January 20, 2021 Update

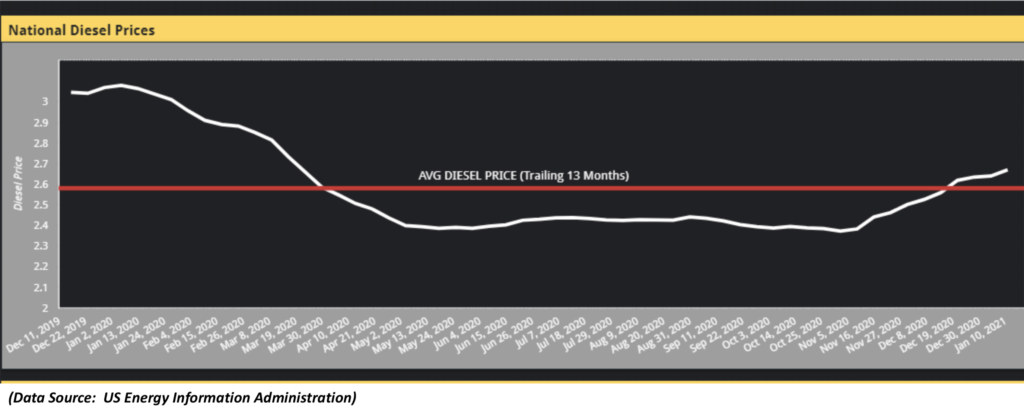

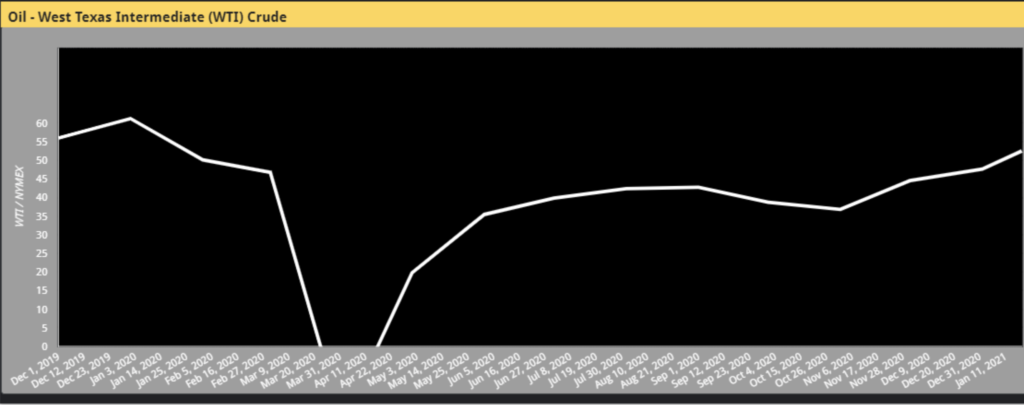

The US National average diesel price, as of January 18, sits at 2.69 / gallon, rising .31 cents since early November. After a period of both low prices and low volatility, diesel has risen 10 consecutive weeks and now is above the trailing 13-month average. The price increase can be directly tied to the recent increase in oil.

There are too many factors weighing against high oil prices including the ability of US shale producers to quickly ramp-up production as prices rise, the continued push toward renewable energy and the degradation of pricing power historically employed by OPEC. Additionally, less energy intensive behavior changes inspired by COVID are likely to become permanent.

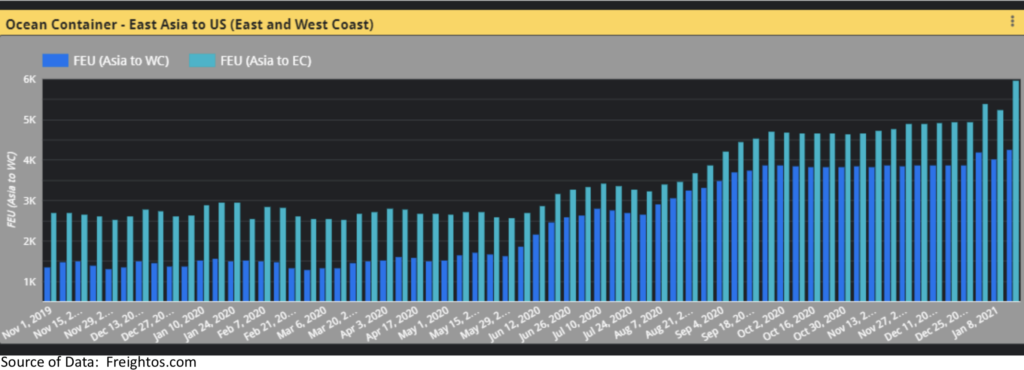

Asia to US ocean container spot rates continue to soar. Asia to US west coast spot rates now exceed $4000 / FEU while Asia to US east coast spot rates are approaching $6000. That represents a 170% and 101% YoY increase, respectively. The west coast spot rates, which held steady at just under $4000 from September to December, are now on the rise again as are the east coast rates.

The delta between WC and EC is now over $1700, likely driven by the increased congestion we are seeing in Long Beach and Los Angeles.

Even more worrisome for the Beneficial Cargo Owner community is the likelihood that the new pricing discipline shown by the carriers (and their respective alliances) will result in significantly higher contract rates on the Trans-Pacific trade lanes as we approach the contract negotiation season.

TL rates, both contract and spot, increased in December for the 7th straight month. DAT data show that Dry Van spot rates for December were up 27% YoY and up an astounding 54% since their lows in May. Carriers have responded by ordering over 100,000 Class 8 power units in the last 2 months of 2020, representing 36% of all 2020 orders. As we move to the winter doldrums, one would anticipate an alleviation in rate pressure. However, increases in fuel may negate the benefits seen by shippers.

sources referenced in this post: Freightos, US Energy Information Administration, DAT

About the Author

Mike Mulqueen is the Executive Principal of Strategy & Innovation at JBF Consulting. Mike is a leading expert in logistics solutions with over 30 years managing, designing and implementing freight transport technology. His functional expertise is in Multi-modal Transportation Management, Supply Chain Visibility, and Transportation Modeling. Mike earned his master’s degree in engineering and logistics from MIT and BS in business and marketing from University of Maryland.

About JBF Consulting

Since 2003, we’ve been helping shippers of all sizes and across many industries select, implement and squeeze as much value as possible out of their logistics systems. We speak your language — not consultant-speak – and we get to know you. Our leadership team has over 100 years of logistics and TMS implementation experience. Because we operate in a niche — we’re not all things to all people — our team members have a very specialized skill set: logistics operations experience + transportation technology + communication and problem-solving skills + a bunch of other cool stuff.