How Did We Get Here?

Just seven months ago, we were looking at historically low spot rates. Before the pandemic, there was already pressure on the spot market due to excess carrier capacity; however, in late March when demand dried up, rates tumbled to unsustainable levels. There were many stories of sub $1.00/mile spot rates. The spot market is a forward indicator of the slower-to-move contract markets, which also declined in the March/April time.

However, since then, spot and contract rates have spiked due to both lost capacity and significant changes to what carriers anticipated in terms of the annual rhythm of freight volumes and flows. Industries that provide consumer staples, such as CPG, grocery and general merchandise retail are doing great, while the industrial and discretionary consumer components of the economy continue to struggle.

Transportation professionals are used to some level of disruption driven by normal economic volatility, ever-increasing regulations and macro-trends that take years to play out. However, the disaggregated nature of the US freight system, for all its benefits, is not able to react in an orchestrated manner to this level of upheaval.

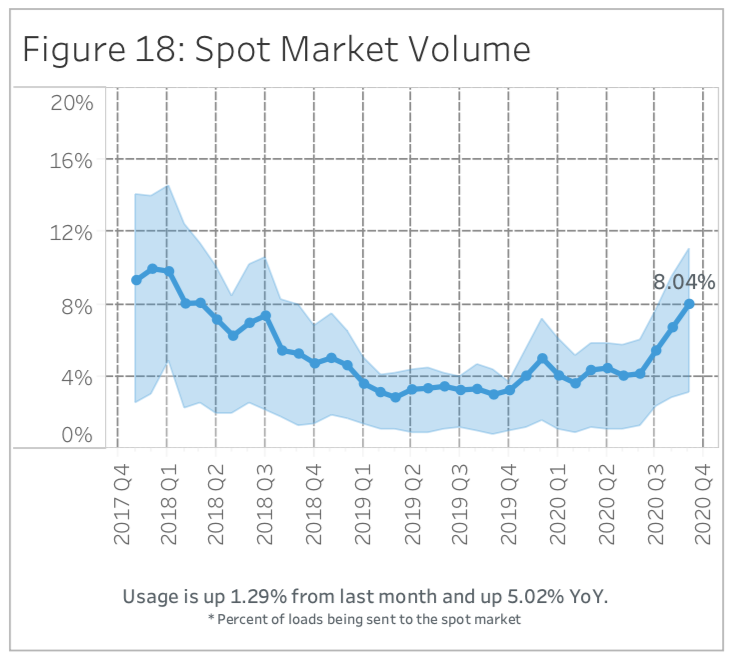

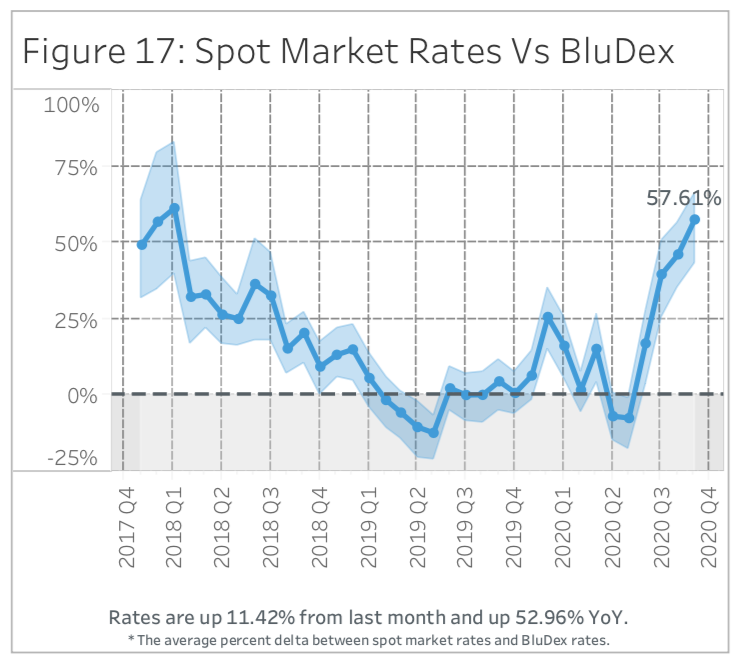

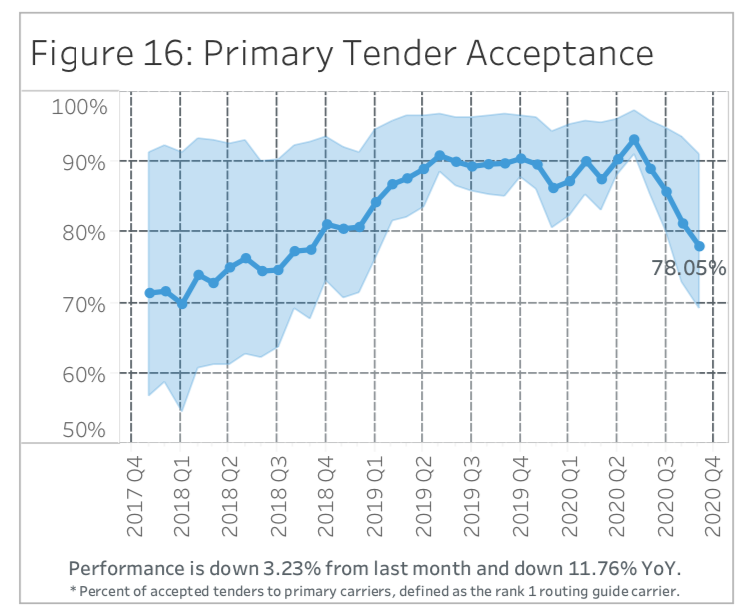

While this report is replete with great information, four figures in the accompanying analysis provide us a lesson into how the US TL freight market goes from favoring shippers to favoring carriers. These four steps do not simply describe 2020, but seem to be the recurring pattern that we see as markets flip in terms of whom they favor.

Step 1 – Spot market volume (Figure 18) began increasing in Q2 as shippers servicing the consumer staples market began to exceed their contracted capacities.

Step 2 – This put upward pressure on spot market rates (Figure 17).

Step 3 – As the spot market soared, carriers began to reject more contract freight moves to drive more revenue through the spot markets. This has led to a significant drop in Primary Tender Acceptance (Figure 16).

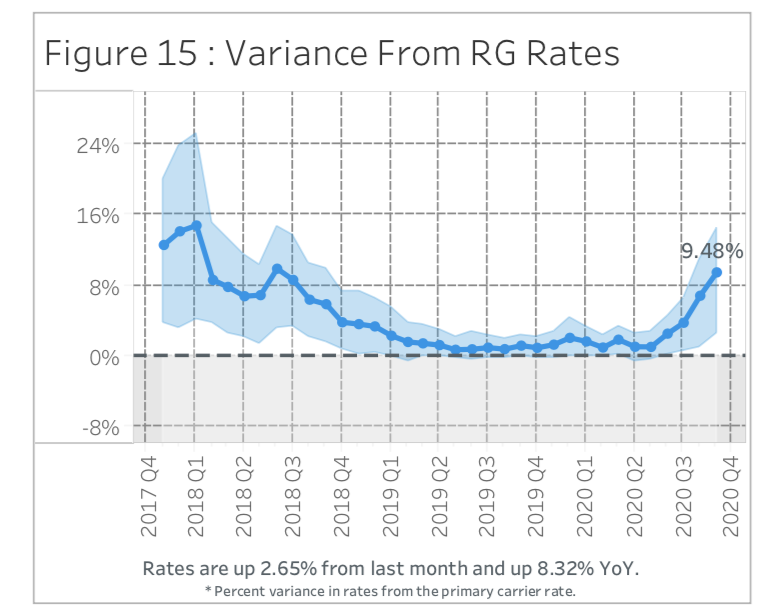

Step 4 – This inevitably leads to shippers going deeper into their routing guide and paying more to haul freight (Figure 15).

This is a reinforcing feedback loop that drives prices higher. However, as we have seen numerous times (most recently, 2018), the balancing component of the feedback loop is that as rates rise, new capacity enters the market. The disaggregated nature of freight transportation ensures that no provider has the power to significantly influence capacity, so the reinforcing effect, while perhaps slow, will ultimately serve to put us back into a natural equilibrium.

Summary

There continues to be significant pressure on TL carrier spot and contract rates which are blowing out shipper budgets. While there will be a plateau, and likely reduction as capacity comes back on-line, the charts don’t indicate we are there yet. However, please note that as the BluJay data charts show, there is a great deal of variability between the top and bottom quartiles within each metric. Being a BluJay customer, you have the technology to be best-in-class. I would be interested to know how you are using that technology to improve your operations.

BluJay Freight Market Index

Read the full commentary here: https://www.blujaysolutions.com/a-lesson-on-the-freight-market-four-standout-kpis/

About the Author

Mike Mulqueen is the Executive Principal of Strategy & Innovation at JBF Consulting. Mike is a leading expert in logistics solutions with over 30 years managing, designing and implementing freight transport technology. His functional expertise is in Multi-modal Transportation Management, Supply Chain Visibility, and Transportation Modeling. Mike earned his master’s degree in engineering and logistics from MIT and BS in business and marketing from University of Maryland.

About JBF Consulting

Since 2003, we’ve been helping shippers of all sizes and across many industries select, implement and squeeze as much value as possible out of their logistics systems. We speak your language — not consultant-speak – and we get to know you. Our leadership team has over 100 years of logistics and TMS implementation experience. Because we operate in a niche — we’re not all things to all people — our team members have a very specialized skill set: logistics operations experience + transportation technology + communication and problem-solving skills + a bunch of other cool stuff.

— — — — —