📭 Subscribe to the JBF Monthly Bulletin for Industry Updates

DAT DRY VAN

Contract Van Rates and Spot Van Rate Trends

DAT Freight & Analytics reports the national average spot and contract dry van rates in September converged at $2.83 / mile.

When we compare today’s rates versus February 2020, the period just prior to the pandemic, dry van contract rates today are up 36% while spot rates are up an astounding 58%.

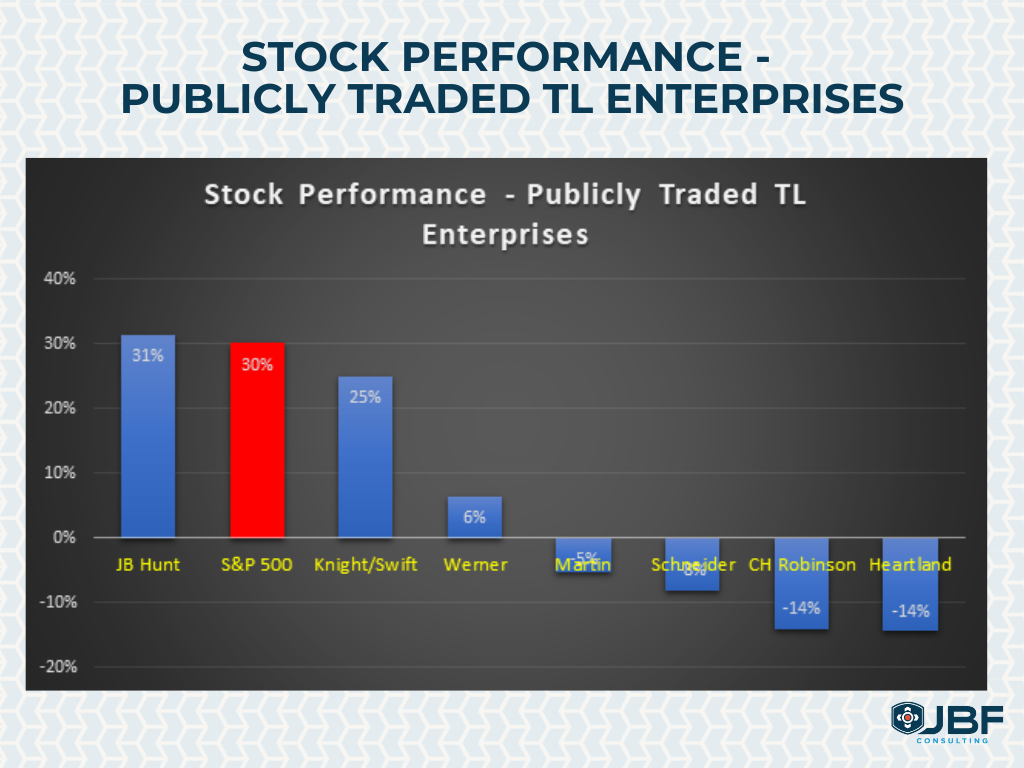

While rates are high and capacity is often difficult to obtain, the publicly traded trucking companies are not seeing share prices surge as we see with their sea-faring counterparts.

As we look at YoY share returns for some of the leading TL providers, the numbers are somewhat surprising with only JB Hunt beating the S&P 500.

While many carriers are generating record revenues, they also facing significantly higher operating costs. Items such as trucks/trailers, fuel, driver wages, owner operator costs, maintenance, and insurance are all increasing.

Even non-asset-based providers are struggling.

C.H. Robinson’s stock is down 14% YoY and even many of the pure-play digital freight brokers are unable to turn a profit in what should be an epic seller’s market.

For instance, Uber Freight lost $41 million dollars on $348 million in revenue in their most recent quarter.

In summary, we believe the higher operating cost for carriers is not transitory, which implies that the high rates we see today will likely stay elevated, even after the current surge in freight diminishes.

However, there is a glimmer of hope.

We are seeing operating ratios (i.e. Operating Costs / Operating Revenues) improve for the publicly traded, mega-carriers from, on average, the low 90s to the mid to upper 80s.

If this trend continues, it will provide an opportunity for other carriers to come in with lower, but still profitable, rates.

Source: DAT

DIESEL

Diesel Price Trends

UPDATE: National diesel price is up to $3.48 / gallon as of Oct 5 as reported by the Energy Information Administration. Energy issues including are continuing around the globe. This is the highest price we have seen in nearly 7 years.

West Texas Intermediate crude, after falling to $62 / barrel in August, was nearing $78/barrel on October 5th.

Brent crude broke $80 during trading on Sept 28th driven by the impact of hurricane Ida, lower inventories and significant energy shortages we are seeing in Europe and China where oil-derived products such as diesel are being used as a substitute for natural gas and coal. As of October 5th Brent is just south of $82.

Short-term forecasts indicate that oil, and consequently diesel, will continue to rise through the end of the year.

Goldman Sachs has forecast that Brent Crude will reach $90 / barrel by the end of this year, which implies diesel prices will be in the $3.60 to $3.90 range assuming the GS prediction holds true.

Sources: OilPrice.com

U.S. Energy Information Administration

OCEAN CONTAINER RATES (Asia to US)

Spot Rates – FEU Container Rates: Asia to US East & West Coast Trends

Source: Freightos

According to Freightos, the Asia to US West Coast FEU spot rate has dropped 16% to $16,153/FEU. This rate is still 311% higher than the same time last year.

Asia-US East Coast prices decreased 16% as well to $18,711/FEU, and are 295% higher than rates for this week last year.

While this week’s rate drops are welcome, as of this writing (Sept 30), there were approximately 60 container ships at anchor off southern California. Savannah, the nation’s fourth largest container port, reports 20 ships at anchor.

The ocean freight system has been overwhelmed by unprecedented demand (LA expects a 30% YoY increase in volumes) along with container, chassis and labor constraints.

The system is a mess, and the situation is exacerbated by importers, who are buying and shipping early to ensure they have products on the shelf for the holiday season. While some freight is being shifted to air, that is not a cost-effective strategy for the majority of moderate and low cost goods.

Some of the largest importers, such as Walmart, Costco, Ikea and Home Depot have taken things into their own hands by chartering container ships, which serves to both ensure capacity while also enabling sailings to off-load at less congested ports.

This is another example of size mattering and will provide the mega-retailers a significant competitive advantage over their smaller competitors who don’t have the volumes necessary to profitably charter their own ships.

While the Beneficial Cargo Owner (BCO) community is struggling with out-of-control costs and horrendous service, the steamship lines are reaping unprecedented profits.

Maersk’s 2021 profits will equal the total of all combined profits the company made in the preceding 9 years. At the beginning of the year, analysts had estimated Maersk would have net income of ~$3 billion USDs. That estimate has turned out to be slightly conservative. The estimates now are for 2021 net income to be $16.2 billion!

Prior to the formation of the 3 ocean alliances, the VOCCs were notoriously bad at managing supply and demand, and therefore, pricing.

However, they learned their lessons well in the leadup to the pandemic and are now making huge profits while simultaneously providing very poor service.

Unlike the fragmented and commoditized US and European trucking markets, where rates are constrained by brutal competition, the ocean spot and contract rates we are seeing are the result of the alliances that have effectively eliminated competition. BCOs are now at the mercy of these alliances with no short-term effective short-term options.

Sources referenced in this post: Freightos, US Energy Information Administration, DAT, Freightwaves, WTI

RELATED READING

Transport-Centric Macroeconomic Metrics: July 23, 2021 Update

Transport-Centric Macroeconomic Metrics: June 25, 2021 update

Transport-Centric Macroeconomic Metrics: May 28, 2021 Update

Transport-Centric Macroeconomic Metrics: May 3, 2021 Update

Transport-Centric Macroeconomic Metrics: March 21, 2021 Update

Transport-Centric Macroeconomic Metrics: February 18, 2021 Update

Transport-Centric Macroeconomic Metrics: January 20, 2021 Update

Transport-Centric Macroeconomic Metrics: November 17, 2020 Update

Transport-Centric Macroeconomic Metrics: October 9, 2020 Update

Transport-Centric Macroeconomic Metrics: August 31, 2020 Update

About the Author

Mike Mulqueen is the Executive Principal of Strategy & Innovation at JBF Consulting. Mike is a leading expert in logistics solutions with over 30 years managing, designing and implementing freight transport technology. His functional expertise is in Multi-modal Transportation Management, Supply Chain Visibility, and Transportation Modeling. Mike earned his master’s degree in engineering and logistics from MIT and BS in business and marketing from University of Maryland.

About JBF Consulting

Since 2003, we’ve been helping shippers of all sizes and across many industries select, implement and squeeze as much value as possible out of their logistics systems. We speak your language — not consultant-speak – and we get to know you. Our leadership team has over 100 years of logistics and TMS implementation experience. Because we operate in a niche — we’re not all things to all people — our team members have a very specialized skill set: logistics operations experience + transportation technology + communication and problem-solving skills + a bunch of other cool stuff.