Transportation Management Systems (TMS) have been around for decades. Whether a Tier One, cloud-based, somewhat holistic platform or an on-premise point solution, the range of options is nearly endless.

The acronym ”TMS” is used and defined differently by shippers and carriers/brokers.

However, TMS generically refers to the category of software that deals with the planning and execution of the physical movement of goods across the supply chain.

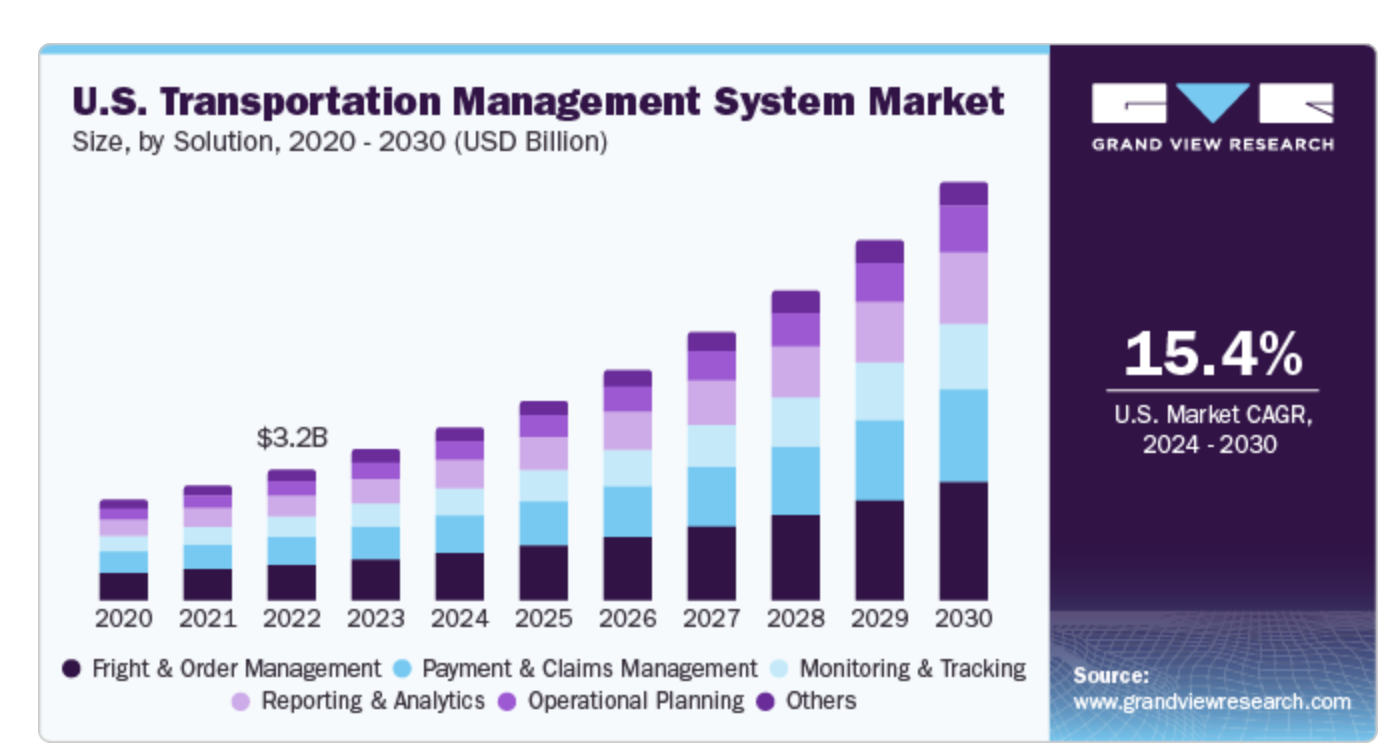

The global transportation management systems market size was estimated at USD 13.61 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 17.4% from 2024 to 2030, according to Grand View Research.

Grand View Research attributes "the factors driving the global transportation management system (TMS) market include the growth of retail and e-commerce industries, consistent advancement in technology leading to the introduction of innovative solutions in the market, and the strengthening of bilateral trade relations among various countries across the world. Further, TMS solutions help automate the manual tasks of supply chain operations, including planning and execution, route optimization, and shipment tracking. Thus, it helps reducing manual errors, saves time, and costs involved in managing transportation operations are the key factors driving the market growth."

Two takeaways from this information - the TMS market is huge ($13.61 billion USD); and if you, as a shipper, are not utilizing technology to manage transportation functions, you are behind the curve.

“As a shipper, if you are not utilizing technology to manage transportation functions, you are behind the curve.”

Survey Says...

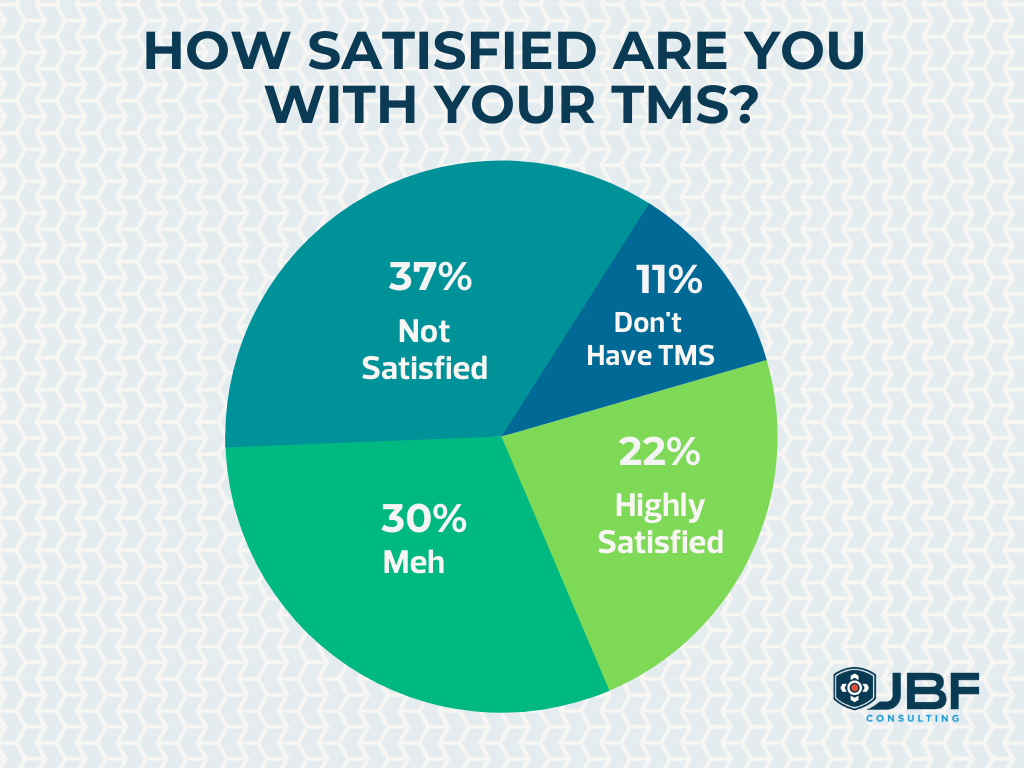

JBF Consulting recently polled Transportation VPs and Directors on LinkedIn asking “How satisfied are you with the current operations of your TMS?”

Because we often work with large shippers that have varying degrees of needs (first time implementation, upgrade existing, swap out), we were curious what the overall marketplace felt about their current technology solution(s).

Poll Results

From our experience, it is not surprising that over one-third of respondents are not satisfied with their TMS and another 30% are so-so. While nice to see that nearly a quarter are highly satisfied, 11% don’t have a TMS.

The fact that over 67% of respondents are unsatisfied with their TMS caught our attention and we wondered what lack of satisfaction means.

Could it be a lack of operational visibility, missed opportunities for cost reduction, digitized yet manual processes, all of the above and more?

And of course given the current situation with freight rates and service, mediocre operations are being penalized more heavily.

"Could it be a lack of operational visibility, missed opportunities for cost reduction, digitized yet manual processes, or all of the above?"

Recommendations

Here are our interpretations of, and suggestions for, these responses:

- 37% Not Satisfied

Too many times shippers do not perform due diligence to understand their requirements (today and into the future) and fail to appropriately communicate their needs to a vendor.

Many vendors are happy to make the sale, slam in the product, and move on. The shipper is left with something that they quickly find does not meet their needs, is not as easy to use as advertised, has gaps in performing specific processes, and the vendor support is lacking.

>>> Recommendation - Take a hard look at why you are not satisfied. Did you expect more savings? Are configurations set up that represent your business? Does your team need additional training? With some investigation, you may be able to make improvement yourself.

Otherwise, consider outside advice. We have seen this situation and have been able to ‘rescue’ implementations using a gap assessment approach that will be unbiased and fact-based designed to maximize your investment.

- 30% Meh

Probably not terribly different from Not Satisfied, our interpretation is that shippers in this group have some features and functions that meet fundamental needs, but they expected much more and there is room for improvement.

Again, the shipper may have not done a great job in defining their requirements, or if they did, perhaps the implementation was poorly conducted, hence fundamentally they can execute, but they are not getting much more value than what they had previously.

>>> Recommendation - There may be some straightforward diagnostics you can perform. Are your mode/carrier selection criteria correct? Are rates current? Are folks reverting old processes and habits that are sub-optimizing outputs?

An external experienced advisor like JBF will have an approach to get you out of the Meh Zone to identify opportunities for improvement and provide solution options for your consideration.

The answers may be rather simple and inexpensive, but require expert eyes to see the way forward.

- 22% Highly Satisfied

These respondents likely put in the effort to define requirements, engaged cross-functional teams, used a systems integrator, managed every step of the implementation, communicated and resolved issues to the vendor, and had definitive goals in mind.

In practice they have considered change management, organizational readiness and acceptance, and denied workarounds that could defeat the value of the system.

Additionally and importantly, this group has likely committed to maintaining the integrity of the system, looked for ways to improve the solutions, and has a culture that IT and the business collaborate to protect the investment.

>>> Recommendation - Frankly if you are Highly Satisfied, you are doing things right….for now. We encourage this group to maintain high stewardship of the solution so you do not fall into the Meh Zone.

Be visionary, challenge the status quo, endeavor to be even better.

- 11% Don’t Have TMS

Even with the proliferation of TMS options in the marketplace, it would be easy to say that most of these respondents are smaller shippers that can’t or won’t make the investment.

Surprisingly though, some respondents are large shippers with global operations. Not surprising to us, we have seen this before.

Too many organizations are running transportation operations with spreadsheets, homegrown databases, and siloed staff “doing what they have always done”. These shippers may have either had other investment priorities or have not recognized the value of systemization.

Admittedly, there are a few shippers that are so simple in their operations that they don’t need a TMS.

>>> Recommendation - Some organizations have the internal horsepower to assemble a team from the business, IT, finance, customer service, manufacturing, etc. to gather requirements, select a vendor partner and implement successfully. If your operation is not overly complex, this is an option.

However, the more complex in terms of modes, geographies, business units, and customer needs, consider an expert that knows the TMS landscape; has an experienced team from software vendors, shippers, and other practitioners; has a track record of leading clients through the TMS journey; has a demonstrated methodology and track record; and is platform agnostic.

Don’t fall into the trap of going with the ‘name’ vendors. Do the hard work upfront. Recognize the business impact. Prepare the organization for change. Prepare to continuously improve.

"Don’t fall into the trap of going with the ‘name’ vendors. Do the hard work upfront."

Conclusion

The TMS space continues to grow and evolve. As with any technology there are always levels of satisfaction. Our goal at JBF is to help every shipper to be highly satisfied in whatever solution is appropriate for them.

Not satisfied with your TMS, then perhaps it's time for a gap assessment. We've been able to ‘rescue’ implementations using an unbiased and fact-based approach designed to maximize your investment. Let’s Have a Conversation!

RELATED POSTS

The Client Journey Through Supply Chain Evolution

4 Signs That You Need to Upgrade Your TMS Software

First-Time TMS Implementation: Essential Organization Considerations for Transportation Leadership

Building Your Logistics Systems is Your Choice

Buyers Guide to Transportation Management Systems (white paper)

Dennis Heppner is a Principal at JBF Consulting. Dennis’ expertise in transportation, logistics and supply chain operations, and third-party providers spans 25+ years. His experience is broad-based, spanning entire supply chains, including business process redesign, sourcing, distribution network design, transportation management, distribution operations, outsourcing selection, and business strategy for major manufacturers, distributors, retailers including eCommerce, and service organizations.

About JBF Consulting

Since 2003, we’ve been helping shippers of all sizes and across many industries select, implement and squeeze as much value as possible out of their logistics systems. We speak your language — not consultant-speak – and we get to know you. Our leadership team has over 70 years of logistics and TMS implementation experience. Because we operate in a niche — we’re not all things to all people — our team members have a very specialized skill set: logistics operations experience + transportation technology + communication and problem-solving skills + a bunch of other cool stuff.