Do any of these quotes, or some variation, sound familiar?

- “I can’t believe that carriers that I have done business with for years won’t pick up my freight”.

- “I understand that capacity is tight, but I have agreements in place that don’t seem worth the paper they are written on”.

- “Some of these shippers are not worth the effort with the amount of detention, late payment, and no notification on volume fluctuations”.

- “It is a sellers market right now and we have to take advantage of that”.

They should if you are in any way connected to the transportation industry - a shipper, carrier, consultant, 3PL, software vendor, et al.

The perfect storm of macroeconomic swings, weather, major canal closure, and consumer demand post-pandemic, amongst other things, has swung the pendulum in favor of freight services providers. Shippers of all sizes are not only dealing with angry customers, they are angry themselves.

“Shippers of all sizes are not only dealing with angry customers, they are angry themselves.”

Survey Says...

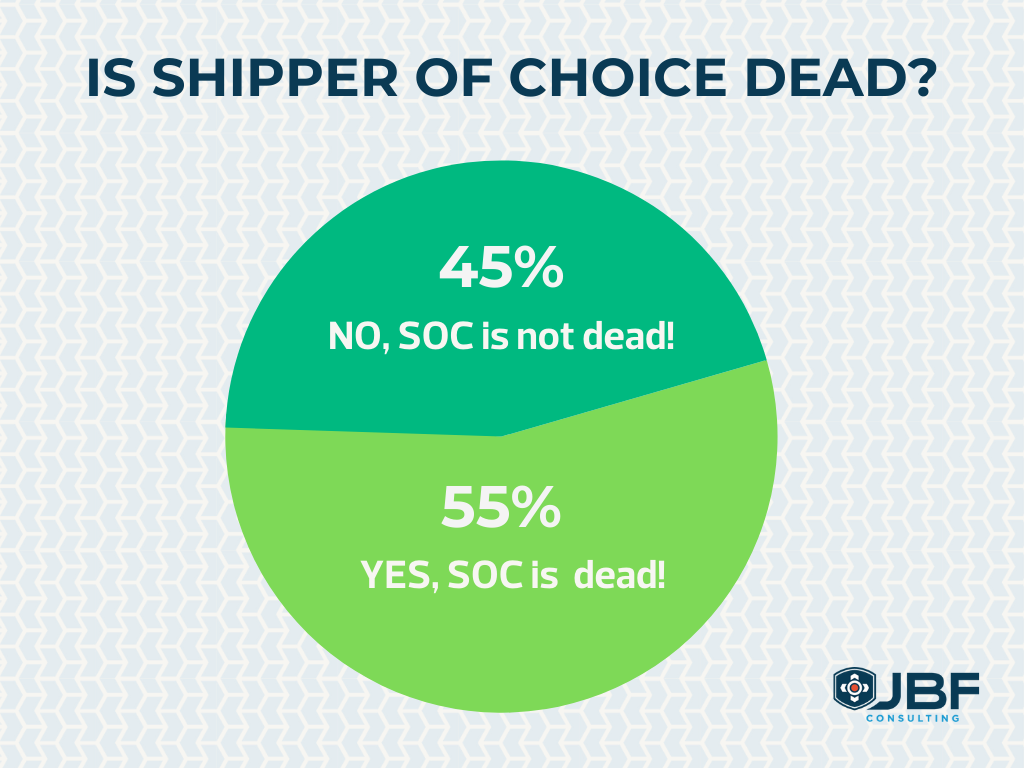

JBF Consulting recently conducted a poll to determine if the concept “Shipper of Choice” (SoC) was still valid. That is, if a shipper is doing things for carriers to be easy to do business with, will they avoid being cut off or raked over the coals when capacity is tight?

The poll showed us that the answer depends. Overall, 55% of respondents said ‘Yes’, SoC is dead; 45% said ‘No’ SOC is not dead.

Respondents were of five primary types:

>> Shipper

>> Carrier

>> Consultant

>> 3PL

>> Software Vendor

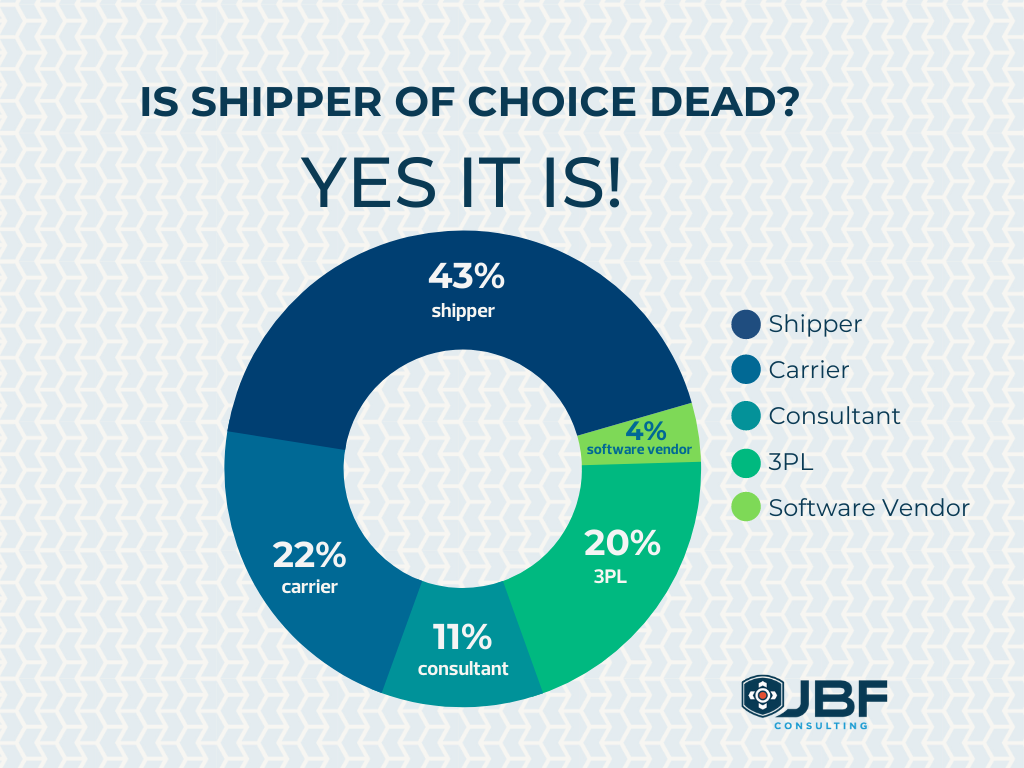

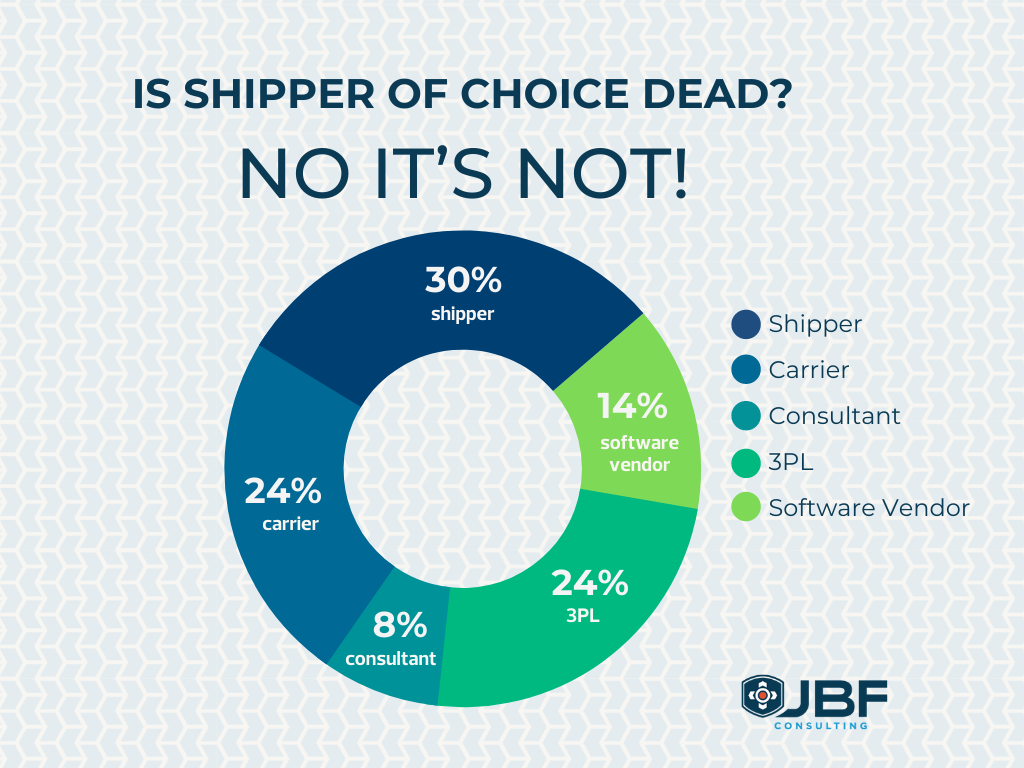

What does this mean? It depends, of course, on your role in the market - most (two-thirds) shippers definitely felt that SoC is dead, as did consultants.

Others seem more optimistic - about half of carriers said no, as did 3PLs; of software vendors, seven out of ten say it is not dead.

"What are you doing to make your freight more attractive to carriers and what do carriers truly value?"

JBF works with parties across the spectrum in the transportation space, but most often our clients are shippers and we work to get them focused on the right initiatives. And since shippers are feeling the brunt of the current situation, the balance of this discussion is directed to them.

Why Carriers Wouldn’t Move Your Freight

The fundamental question is “What are you doing to make your freight more attractive to carriers and what do carriers truly value?” Here are a few tips and calls to action.

- Yeah, you are mad.

Call to Action: Don’t let your anger get the best of you when the market turns. And it will;

- Know your freight characteristics, lanes, current performance levels, volume & variability, and costs.

Call to Action: Be an educated buyer;

Identify and reward those carriers that acted as partners vs. those that abandoned you;

- Some of your practices are bad and need revision.

Call to Action: Look in the mirror and understand why carriers wouldn’t move your freight:

>> Do you have poor loading/unloading operations that are causing significant detention?

>> What are your payment terms and are they competitive?

>> Do you require live loads/unloads or do you have drop trailer programs

>> Do you have high variability in shipment volumes and if so, do you provide forward notification to your carriers and brokers of surges and lulls;

- The annual bid process does not operate well in times of high volatility. A lane that a contract carrier bid on in December may have completely different value to a carrier in May.

Call to Action: Look to be more dynamic in terms of your contract carriers, continually assessing performance;

- Not every carrier is a trusted partner, nor should they be. Identify those carriers that have performed for you in the past and that you can trust won’t leave you to chase the spot market when the opportunity arises.

Just as you have A, B and C customers, you will also have A, B and C suppliers, and suppliers of indirect materials/services, like a carrier.

Call to Action: Identify the role of each and develop relationships accordingly.

Another Perspective

MIT’s Freight Lab has explored some different tactics. Additionally, Angela Acocella, also of MIT, has done some detailed research about the buying and selling trends of the shipper-carrier relationship that is worth reading.

Per Acocella, “At a high level, the most important behaviors shippers can have for loyalty from carriers are competitive contract prices (keeping rates current with either mini-bids or more dynamic price alternatives) and consistency and frequency of tendered volume”.

The bottom line is shippers, carriers, and other parties to the transportation dance party need to be cognizant of the dynamic nature of the industry and put tactics in place to rebuild trust as the market will definitely swing back in the future.

If you are a shipper and are unsure what to do, let’s have a conversation to get you started.

About the Authors

Dennis Heppner is a Principal at JBF Consulting. Dennis’ expertise in transportation, logistics and supply chain operations, and third-party providers spans 25+ years. His experience is broad-based, spanning entire supply chains, including business process redesign, sourcing, distribution network design, transportation management, distribution operations, outsourcing selection, and business strategy for major manufacturers, distributors, retailers including eCommerce, and service organizations.

Mike Mulqueen is the Executive Principal of Strategy & Innovation at JBF Consulting. Mike is a leading expert in logistics solutions with over 30 years managing, designing and implementing freight transport technology. His functional expertise is in Multi-modal Transportation Management, Supply Chain Visibility, and Transportation Modeling. Mike earned his master’s degree in engineering and logistics from MIT and BS in business and marketing from University of Maryland.

About JBF Consulting

Since 2003, we’ve been helping shippers of all sizes and across many industries select, implement and squeeze as much value as possible out of their logistics systems. We speak your language — not consultant-speak – and we get to know you. Our leadership team has over 100 years of logistics and TMS implementation experience. Because we operate in a niche — we’re not all things to all people — our team members have a very specialized skill set: logistics operations experience + transportation technology + communication and problem-solving skills + a bunch of other cool stuff.