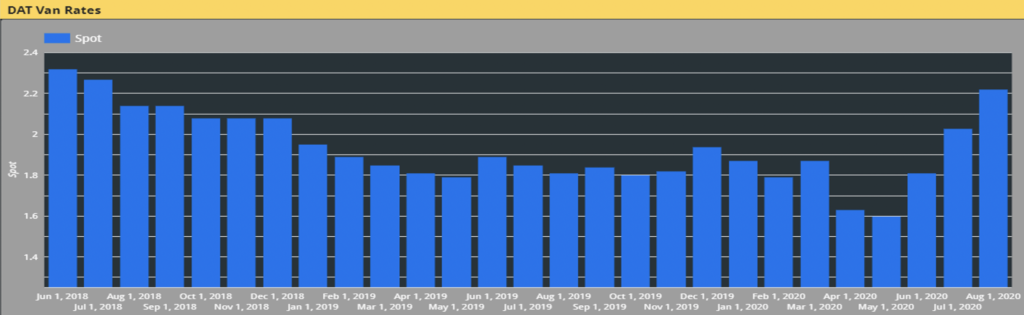

Truckload rates, especially in the spot market, continue to rise. According to DAT, the average van spot rate now exceeds contract rates for the first time since the spring of 2018. Spot rates are up over 10% year over year and 39% in the last 3 months. The increase is somewhat difficult to understand, given the continued shutdown/slowdown of a good portion of the economy.

My sense is that the surge in spot is not driven by network wide increases in volume nor significant capacity reductions, but instead, are because of carrier balance issues as certain segments of the economy are reacting in non-forecasted ways.

I would be interested in getting other's perspectives on why spot rates are so high, as my supposition is based on feeling and not data.

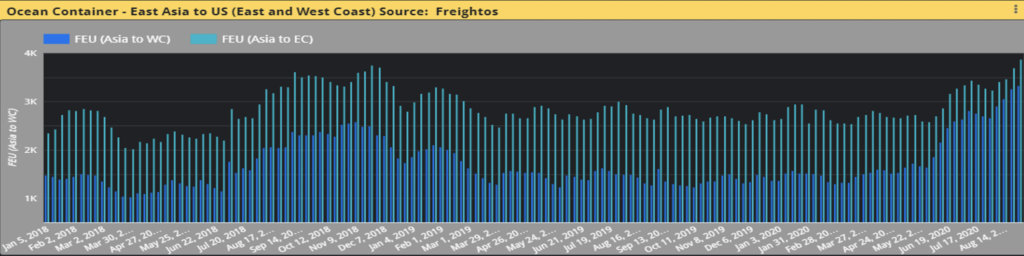

Ocean container spot rates are also extraordinarily high. According to Freightos, the average Asia to the US west coast trade lane spot rate for a FEU is up 152% since their low in mid-March and now sits at approximately $3300. The surge in spot rates is because of the steamship lines dramatically reducing capacity.

However, the largest importers into the US are Walmart, Target, Home Depot and Lowes. These companies are actually doing pretty well so the capacity did not dry up to the extent that was anticipated. One would expect ocean rates to drop in the coming months as more capacity comes back on line.

An additional point of interest is for those shippers that use west coast ports for shipments ultimately destined to the east coast, it may be time to look at east coast ports of call.

In 2018 and 2019, the average difference in spot rates between west coast and east coast ports was $1200. Today, that difference has shrunk to just over $500.

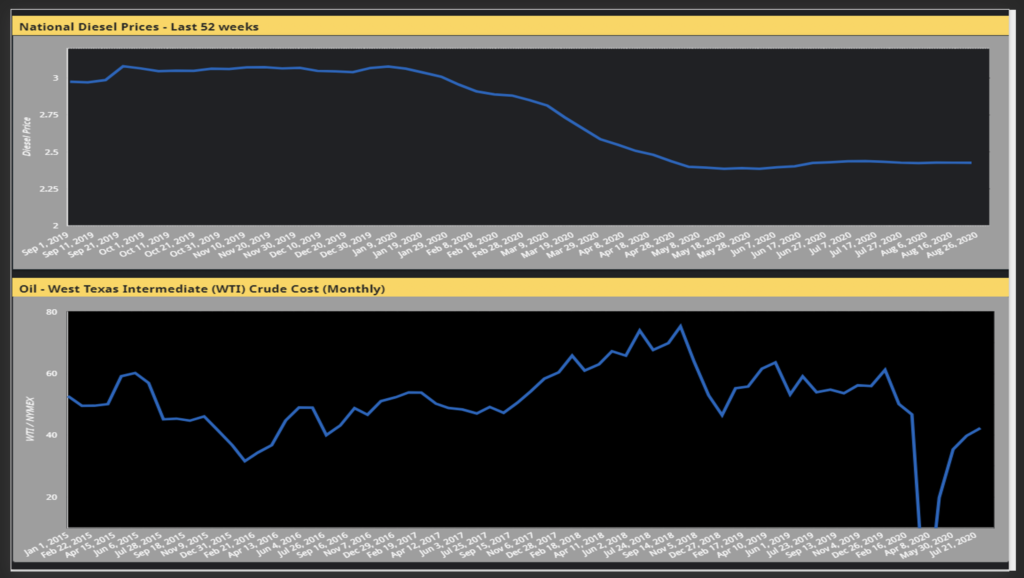

While ocean and TL rates are posing challenges, both oil and diesel prices remain in a narrow band. West Texas Intermediate seems to have found a home in the low $40s. Similarly, diesel prices are also very stable at around $2.42, rarely moving more than a portion of a penny per week.

About the Author

Mike Mulqueen is the Executive Principal of Strategy & Innovation at JBF Consulting. Mike is a leading expert in logistics solutions with over 30 years managing, designing and implementing freight transport technology. His functional expertise is in Multi-modal Transportation Management, Supply Chain Visibility, and Transportation Modeling. Mike earned his master’s degree in engineering and logistics from MIT and BS in business and marketing from University of Maryland.

About JBF Consulting

Since 2003, we’ve been helping shippers of all sizes and across many industries select, implement and squeeze as much value as possible out of their logistics systems. We speak your language — not consultant-speak – and we get to know you. Our leadership team has over 100 years of logistics and TMS implementation experience. Because we operate in a niche — we’re not all things to all people — our team members have a very specialized skill set: logistics operations experience + transportation technology + communication and problem-solving skills + a bunch of other cool stuff.