March 21, 2021 Update

If a pandemic isn’t enough, let’s throw in a polar vortex that disrupts transportation across 2/3 of the country!

Contract Van Rates and Spot Van Rates

CLICK ON THE INTERACTIVE CHART

Shippers were hopeful that the traditional winter freight slowdown would provide a chance to re-group and re-align capacity based on learnings over the last year. Unfortunately, that has not occurred. Contract rates are now at a 5- year high and, according to DAT, the spot market is now .60 / mile higher than Feb 2020 for dry van and .80 / mile for reefer. Freightwaves reports that national tender rejection rates for dry van are just above 26%. This remains consistent with the rejection rates we’ve seen since September.

In other words, things are NOT getting better, and the conventional thinking is that the situation will not reverse any time soon. Retail inventory levels remain low, spending on services (vs. goods) is likely to remain suppressed through the summer and the $1.9 trillion COVID stimulus package will continue to put pressure on the already stressed transportation services industry.

Given this environment, shippers are looking more toward intermodal for longer haul freight, especially given the significant increases in diesel. Additionally, dedicated contract services remain an attractive way to lock in capacity and reduce exposure to the spot market. However, both alternatives to TL come with unique challenges that many shippers are leery to take on.

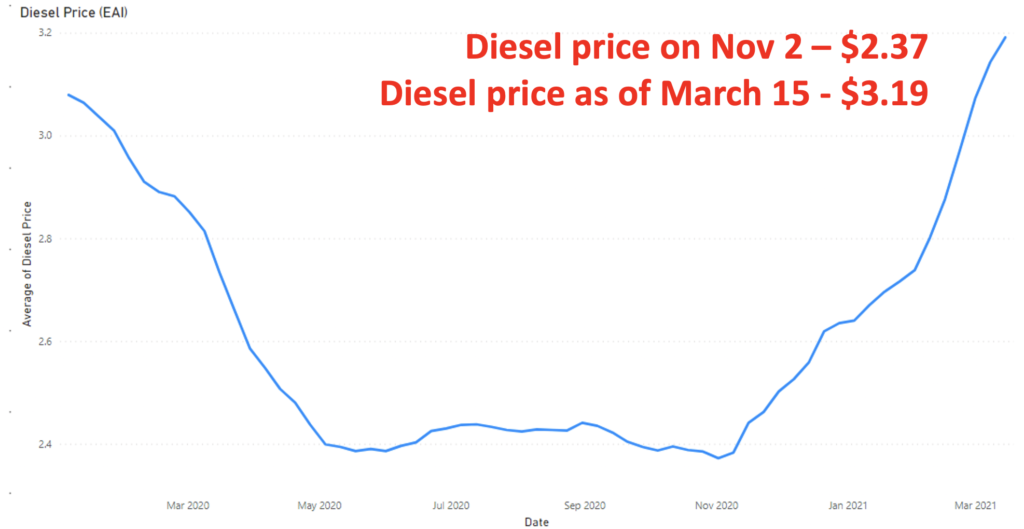

Diesel Price (EIA)

It’s great to set records! Well, maybe not all the time.

According to the Department of Energy, diesel prices on Nov 2, averaged 2.37 / gallon. After 19 consecutive weekly increases, the price, as of March 15th, was $3.19. This streak breaks the previous record of 15 consecutive weekly increases, set in both 2011 and 1999. The March 22nd numbers have not come out at the time of this writing, but “sadly” it appears the streak will be broken as oil prices fell sharply on March 18th due to a variety of global events.

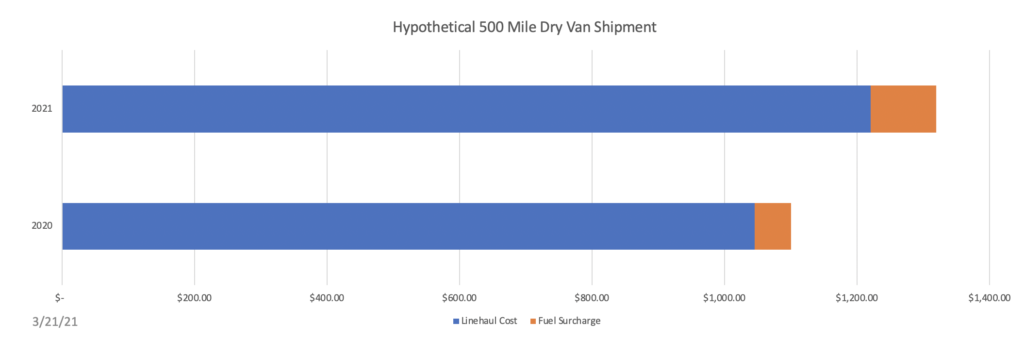

The impact of higher diesel prices, along with the increases to linehaul rates can be seen below. The net effect is a 20% increase on a hypothetical 500 mile contract freight move today vs. last year at this time, with the FSC accounting for approximately $45 of the increase (Assume 2.00 PEG and .06 escalator).

Hypothetical 500 Mile Dry Van Shipment

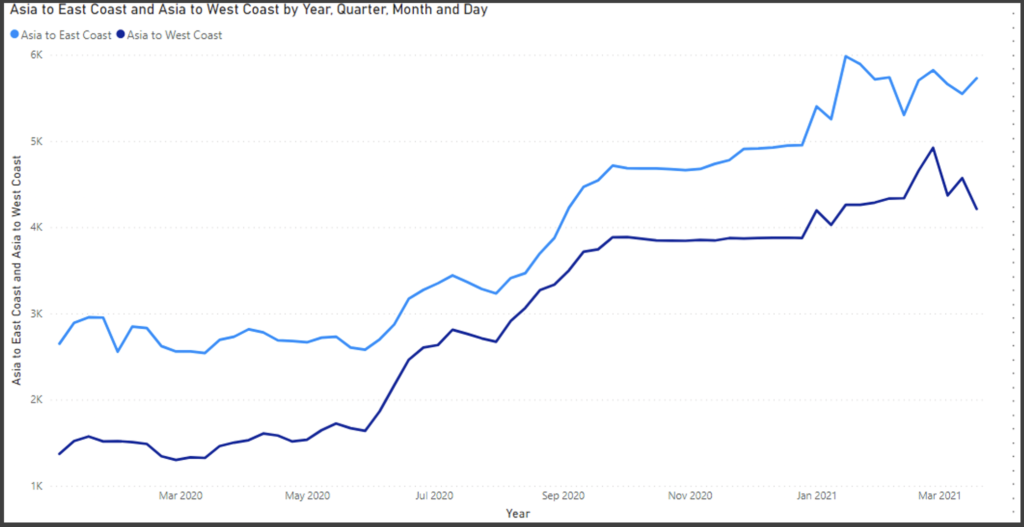

Ocean Container Rates (Asia to US)

We will be closely watching how the ocean contract seasons plays out. During the last contracting season, Asia to US trade spot rates were ~$1300-$1400 / FEU. The elevated spot market will certainly likely cause historic increases to the contract space for US bound freight.

Will these higher rates, coupled with poor service, historic numbers of rolled loads, the impact of port congestion at our biggest ports and the inherent risks of geographically expansive supply chains make US importers rethink their reliance on Asian manufactures? Will regulatory bodies / governments step in, and if so, how?

sources referenced in this post: Freightos, US Energy Information Administration, DAT, Freightwaves

About the Author

Mike Mulqueen is the Executive Principal of Strategy & Innovation at JBF Consulting. Mike is a leading expert in logistics solutions with over 30 years managing, designing and implementing freight transport technology. His functional expertise is in Multi-modal Transportation Management, Supply Chain Visibility, and Transportation Modeling. Mike earned his master’s degree in engineering and logistics from MIT and BS in business and marketing from University of Maryland.

About JBF Consulting

Since 2003, we’ve been helping shippers of all sizes and across many industries select, implement and squeeze as much value as possible out of their logistics systems. We speak your language — not consultant-speak – and we get to know you. Our leadership team has over 100 years of logistics and TMS implementation experience. Because we operate in a niche — we’re not all things to all people — our team members have a very specialized skill set: logistics operations experience + transportation technology + communication and problem-solving skills + a bunch of other cool stuff.