for trucking.

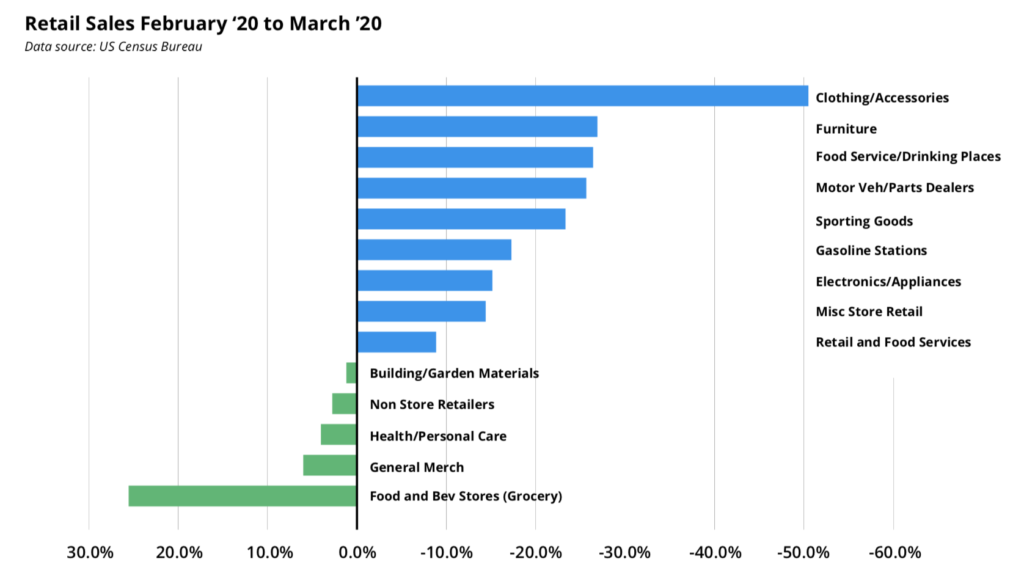

While certain industries (e.g. CPG, Grocery, General Merchandise, E-Commerce) that support a “hunker-down” economy are doing well, most other parts of the economy are in shambles. Sectors including energy, industrial, consumer discretionary and large portions of retail are seeing unprecedented drops in sales that are impacting freight volumes.

The chart below uses newly released data from the US Census Bureau that compares retail sales from February to March. The numbers are alarming, especially considering that the economy was largely still open for business for much of March.

What Does This Mean?

The finely tuned US freight system has been upended. Carriers that have built their businesses servicing shippers in the hardest-hit sectors or those that rely on the spot market will be severely tested. Over the next few months, we anticipate that a significant amount of capacity will be wrung from the system and smaller carriers and those with distressed balance sheets, will be hardest hit.

Larger carriers with combined dedicated and contract operations are therefore better protected as CPG freight typically moves under contract vs. spot rates. Additionally, the vast majority of DC to store freight in grocery and big-box retail is handled by private or dedicated fleets.

Conversely, smaller carriers and owner-operators that typically operate in the spot market will likely see the greatest compression in both volume and rates and therefore, the greatest risk of bankruptcies.

Over time, the economy will recover, and freight demand will pick up and ultimately exceed capacity as it has done time and time again. Rates will rebound sharply, and carriers that are able to weather this storm will benefit. However, the process of getting back to a market equilibrium will be difficult as it is unclear what the “new normal” will look like or when we will see it. Ultimately, it is in everyone’s benefit to have a healthy freight market. A few things we are recommending to our shipper clients are:

- Provide short-term freight forecasts (2-4 weeks out) to carriers identifying significant deviations from typical lane volumes. This will enable carriers to increase their utilization through better planning and asset positioning.

- Focus on improving carrier “velocity” through your DCs. Load and unload times in excess of two hours are a significant drain on carrier revenues and profitability.

- If possible, reduce payment term duration. Terms in excess of 60 days are common now, but they represent a challenge, especially to smaller carriers and owner-operators.

Summary

While the upcoming months will remain challenging, I want to end on a positive note. For the first time in my 30-year career, people who are responsible for the movement of freight are being celebrated. Before the pandemic, drivers, competently and without fanfare, went about their business. The only stories we read about truck driving was that it was unsafe, in need of more regulation and ultimately doomed to be replaced by autonomous driving vehicles. A silver lining to today’s events is that these men and women are finally being recognized for the indispensable job that they do.

In closing, we hope you enjoy BluJay’s market update. I find it an important piece of research that arms me with insights and critical market information. I hope you find it useful, as well.

About the Author

Mike Mulqueen is the Executive Principal of Strategy & Innovation at JBF Consulting. Mike is a leading expert in logistics solutions with over 30 years managing, designing and implementing freight transport technology. His functional expertise is in Multi-modal Transportation Management, Supply Chain Visibility, and Transportation Modeling. Mike earned his master’s degree in engineering and logistics from MIT and BS in business and marketing from University of Maryland.

About JBF Consulting

Since 2003, we’ve been helping shippers of all sizes and across many industries select, implement and squeeze as much value as possible out of their logistics systems. We speak your language — not consultant-speak – and we get to know you. Our leadership team has over 100 years of logistics and TMS implementation experience. Because we operate in a niche — we’re not all things to all people — our team members have a very specialized skill set: logistics operations experience + transportation technology + communication and problem-solving skills + a bunch of other cool stuff.