📭 Subscribe to the JBF Monthly Bulletin for Industry Updates

Highlights

- US freight market is softening, however, this does not mean that we are headed toward a Carrier Armageddon. That said, SMB carriers are at most risk

- As contract rates fall, shippers should look to to evaluate, and potentially bid, their TL and LTL freight

- Shippers should also look to implement a strategy to take advantage of spot market rates given their position relative to contract rates

- When selecting a logistics technology provider, don't underestimate the need to perform financial due diligence

From a shipper perspective, the softening of the US freight markets comes as a welcome relief. Contract rates, which have remained stubbornly high, have slowly begun to fall.

There is still a significant delta between contract and spot rates, however market forces will put downward pressure on contract rates to close this gap over the next few months.

TL and LTL companies, who are, in many cases, coming off record Q3 revenue and profitability, are warning that the next few quarters will see significant softness in terms of freight demand, increasing the downward pressure on both spot and contract rates.

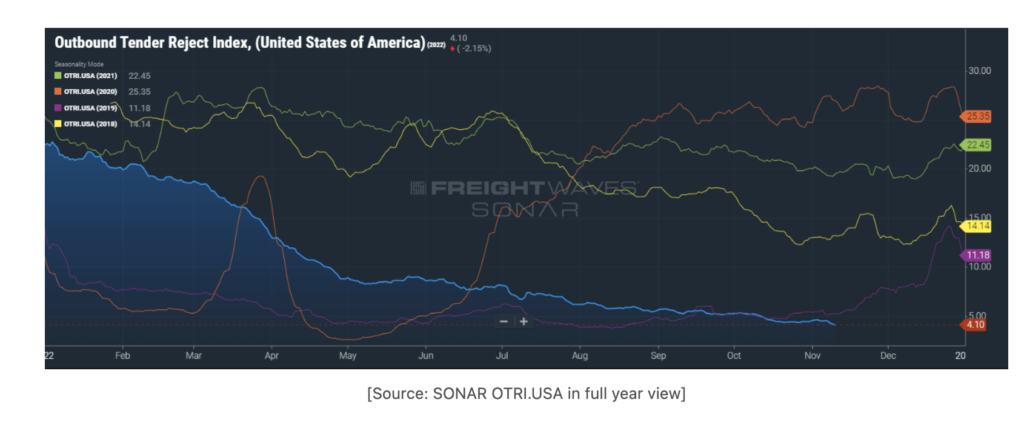

According to FreightWaves Sonar™, TL carrier load decline rates are down to 4.1% (from over 20% this time last year) indicating over-capacity. Third quarter management presentations from virtually all the publicly traded trucking companies are warning of softening demand, with no meaningful holiday peak season to bolster Q4 revenues.

US Outbound Tender Reject Index

While the US freight market is softening, this does not mean that we are headed toward a “2019-like” Carrier Armageddon. The year-over-year comparisons we are going to see are against record revenue and volumes and will tend to exaggerate the impact of a downturn. However, volumes are simply returning to historical norms, and rates are still significantly higher than they were at the beginning of 2020.

The next few quarters will see significant softness in terms of freight demand, increasing the downward pressure on both spot and contract rates.

An Area of Concern

We believe the large national carriers will be able to effectively manage their way through the next year, smaller carriers and owner operators will have a harder time.

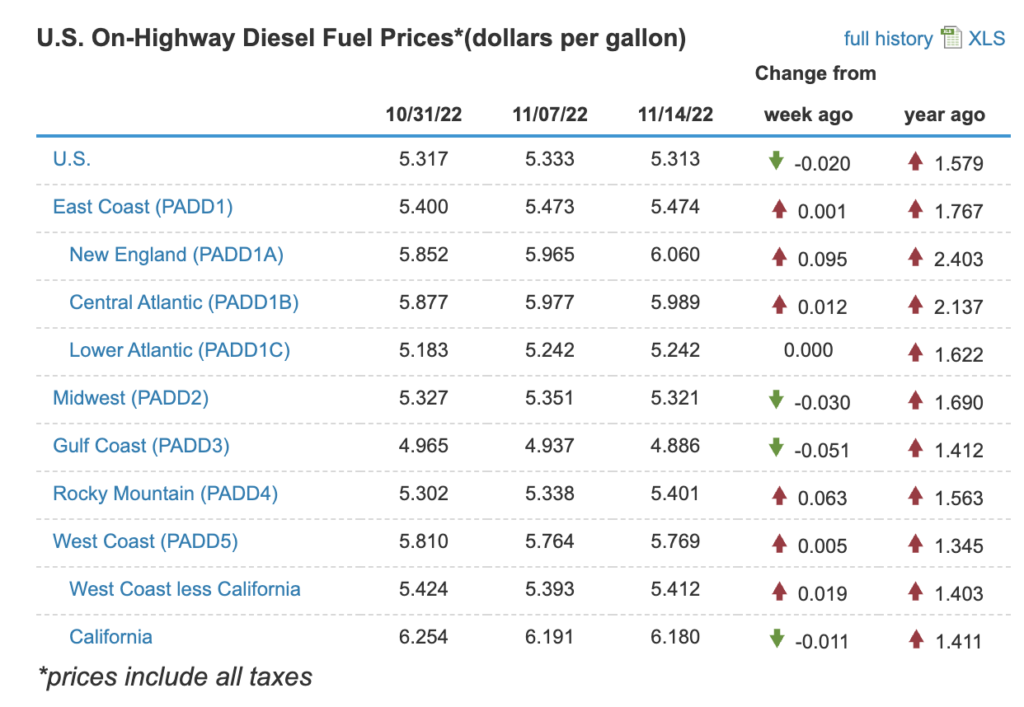

As of November 15, the national price of diesel was $5.31 / gallon nationally (Source: EIA), and over $6.00 in both the New England and California PADDs.

These prices hit smaller carriers and owner operators much harder than the national carriers, given they are more likely to pay the retail price versus the national TL carriers, who can negotiate significant discounts (rack plus taxes and some markup) off retail prices.

Additionally, smaller carriers rely much more heavily on the spot market, which has seen rate compression since January.

When we consider the upward pressure on the cost of operating a fleet including fuel, new / used asset costs, maintenance, and insurance costs, one can easily see a scenario where a substantial number of small to medium size carriers are purged from the capacity pool.

Take care in selecting a technology partner as those relying on VC cash to stay solvent must adapt.

Shipper Recommendations

- We believe now is a good time to lock in long-term TL and LTL contracts with carriers given market softness with a network wide bid.

- Shippers should devise a strategy to take advantage of the depressed spot market. This could be leaving a certain amount of volume outside of the TL bid process or using the spot market more effectively on low-volume lanes (e.g., rely on the spot market versus state-to-state contract lanes).

- Work with your TMS provider to integrate with load boards (e.g., Loadsmart, Emerge, Truckstop.com, Uber Freight, Convoy) that can give you access to the spot market.

- Develop a mechanism to create freight forecasts that can be used to proactively identify capacity shortfalls prior to tendering.

- Develop competency around executing “mini-bids.” The freight markets have become too volatile for annual contracts and shippers need to be able to solicit the market when carriers underperform, or freight volumes exceed our contracted carrier capacity quickly and efficiently.

Shippers need to be able to solicit the market when carriers underperform, or freight volumes exceed our contracted carrier capacity quickly and efficiently.

Logistics Technology - A Warning

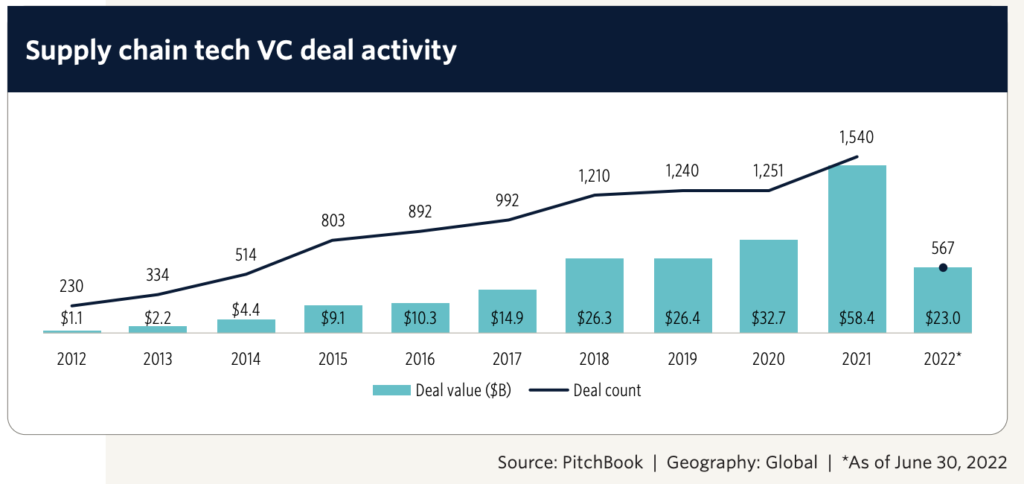

Over the past 5 years, we have seen an explosion of new and (sometimes) innovative logistics technology focused companies.

The investment community has poured billions of dollars into last-mile solutions, digital freight brokerages, real-time visibility tools, robotics and virtually every other nook and cranny of supply chain management.

The pitches are eerily similar, in that log-tech companies are all bringing to market “disruptive technologies” designed to “seamlessly unlock efficiencies and shareholder value” by leveraging “machine learning and artificial intelligence using “cloud computing and big data.”

While that may be true, a successful business must also have a path to profitability.

As the public markets enter the final weeks of a dismal year - the NASDAQ is down 30% YoY - the venture capital community is taking a more prudent and financially conservative look at their current and prospective investments.

NASDAQ Composite Index - YoY November 2021 - November 2022

According to Pitchbook, VC investment in supply chain technology was down 38% in the first half of 2022.

Supply Chain Tech VC Deal Activity

The Log-Tech companies that have relied on infusions of VC cash to stay solvent now must figure out alternative plans. The options are not pleasant:

- Cut costs, typically through layoffs

- Raise equity but at a lower valuation than in previous rounds (aka the dreaded “Down Round”). Down rounds signal to investors and employees that the health of the company is in question

- Borrow (aka Venture Debt). While this does not result in a lower valuation, debt is expensive for a non-profitable company, especially given today’s interest rates

We are continually impressed with much of the technology that is being brought to market, but we also need to ensure that our shipper clients are protected

Key Takeaways

When selecting a technology partner, it is incumbent upon shippers to perform a thorough financial assessment in the same manner they vet the log-tech provider’s functionality and technology.

Unlike publicly traded companies, getting detailed financials from privately held companies is difficult. However, gaining a high-level understanding of revenue, employee count, cash on hand and EBITDA should be the minimum requirement for any prospective log-tech customer.

Without this information, and sometimes even with this information, a significant risk discount should be applied when comparing against a publicly traded company with a strong balance sheet.

To be clear, we are continually impressed with much of the technology that is being brought to market, but we also need to ensure that our shipper clients are protected, as the cost of a failed technology partnership is significant in terms of both real costs and opportunity costs.

RELATED READING

Shipper Pain Points – How To Squeeze as Much Value as Possible Out of Your Logistics Systems

Key Logistics Technology Changes Shippers Should be Watching

Get Maximum Value From Your Transportation Freight Bid

Challenges of an Annual RFP and Why it’s Going Extinct

Are Annual Carrier RFP Events Dead?

Trimble ‘Shutting Down’ Their Kuebix TMS Platform – Now What?

About the Author

Mike Mulqueen is the Executive Principal of Strategy & Innovation at JBF Consulting. Mike is a leading expert in logistics solutions with over 30 years managing, designing and implementing freight transport technology. His functional expertise is in Multi-modal Transportation Management, Supply Chain Visibility, and Transportation Modeling. Mike earned his master’s degree in engineering and logistics from MIT and BS in business and marketing from University of Maryland.

About JBF Consulting

Since 2003, we’ve been helping shippers of all sizes and across many industries select, implement and squeeze as much value as possible out of their logistics systems. We speak your language — not consultant-speak – and we get to know you. Our leadership team has over 100 years of logistics and TMS implementation experience. Because we operate in a niche — we’re not all things to all people — our team members have a very specialized skill set: logistics operations experience + transportation technology + communication and problem-solving skills + a bunch of other cool stuff.