February 18, 2021 Update

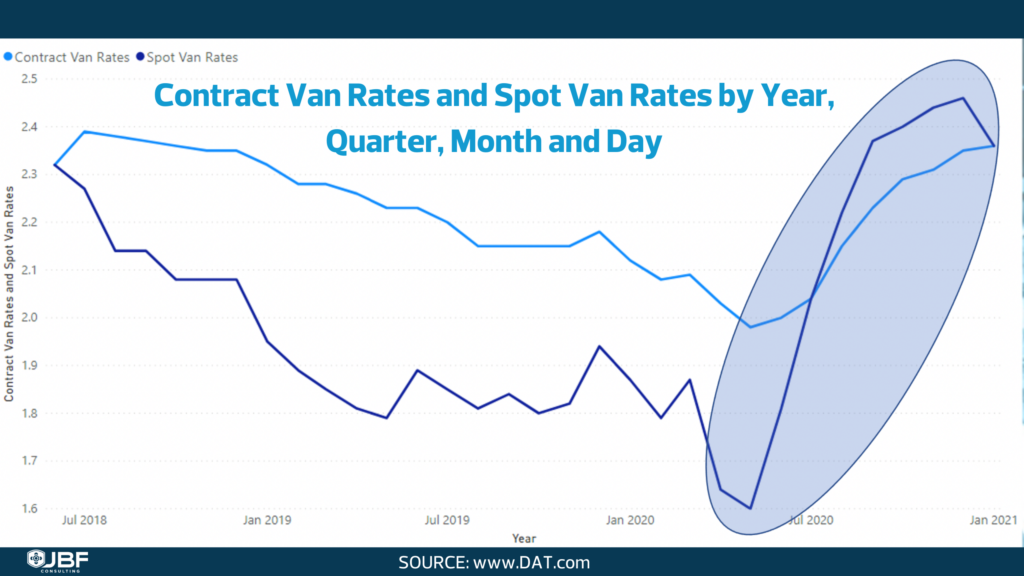

The contract market for TL freight remains tight. National TL carrier Werner expects ‘21 contract rates to rise from high single to low double digits this year, while dedicated contract service rates will rise 3-5%. Other carriers are echoing Werner’s thoughts. At JBF, we believe that 10% across the board TL rate hikes are unlikely, however contract rates will be significantly higher in 2021. Additionally, tender rejection rates remain elevated, which is putting additional pressure on freight budgets as shippers go deeper into their routing guides and are forced to go to the spot market, which continues to see impressive YoY increases in volume.

JBF has long been a proponent of Shipper of Choice programs where we encourage our shipper clients to have carrier friendly practices, from payment terms, to electronic integration to focused programs aimed at reducing dwell time. However, if carriers chase rates and abandon long-term commitments made during contracting, I must question if the expected benefits of carrier friendly practices are economically justified.

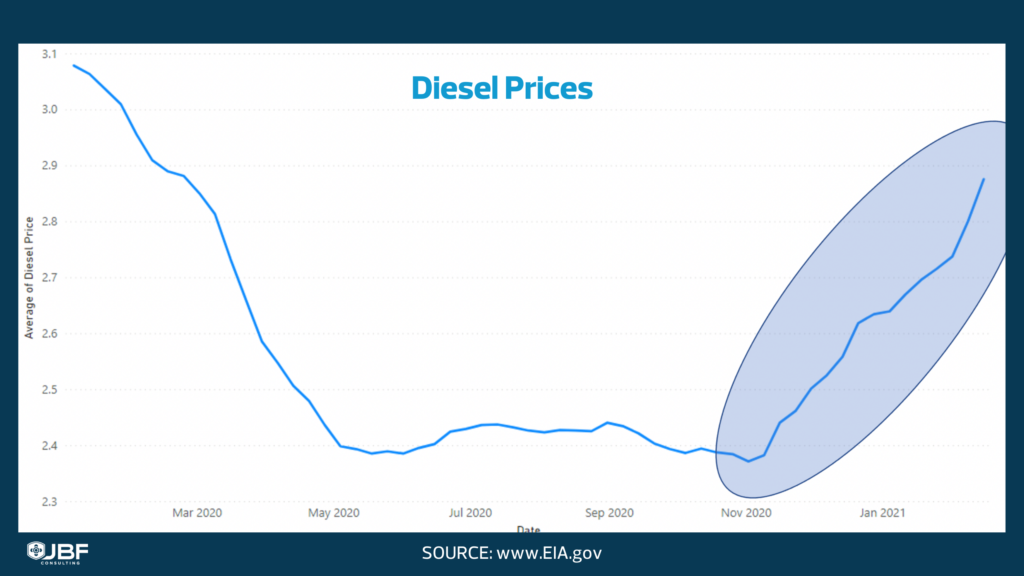

The one (and perhaps, only) bright spot in 2021 was consistently low diesel prices. Well, good things don’t last forever. We have seen increases to the DOE national average for 15 straight weeks as diesel hit $2.88 / gallon for the week of Feb 15.

To put things into financial perspective, diesel is up 51 cents a gallon since early November. Assuming a 6-cent fuel surcharge escalator, that would equate to an increase of 8.5 cents per mile, or $85 in additional cost for a 1000-mile haul.

Similar increases to fuel surcharges are hitting LTL and parcel freight. For example, FDX has increased their domestic ground surcharge from 5.5% in early November to 7% today.

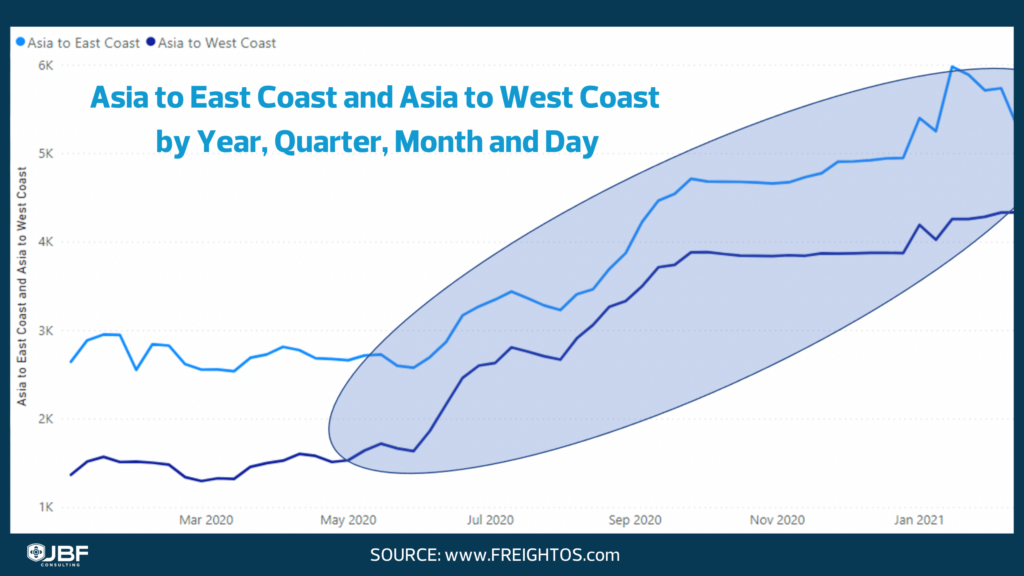

Asia to US bound container spot rates remain extraordinarily high, which is especially disconcerting as we approach the traditional ocean contracting season. Large shippers will likely see sticker shock as they review their 2021 contract rates.

Spot rates for east coast ports of call have dropped slightly in the past few weeks but are still up 100% YoY. West cost rates are up an astonishing 228% since March and have now remained over $4000 / FEU for all of 2021.

The 3 largest carrier consortiums, which represent 80% of total container volumes, have been able to maintain high rates by managing capacity in a much more orchestrated and effective manner than when acting on their own.

With the increased costs and continued horrendous performance, some of it due to the west coast port congestion, one would wonder if on-shoring / near-shoring suppliers may again be on the minds of US BCOs.

sources referenced in this post: Freightos, US Energy Information Administration, DAT

About the Author

Mike Mulqueen is the Executive Principal of Strategy & Innovation at JBF Consulting. Mike is a leading expert in logistics solutions with over 30 years managing, designing and implementing freight transport technology. His functional expertise is in Multi-modal Transportation Management, Supply Chain Visibility, and Transportation Modeling. Mike earned his master’s degree in engineering and logistics from MIT and BS in business and marketing from University of Maryland.

About JBF Consulting

Since 2003, we’ve been helping shippers of all sizes and across many industries select, implement and squeeze as much value as possible out of their logistics systems. We speak your language — not consultant-speak – and we get to know you. Our leadership team has over 100 years of logistics and TMS implementation experience. Because we operate in a niche — we’re not all things to all people — our team members have a very specialized skill set: logistics operations experience + transportation technology + communication and problem-solving skills + a bunch of other cool stuff.