by Tony Wayda, Mike Mulqueen, and Wynn Marlow

May 3, 2023

Introduction

JBF virtually attended the Blue Yonder (BY) Partner Summit. During the Summit, BY detailed their product strategy roadmap, various organizational adjustments, and changes to their engagement methodology with implementation partners and system integrators.

They also shared some interesting analyses of “Red” projects and the common factors that caused the project challenges. Below are the key points that were discussed and JBF’s perspective on the strategy Blue Yonder laid out.

Primary Takeaways

- BY stated that they intend to build the “supply chain operating system for the world”. This will require BY move to a singular data model for all BY applications (Planning, OMS, TMS, WMS) using the Snowflake Data Cloud.

- BY indicated that there would be no “Cliff Events” (i.e. sunsetting legacy technology) and that their investment into microservices will enable legacy customers to migrate to this technology over time and at their own pace.

- BY stated that they would be investing $1 Billion in R&D over the next 3 years.

- BY provided a “Red” project review along with a refined approach for how BY and System Integrators should work together.

BY stated that their intention is to build the “supply chain operating system for the world”

Product Strategy

The End of Integration?

BY announced a grand strategy to re-architect and re-design their applications on a scale we have not seen from any other vendor. This redesign includes moving all applications to a singular data model and application platform using the Snowflake Data Cloud.

BY believes that this will result in a step-change in value creation as the architecture will break down the traditional process silos (e.g. OMS, WMS, TMS, Planning) that we have seen since the supply chain software market began 30 years ago.

This singular data instance for all applications is designed to support their vision and, they state, will also eliminate integrations. Instead of passing data between applications in costly and often, fragile integrations, the idea is for the applications to pull the data required by each application directly from Snowflake. Regarding cross-enterprise processes, trading partners that are on Snowflake can share information without building integrations.

While visionary, we believe that eliminating integrations completely may be overly optimistic for most clients. Data would need to be available in a location and format that BY can access to eliminate building custom integrations with BY. Most clients have at least some data stored in custom-built systems or local databases. These data sources, along with data requiring extensive manipulation/cleansing will require custom integrations.

With Blue Yonder’s DMS product(s) having standard data mappings defined, mapping and integration will be easier. DMS has a standard set of flexible APIs and file loads, along with custom data validations based on the data entity and client specifications. Therefore, we believe a comprehensive data mapping and data definition effort will be all the more critical in the future.

While visionary, we believe that eliminating integrations completely may be overly optimistic for most clients.

Incremental Movement Toward a Microservices Architecture

BY re-stated their commitment to microservices. They are designing the Luminate microservices architecture to allow existing clients to migrate legacy modules at their own pace, thereby eliminating the need for clients to perform a full re-implementation of the new platform. The company reiterated this point on multiple occasions in an effort to reassure existing clients that there will be a migration path to move from legacy BY applications to the micro-services architecture.

While the “hows” were somewhat vague and left to interpretation, the vision is in stark contrast to the path that BY competitor Manhattan Associates has taken, which is to require clients to re-implement (vs. upgrade) the solutions that they have in place or risk being on obsolete and unsupported technologies. Clients should appreciate BY’s approach, although we are eager to learn more details in terms of how it will be accomplished.

Blue Yonder’s Investment in R&D

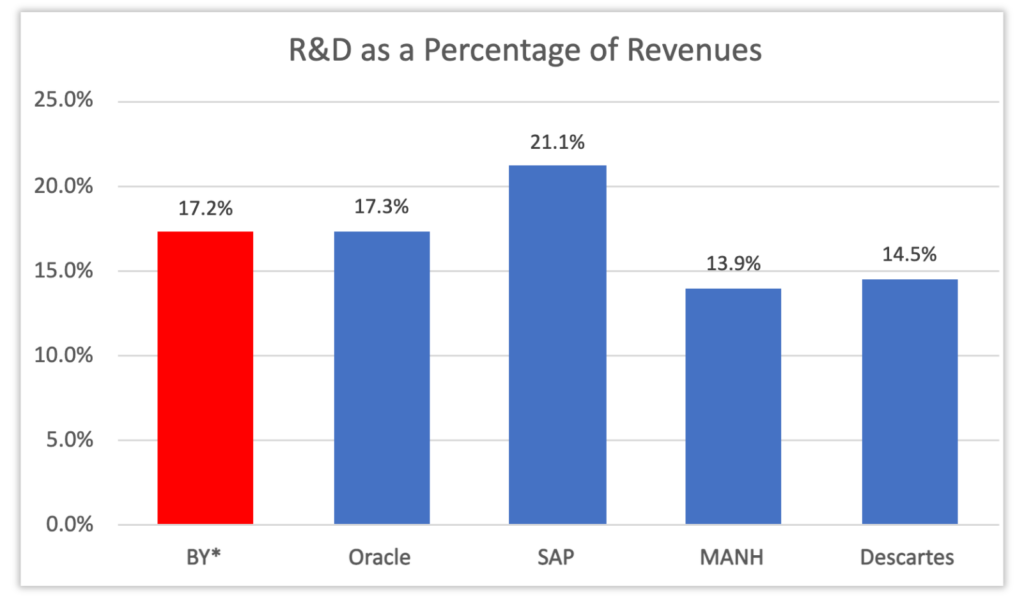

BY announced that they would be investing $1 billion in R&D over the next 3 years. While this number is eye-opening and touted as a huge incremental increase in spending, our calculations estimate that it represents approximately 17% of revenues. This is a healthy, but not excessive ratio, and is in line with where we see other enterprise software companies.

*Blue Yonder is not publicly traded and has not released detailed financial information since July 2022. Our calculations assume a 15% annualized growth rate in total revenues through FY 2026.

“Red” Projects

We found it quite refreshing that BY is willing to discuss, diagnose, and mitigate the issues that lead to floundering projects. BY revealed that in their internal review of projects with poor results, the leading causes of project failures are ineffective change management and issues with data migration and integration. BY specifically called out the need for system integrator (SI) support in customers’ data conversion and migration to the Luminate platform. These are areas qualified partners are capable of assisting, but they need to be addressed and planned for at the beginning of the implementation and not as an afterthought.

In a nutshell, BY appears to be more focused on taking a partnership mentality in partner-led projects rather than leaving the outcome of the project to the client and SI after the deal has closed. They talked about working directly with partners during the proposal to develop a RACI and joint project plan. This is refreshing to hear, and we hope to see it implemented soon, as we believe it will have a significant and positive impact on SI-led projects.

While this number is eye-opening and touted as a huge incremental increase in spending, our calculations estimate that it represents approximately 17% of revenues.

Caveats

While we are excited about the investment and product direction BY is pursuing there are areas we think are going to take some time.

- Item 1 - Current Product Migration Paths

BY promised more detail on this in the next few weeks. We have a lot of questions concerning this area. How are customizations moved to the BY extensions framework? How much rework is required? Can we be assured that the extensions are upgradeable? - Item 2 - The Migration Path From an On-Premise BY System to Luminate

BY stated that clients would be able to migrate modules at their own pace. Does their current app need to have all the data migrated to the cloud first? Are they building adaptors for the legacy application to work over the new SnowFlake data model so there will be a hybrid on-prem app and cloud database? Will this have performance impacts? - Item 3 – Elimination of Integrations

The concept of no integrations may be valid for communication between their applications, but we don’t think this is realistic. Given that data often resides in a host of systems for a large enterprise, the data will need to have some transformation done to it to support the various capabilities of the process application, and it is likely trading partners will not be fully in the Snowflake data cloud.

Conclusion

In summary, JBF thinks this product roadmap is quite visionary, and we especially appreciate the planned improvements to the implementation partner program. Both of these areas show that Blue Yonder continues to keep its customers at the forefront of its investment strategy.

However, the scope of what Blue Yonder is attempting should not be minimized, and we foresee significant hurdles and obstacles that will need to be overcome in the next few years.

Given JBF is a Blue Yonder partner, we are eager for the company—and our clients—to reap the benefits that the vision promises, and while the road may be difficult, the vision and accompanying investment are compelling and potentially game-changing.