by Chris Doersen and Adam Gray

With rates rebounding and carrier reliability stretched thin, more shippers are asking a critical question: Should we take control with a private fleet?

According to the 2024 Benchmarking report from the National Private Truck Council, private fleets have been gaining traction with enterprise shippers, but how do you know if it’s the right move for your organization?

Chris Doersen, Executive Principal of Client Delivery at JBF, and Adam Gray, Business Architect, share their insights on the benefits, cost structures, and tactical use cases of shipper-owned private fleets.

Watch their conversation here, or keep reading for a summary.

Making the Case For Private Fleets

A private fleet is a transportation solution fully owned and operated by the shipper. Unlike third-party carriers, it gives companies direct control over drivers, equipment, and service execution.

According to Adam, "Private fleets shine when service complexity increases. When you’re hitting 10 to 15 stops per route or need inventory support at delivery sites, you’re beyond what most common carriers provide."

A private fleet may make sense for your organization if one or more of the following are true:

- You have higher stop counts (10, 20, or even more stops per route) in defined regions

- White-glove delivery service (in-store stocking, inventory handling, etc.) is important to your business model

- Timing is critical to your shipments – for example, just-in-time delivery for perishables, medical supplies, or high-impact goods

- You have opportunities with certain geographic areas, such as locations with natural internal backhaul opportunities

Strategic Value

A private fleet can serve as a strategic asset in several ways:

- Risk mitigation: Protects against market volatility, seasonal rate spikes, and capacity constraints (e.g. – holidays, weather events, daily demand)

- Lane optimization: Fleets can be deployed strategically to offset rising common carrier rates

- Relationship-driven service: Consistent drivers build trust and improve stop efficiency

"Private fleets shine when service complexity increases. When you’re hitting 10 to 15 stops per route or need inventory support at delivery sites, you’re beyond what most common carriers provide."

Application Types

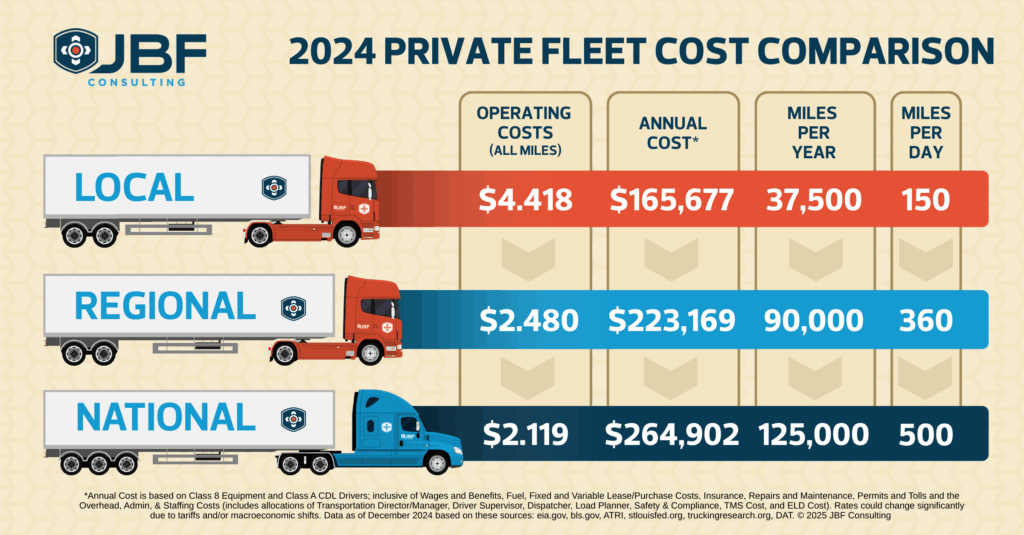

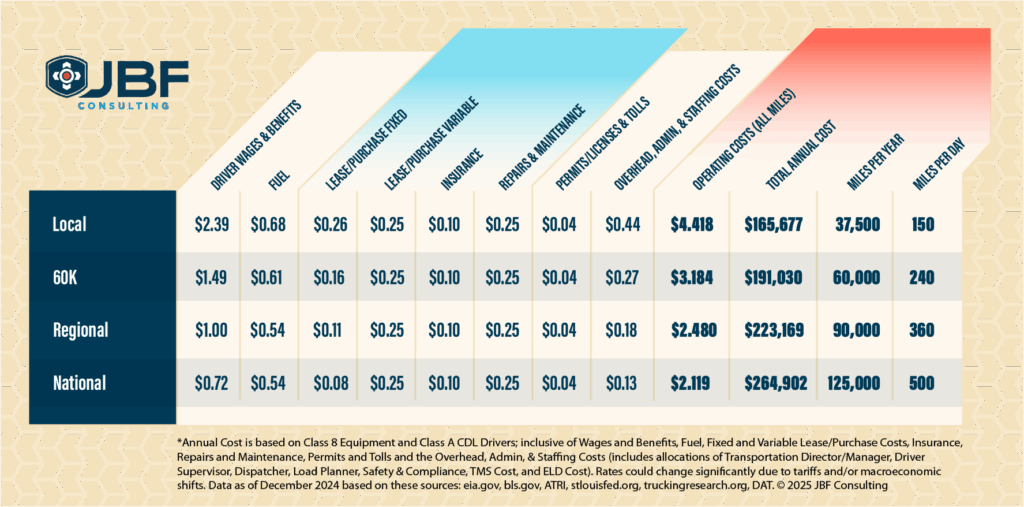

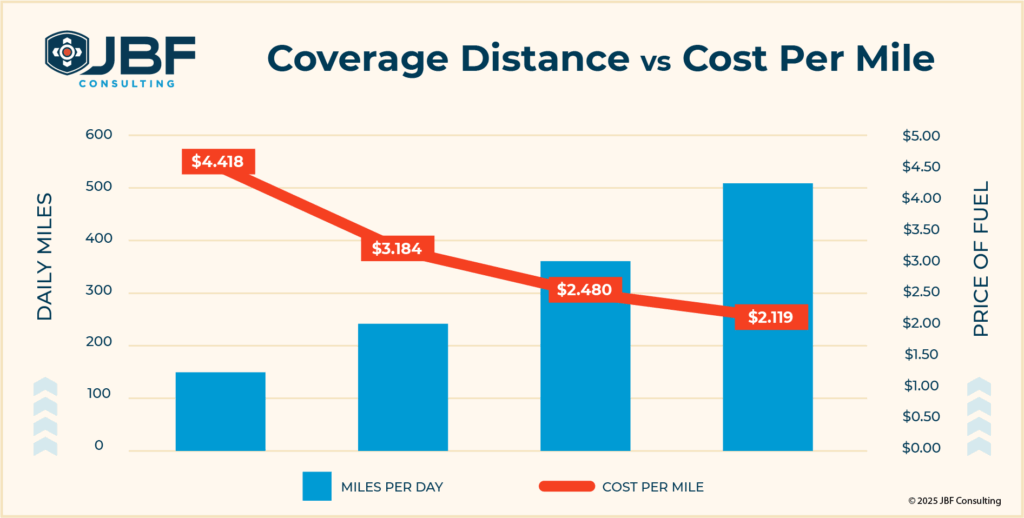

Private fleet utilization depends heavily on geography and route density. These can be broken down into Local, Mixed Use, Regional, and National.

- Local: High stop-density, “white glove” services like in-home or store deliveries. 75 Mile Service Radius from a domicile, estimated 150 total miles per day

- Mixed Use: Combines store and distribution center deliveries. 120 Mile Service Radius average from a domicile

- Regional: Broader geographic areas with consistent round trips (limited overnights/layovers). Stock transfers are used to facilitate local fleet sourcing. 180 Mile Service Radius average from a domicile

- National: Relays and Multiday Routes supporting stock transfers and manufacturing. Less suited to private fleets unless service levels demand it or efficient roundtrip moves can be made. 250 Mile Service Radius locally and approximately 500 miles between domiciles

Cost Modeling and Breakeven Analysis*

Shorter routes may result in higher per-mile costs, but as outlined in our Commercial Truck breakeven cost analysis, the added service value often justifies the investment. For longer hauls, private fleets can still be competitive when paired with effective backhaul strategies or return loads, either as part of reverse logistics or moving inbound freight.

Chris noted that management, safety, and technology accounted for only 5 to 10 percent of total fleet costs: “It was less than expected,” he said, “suggesting that operational efficiency and technology offer strong returns on investment.”

Outlook

In the midst of market unpredictability, it is especially important that you take proactive steps to minimize risk. As you plan ahead, a few key factors may influence your decision:

- Equipment age, rising wages, and carrier rate fluctuations will shift cost dynamics

- Lane coverage and seasonal demands may shift and should be reassessed regularly

- Asset strategies may need adjustment to protect margin and service expectations

"Shorter routes may result in higher per-mile costs, but the added service value often justifies the investment."

Conclusion

As costs rise and market unpredictability grows, now is a good time to reassess your transportation strategy. Technology and the associated expenses are often a small percentage of the overall cost to run a fleet, so make sure that you are getting the best out of your routing, dispatch, mobile, tracking, and metrics applications – and determine if you can add value by improving processes or adding new technology.

Whether you are evaluating how to best utilize your fleet – or whether a private fleet makes sense in the first place – we can help you identify where it adds value and where to balance with other forms of transportation. Sometimes, a quick conversation is all it takes to gain clarity and move forward with confidence.

Private Fleet Case Studies

Private Fleet Case Studies

Private Fleet Solution for Automotive Supplier & Industrial Manufacturer: Provided project management support and led the deployment of a regional pilot program for a high-service, combined delivery and reverse logistics solution.

Private Fleet Solution for Commercial HVAC Maintenance Provider: Provided project management and enterprise design support to deploy a highly automated routing and dispatch process for a hybrid product delivery and service solution.

Private Fleet Solution for Healthcare Device Provider: Worked with the client and vendor to find a path forward with the reimplementation of their current routing platform

Private Fleet Solution for Commercial HVAC Maintenance Provider: Led client engagement with their TMS vendor to validate and improve their solution capabilities in a high service-based environment.

*Assumptions

--> Fleet sizes ranging from approximately 50 to 500 drivers

--> Based on fleets using Class 8 tractors with dry van trailers and Class A CDL drivers

--> Fuel priced at $3.54 per gallon (DOE average, week of 12/9)

--> Driver compensation set at $90K annually, or approximately $45 per hour with benefits

--> Insurance cost estimated at $0.10 per mile

--> Administrative overhead includes planners, driver managers, compliance, management, and technology

--> Data as of December 2024 based on these sources: eia.gov, bls.gov, ATRI, stlouisfed.org, truckingresearch.org, DAT

--> Rates could change significantly due to tariffs and/or macroeconomic shifts

NPTC 2025 Annual Conference

The JBF Consulting team is gearing up for the National Private Truck Council (NPTC)’s Annual Conference in Orlando, May 11–13. Catch Chris Doersen, Bernadette Harmon, and Tony Wayda on-site ready to dive into all things private fleet strategy, optimization, and technology.

Let us know if you’ll be there. We’d love to connect. Let’s talk private fleet in person!

About the Authors

Chris Doersen is an Executive Principal overseeing the Solutions Team at JBF Consulting. Chris’ talent is in leading diverse teams to create valuable and implementable solutions for complex supply chain networks. He has 21+ years of experience working with large inbound and outbound supply chains in North America, Europe, and Brazil. Outside of work, Chris enjoys coaching his daughter's soccer team and writing for the BMW Car Club of America.

Adam Gray is a Supply Chain and Logistics Professional with 25+ Years of experience in the industry. His career started in Brokerage and Procurement, expanding to Fleet Operations, Warehousing, Transportation, Network Design, and Systems Implementation. When not solving Supply Chain issues, Adam can be found fishing and playing music as frequently as possible.