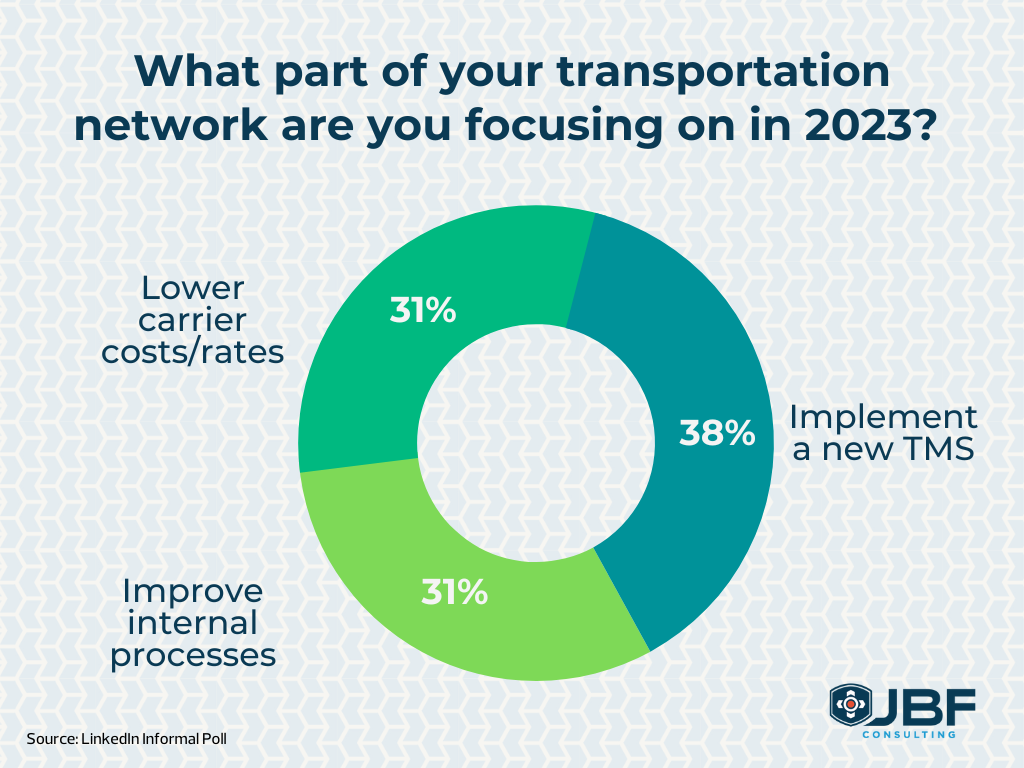

JBF Consulting recently conducted a poll on LinkedIn, the title of which was “What part of your transportation network are you focusing on this year?” We offered up four responses to our LI community.

“The pendulum will swing back and you must have strategies to react to that market.”

Survey says...

Here are the response choices, percentage of respondents that selected this response, and our take on each.

Lower carrier costs/rates: 31%

This one was more or less a softball for shippers and Logistics Service Providers.

Transportation budgets took a beating during the pandemic and shippers are generally always looking for lower rates (though capacity and service better not change!). Competitive rates are desirable, but not at levels which are unsustainable to our carrier partners.

Conversely, no one wants to be gouged. Fair and balanced should be the drivers.

JBF Take

If you are a low cost, transaction-based buyer then we see why you would select this answer.

Yes, the worm has turned relative to rates. But know that the pendulum will swing back and you must have strategies to react to that market. We prefer an approach that is more based on mutual satisfaction between shipper and carrier than focus on rates such as:

- How can I be a better shipper?

- Are my carriers taking on bad freight or lanes in which they lose money, just to keep the cream?

- Do I understand my total costs, not just rates?

- Is a holistic approach most appropriate?

Additionally, savvy shippers stay on top of the carrier rate market and take advantage when they can.

One tactic is to perform smaller, more frequent mini-bids where current contract rates are above market in cost (benchmarks have become very accessible).

Another related tactic is to hold some portion of your total volume, usually the irregular or low volume lanes, and strategically use the spot market, which is very attractive at the moment.

“You can’t lay good technology on bad processes and expect world class results.”

Improve internal processes: 31%

The inference here was that transportation organizations, like the larger corporate entities they are part of, are constantly evolving. One may have costs at an acceptable level, technology(ies) in place, skilled staff, yet we always want to strive to improve. Perhaps we need standardization of processes due to an acquisition or maybe we have new customer requirements. Perhaps we have had staff turnover and new features of the tech to implement.

JBF Take

This is telling because to us it reveals an underlying issue that we believe many transportation organizations face. That is, “we spent a lot of money to have technology and staff in place, yet we are not seeing the returns we expected”.

This brings to mind a couple thoughts. One, you can’t lay good technology on bad processes and expect world class results. Operating requirements must be supported by the implemented technology, but so should your processes. And as pointed out above these morph over time and can eventually hinder effective execution if not regularly examined.

Whether a tweak or major overhaul, internal processes likely can always use review and improvement to keep up with the dynamic nature of business.

"We spent a lot of money to have technology and staff in place, yet we are not seeing the returns we expected.”

Implement New TMS: 38%

Like many things in Supply Chain, TMS means different things to different folks.

If your perspective is that of a shipper, LSP, carrier, or other participant in the transportation function, your definition may be different. Regardless, nearly 4 out of 10 respondents identified a new TMS as a priority.

It appears that a large number of our poll respondents are taking steps to at least consider, if not select and implement a new TMS. We expect that some of this response could also mean, upgrade or extension to an existing platform. But it appears the demand is there.

JBF Take

This level of response is not wholly unexpected. We hear from potential TMS buyers every day that they are “in the market”. What does that mean?

Well, first we must understand the current situation and future needs. That in and of itself is, and should be, a significant step.

We engage clients to identify their business requirements and develop a Desired End State (DES). It is extremely important to perform this upfront task or risk wasting enormous money on selecting and implementing the wrong solution. Once requirements & DES are complete, identification of potential vendors can proceed. This is the beginning of a journey that frankly does not end.

The “Implement a New TMS” responses at least signal to us that many users across industry verticals recognize the need for modern transportation technology.

"If we have learned nothing else in the last 3 years, it is that continuous improvement is required to be the best we can be. ”

Not sure need to figure it out: 0%

Not having some idea of what to do is rarely a good thing. Yet, zero responses is a surprise.

JBF Take

The fact that our group of respondents at least selected another answer is encouraging. That tells us that whether very tactical (rates), operational (processes) or strategic (new TMS), our LinkedIn community is bent on doing something. These respondents know that no action is a poor plan. If we have learned nothing else in the last three years, it is that continuous improvement is required to be the best we can be.

Key Takeaway

Transportation is more dynamic and mission critical than ever before. If you are thinking along the lines of our poll or have other ideas or concerns, let’s have a discussion. Let’s make 2023 a year to remember in a positive way.

RELATED POSTS

Desired End State – An Insiders Guide to Acquiring TMS Technology

How Much ROI Can You Realize From Your TMS Implementation

Leadership in a New TMS Environment

First-Time TMS Implementation: Essential Organization Considerations for Transportation Leadership

How a Transportation Management System Can Be a Catalyst For Change

ebooks/white papers

Buyers Guide to Transportation Management Systems (white paper)

Optimizing Transportation's Spend and Impact (white paper)

Case Studies

First Time TMS Implementation for Automotive and Industrial Battery Manufacturer

TMS Selection, RFP Management, & Assessment for Global Fashion Retail

Dennis Heppner is a Principal at JBF Consulting. Dennis’ expertise in transportation, logistics and supply chain operations, and third-party providers spans 25+ years. His experience is broad-based, spanning entire supply chains, including business process redesign, sourcing, distribution network design, transportation management, distribution operations, outsourcing selection, and business strategy for major manufacturers, distributors, retailers including eCommerce, and service organizations.

About JBF Consulting

Since 2003, we’ve been helping shippers of all sizes and across many industries select, implement and squeeze as much value as possible out of their logistics systems. We speak your language — not consultant-speak – and we get to know you. Our leadership team has over 100+ years of logistics and TMS implementation experience. Because we operate in a niche — we’re not all things to all people — our team members have a very specialized skill set: logistics operations experience + transportation technology + communication and problem-solving skills + a bunch of other cool stuff.