BluJay Freight Market Index January 2020

Guest commentary by Mike Mulqueen, JBF Consulting

As we kick off 2020, financial and freight industry analysts are busy reading the TL market tea leaves. Given the complete turnaround in market dynamics between 2018 and 2019, it is not hard to understand why these predictions are garnering so much attention amongst transportation professionals. Freight operations that were unable to effectively manage through the recent turmoil have left more than a few careers in tatters.

Having to explain to the C-Suite why the transportation organization is 15% over budget is not a conversation that most of us want to have, so being able to develop an approach to freight operations that is able to thrive in times of surplus or deficit capacity requires we begin looking beyond just today.

A careful inspection of the BluJay Freight Market Index (FMI) report shows that shippers who develop operating plans that don’t take into account the realities of the trucking cycles are putting their businesses at risk. As proof of this, take a look at the difference between high performers and low performers in the BluJay charts. You’ll notice that during times of excess capacity, there is not that much difference in shipper performance across most of the metrics. Where you really see the difference is during the tough times. As the saying goes, you don’t win marathons on the downhills, you win them on the uphills.

With that in mind, I’ll lay out two competing TL rate perspectives we are seeing from the analysts. While probably an oversimplification, I’ve labeled these perspectives as Conventional and Unconventional Wisdom.

The Conventional Wisdom

The delta between spot rates and contract rates is tightening and the feeling is that the market has bottomed out. This group expects spot rates to slowly rise in the first half of 2020 with a bias toward a more substantial market swing to the carriers in the latter half of the year. Factors that are going to impact capacity include rising insurance rates, the final implementation of the ELD mandate and the potential for rising diesel costs resulting from IMO 2020. Overall, the environment is still positive for shippers, but the shift in the freight cycle seems to have started.

Many financial analysts agree with this sentiment, including Goldman Sachs, who, in December, put “Buy” ratings on truckload carriers Schneider, Knight-Swift and Werner, with the underlying assumption being that the market has bottomed out and well-run TL carriers will now be in the driver’s seat.

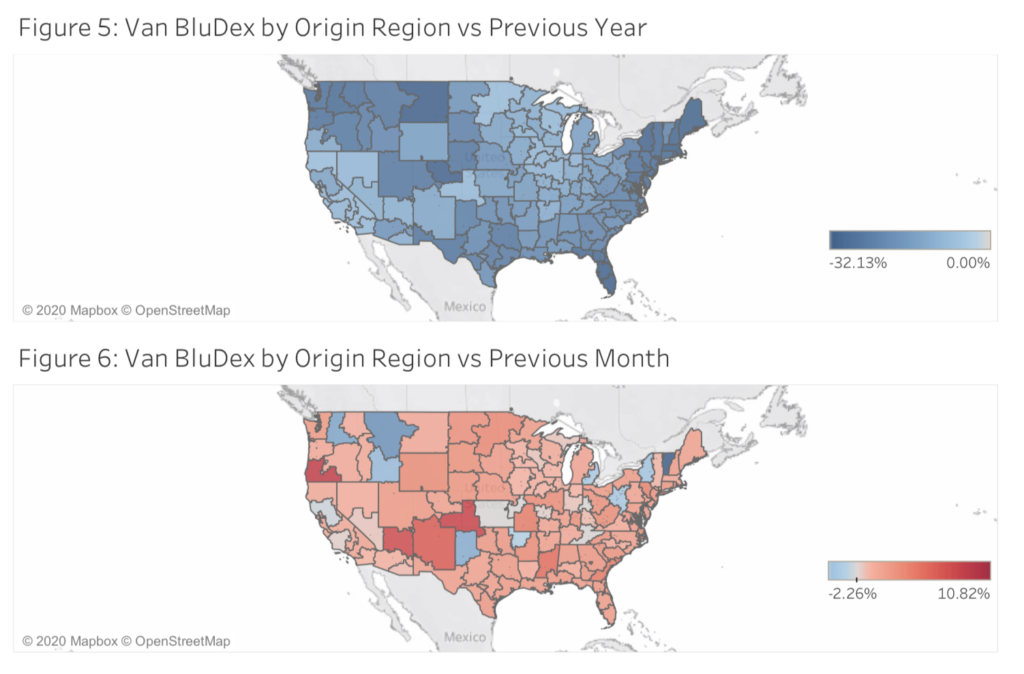

BluDex % Change: Truckload Van

A look into the BluJay FMI data seems to support this finding. Figures 5 and 6 show Year over Year and Month over Month BluDex Dry Van rates by region. As you would expect, 2019 rates were significantly lower than their YoY counterpart, but the MoM numbers show a pretty sizable increase in most geographies. The Reefer rates show a similar pattern indicating we’ve reached a bottom and the recovery has begun. The following charts explicitly or implicitly back this thinking:

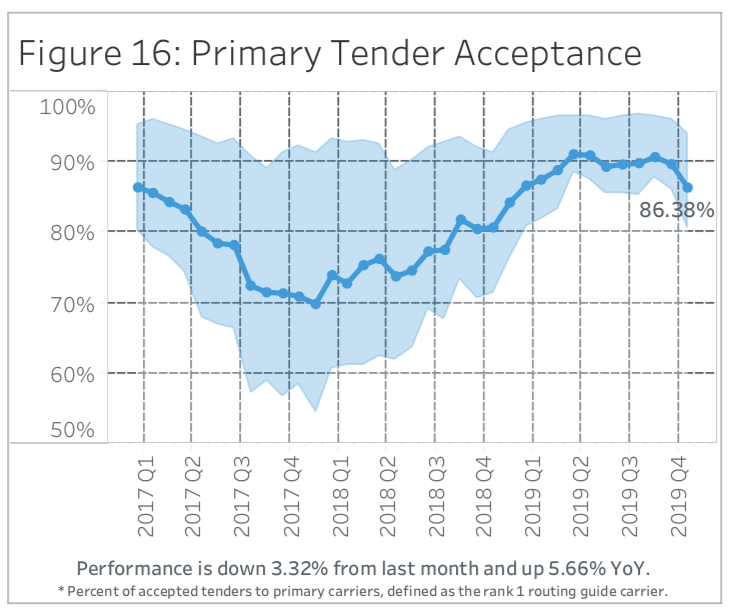

Figure 16 shows a rather significant drop in primary carrier tender acceptance percentage rates, from the low 90s to the mid 80s.

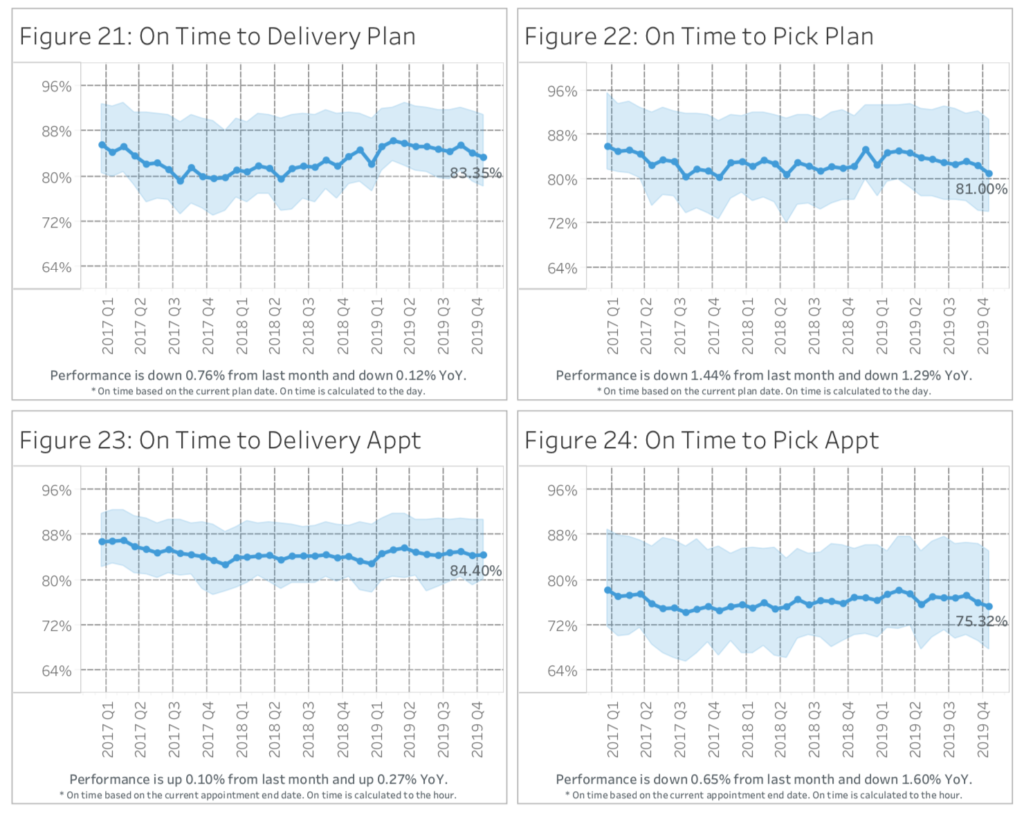

Figures 21-24 show a deterioration in on-time pickup and delivery performance, which is also a symptom of demand beginning to outstrip supply.

Although we may be early in the cycle, these data points are viewed by the conventional thinkers as “canary in the coalmine” metrics that show the market has stabilized and is now swinging back to the carriers.

Unconventional Wisdom

This group, while significantly smaller, believes that the respite in rates degradation is temporary. Rates, especially contract rates, will continue to fall. The arguments made by this group are based on two factors:

1. This group believes that there is a significant chance that the US economy goes into a recession. This will have a significant, negative impact on demand. This assumption is a contrarian perspective, given that the consensus amongst economists is that the US economy, spurred by consumer spending, will grow at about 2% this year. While that is certainly not robust growth, it is a far cry from negative growth, as a recession implies.

2. Unconventional thinkers believe that technological disruption, as brought about by digital market places such as Convoy and Uber Freight, will significantly increase trucking efficiencies through the reduction of empty miles. This cost reduction will be passed on to shippers in the form of lower rates. This is a long-term change that will fundamentally change the way TL freight is managed, hence why it is viewed as disruptive.

My Best Guess

While only time will tell which perspective turns out to be correct, I believe is that the conventional wisdom, in this case, has a higher probability of becoming reality. The rationale for this belief is as follows:

- The FMI BluDex data seems to indicate that we hit rate lows a few months ago. While there is the possibility that supply/demand environment reverses, the historical patterns show that the cycle typically is typically around 18-24 months.

- I am unaware of any economist that is predicting a recession this year. Therefore, we will not see a huge drop off in demand for TL freight services.

- The unconventional thinkers view the digital matching capabilities of the marketplaces (e.g. Convoy, Uber Freight) as a game-changer. However, while I can see them having a detrimental effect on brokers and load boards, most large shippers are leery to move away from their trusted contract carriers in favor of highly variable spot rates.

- The underlying cost of operating a trucking fleet has ratcheted up significantly. Driver costs, insurance and assets are simply more expensive to operate in 2020 than in 2018 and these expenses must be passed on to shippers in a healthy and viable TL market.

Please enjoy the BluJay Freight Market Index. It is an interesting read and will hopefully provide you with insights into market conditions and what you can do, as a transportation leader, to maximize your organization’s possibility of success.

About the Author

Mike Mulqueen is the Executive Principal of Strategy & Innovation at JBF Consulting. Mike is a leading expert in logistics solutions with over 30 years managing, designing and implementing freight transport technology. His functional expertise is in Multi-modal Transportation Management, Supply Chain Visibility, and Transportation Modeling. Mike earned his master’s degree in engineering and logistics from MIT and BS in business and marketing from University of Maryland.

About JBF Consulting

Since 2003, we’ve been helping shippers of all sizes and across many industries select, implement and squeeze as much value as possible out of their logistics systems. We speak your language — not consultant-speak – and we get to know you. Our leadership team has over 100 years of logistics and TMS implementation experience. Because we operate in a niche — we’re not all things to all people — our team members have a very specialized skill set: logistics operations experience + transportation technology + communication and problem-solving skills + a bunch of other cool stuff.