Overview

Over the years, JBF has assisted a variety of shippers select and implement Transportation Management System (TMS) technology. The types of clients we serve vary greatly, spanning industry verticals, geographies, and freight spends.

During each engagement, we capture, prioritize, and categorize hundreds of shipper-specific requirements and develop conceptual designs aimed at addressing each of our client’s unique needs.

However, regardless of the engagement, there are 4 underlying improvement areas that have become imperatives for all prospective TMS buyers. These are:

- Area 1: Process Automation – Eliminate redundant and error-prone manual processes that rely on tribal knowledge

- Area 2: Data Digitization – Capture and store all relevant data for later use as the basis for insights and continuous improvement opportunities

- Area 3: Operational Visibility – Measure and manage freight operations with effective proactive and reactive event management

- Area 4: Planning – Generate low cost, operationally feasible plans through mathematical solvers

While all these concepts are important, for many shippers, the anticipated cost reductions driven by improvements to Area 4: Planning represent the lion-share of the projected savings that were used to fund a TMS initiative.

However, too often, this critical capability goes underutilized.

The ramifications of this are significant. Aside from the unrealized operational savings, the inability to effectively perform daily planning impacts each of the other improvement areas. Load building and carrier selection stay manual while off-line databases and spreadsheets impact both the digitization and operational visibility initiatives.

"For many shippers, the anticipated cost reductions driven by improvements to Area 4: Planning represent the lion-share of the projected savings that were used to fund a TMS initiative."

Three Factors Inhibiting Transport Planning

Given the sizable benefits of successfully deploying daily planning optimizers, it is important to understand why this critical function remains elusive for many shippers. In our extensive work with shippers, we find three common factors at the heart of the problem.

Factor 1 - “Optimizer” Efficacy

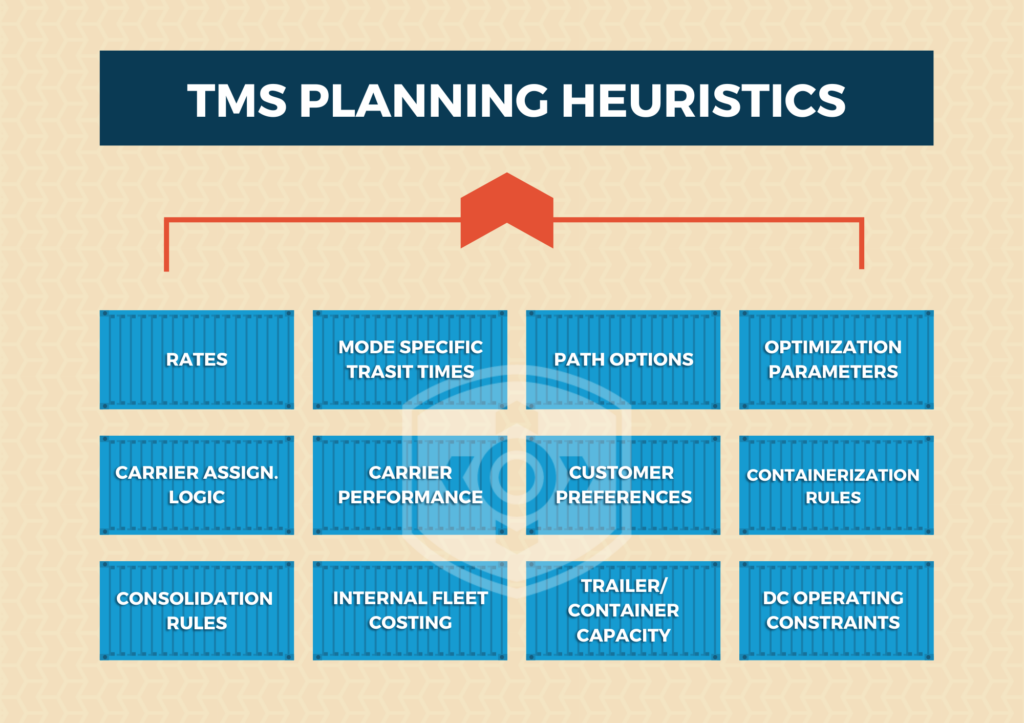

The term “optimizer” is a misnomer when it pertains to enterprise transportation management. Given the impossibly large number of permutations even a moderately sized network poses, these problems cannot be solved to optimality. To address this, each TMS provider has developed a set of their own proprietary heuristics. The efficacy of these heuristics varies greatly across vendors, with the Tier 1 providers typically having the most sophisticated solvers.

Of course, virtually all TMS providers can perform the basics, such as order consolidation, rule-based mode selection, multi-stop TL formation and carrier assignment, but many are ill-suited to support the more “exotic” planning requirements.

Specific areas where we see solver deficiencies, even for the Tier 1 providers such as Oracle and Blue Yonder, include:

- Private / Dedicated Fleet Planning – We see significant limitations in the ability for even the best TMS solutions to effectively plan private and dedicated fleets. These limitations are especially pronounced in both high density secondary networks as well as in networks that use their fleet in long-haul lanes, where the asset location and driver availability are critical factors in the decision-making process.

- Parcel – Effectively planning parcel shipments in a TMS implies capabilities such as zone skipping, virtual cartonization, cross-carrier rate shopping and optimal service level determination remains a weak area across many TMSs.

- Probabilistic Planning – Combining deterministic and probabilistic inputs to make better decisions is a much-needed improvement to today’s heuristics that we are still waiting on. Batch solvers today assume that they have all the data required to develop a plan. However, we all know that new orders will be continuously added to the problem set and that, if known at the time of the batch optimization, would have led to a different solution. The inability to anticipate plan adjustments leads to poor decisions.

- Planning Parameter Configuration – Sometimes, the reason for poor solution quality has nothing to do with solver deficiencies, but instead are related to the configuration parameters the solver is using. These parameters are often unintelligible to the end users and never touched after the initial implementation even though a shipper’s network may have changed considerably over time.

Recommendation

Before acquiring or replacing TMS technology, vet the solution providers capabilities against your planning requirements. As part of the evaluation process, have the TMS provider run your data through their system and meticulously and methodically evaluate the results. Finally, talk with other shippers using that technology that have similar planning requirements.

For both parcel and fleet networks, there may be a need to decouple these modes from the standard TMS if it becomes apparent that their capabilities are simply insufficient for your business. Bolting on purpose-built solutions to solve for a sub-set of the transport network is common as there are whole classes of providers that focus on specific modes such as private/dedicated fleet and parcel management.

Factor 2 - Data Integrity

It goes without saying that inaccurate data will lead to dubious, and at times, nonsensical results. While solvers are highly sophisticated, especially from the tier 1 providers, they need clean data to operate effectively.

Conceptually, everyone understands the GIGO principle. However, too often shippers don’t put in the effort to ensure their data are clean and accurate, both at the go-live, but also, long-term.

While we place most of the blame for data integrity issues on the shipper, the TMS providers also must shoulder some of the responsibility.

Troubleshooting solvers can be ludicrously difficult and understanding why a specific solution was arrived at is often impossible to ascertain. This leads to frustration on the part of the shipper and ultimately, a lack of trust in the system.

The diagram below provides a subset of the business objects that will impact solution quality. If any of these objects are inaccurate or incomplete, the solution quality will suffer.

Having people that truly understand both the heuristics, and how they use and interpret transactional and static data is critical when tuning the solver to address shipper needs.

Recommendation

TMS providers need to do a much better job of continually assessing the efficacy of the solver and reporting to the TMS user (aka the Shipper) when the tell-tale signs of solution quality degradation begin to appear.

Reports indicating the percentage of loads that are manually manipulated or how frequently carrier invoices deviate from the expected invoice amount are examples of red flags that need to be identified and addressed. Providing this information along with benchmark information across other TMS users would enable shippers to address issues before they become out of hand.

Additionally, using machine learning to identify suspicious or inaccurate data would help shippers tackle data clean-up more effectively.

We also would like TMS providers to proactively re-run solves on behalf of their shipper clients and make recommendations as to how the heuristic configurations can and should be adjusted to drive better solution quality.

Shippers, on the other hand, must invest in data governance processes that address long-term system sustainability. Both the transactional inputs (e.g. Orders, Items) as well as the business objects that reside in the TMS must be accurate and that takes a concerted and continuous effort that cannot be viewed as a one-time data clean-up project.

"Each TMS provider has developed a set of their own proprietary heuristics. The efficacy of these heuristics varies greatly across vendors, with the tier 1 providers typically having the most sophisticated solvers."

Factor 3 – Externalities Impacting Solutions

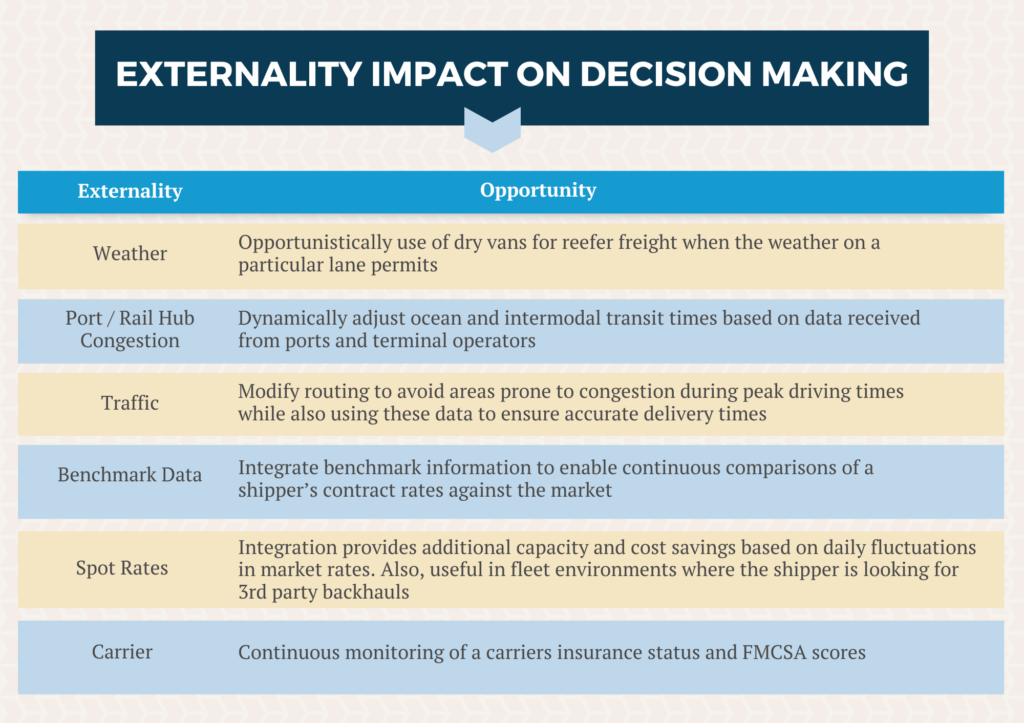

Assuming a shipper’s TMS has effective optimization capabilities (Factor 1) and clean data (Factor 2), these systems are still prone to inaccurate decision making. Real-world events such as port congestion, geo-political turmoil, weather and black-swan events all impact transport planning.

Unfortunately, TMSs are largely ignorant of these externalities.

Examples of how these externalities impact decision making include:

"Real-world events such as port congestion, geo-political turmoil, weather and black-swan events all impact transport planning. Unfortunately, TMSs are largely ignorant of these externalities."

Recommendation

Shippers must understand their exposure to various externalities and press the TMS providers to develop solutions that can react to these events with no, or very limited, manual intervention.

While still early, we are beginning to see TMS providers partner with companies including everstream, Loadsmart, Emerge, Truckstop.com/RMIS and the RTVS providers to integrate real-world data back to the TMS. However, simply integrating these data to the TMS is only half the battle. The TMS providers must develop mechanisms to not only absorb these data, but to use the data to inform and enhance the planning process.

Along with Gen-AI, we view this as one the most important areas that TMS providers should be investing in. Solvers are only as good as the inputs, and being blissfully ignorant of an entire class of variables (i.e. externalities) will result in poor solutions.

Addressing the Issue

Uncovering the reasons why a shipper is not effectively using the TMS planning component may seem daunting, but having a fresh set of eyes on the problem can expedite the process. JBF uses a 4-step process to get shippers back on track.

- Step 1: Current State Assessment

> Is the TMS optimizer being used for load building and if so, for what percentage of the freight is planned in this manner?

> Are the anticipated savings being generated and if so, how is this calculated?

> Is a significant portion of the freight handled without manual intervention? - Step 2: Identify which factors are negatively impacting solution quality using the factors identified above

> Heuristics efficacy versus business needs

> Data accuracy and cleanliness

> Impact of externalities - Step 3: Quantify the savings opportunities between the current state and the “optimized” future state

> This helps justify the mitigation steps that will require to use the planning capabilities of the system - Step 4: Recommendations

> If the technology is adequate, put in place standard operating processes and system measures to ensure long-term system efficacy

> If the technology is NOT adequate, determine if other solution providers are better suited to the shipper’s particular optimization problem

Conclusion

A common misconception among buyers of TMS technology is that any logistics plan developed by a computer will be inherently better than that built or “corrected” by a human. The TMS salesperson told you as much, and an entire business plan sold to the CFO was built upon that assumption.

However, in too many instances, these benefits are not delivered. We see shippers “turn-off” the planning component, essentially leaving them with an overly complex tendering, freight payment and reporting system.

While there is the temptation to just say that the TMS doesn’t work, take the time to truly understand the root causes and develop a plan to mitigate. Similarly, if you are looking to acquire TMS technology, spend ample time ensuring that your planning needs are being accommodated.

Next Steps

Navigating the complexities of TMS planning can be overwhelming, with challenges ranging from underutilized optimizers to external factors that impact logistics decisions.

The journey to optimizing transportation management is intricate, requiring a blend of the right technology, clean data, and an understanding of the external variables that shape logistics.

To ensure your TMS strategy is not just a concept but a driver of tangible savings and operational efficiency, consider partnering with JBF Consulting for expert guidance and actionable solutions. And if this topic resonates with you and you'd like to get some solid insights, please connect with me on LinkedIn.

About the Author

Mike Mulqueen is the Executive Principal of Strategy & Innovation at JBF Consulting. Mike is a leading expert in logistics solutions with over 30 years managing, designing and implementing freight transport technology. His functional expertise is in Multi-modal Transportation Management, Supply Chain Visibility, and Transportation Modeling. Mike earned his master’s degree in engineering and logistics from MIT and BS in business and marketing from University of Maryland.

About JBF Consulting

Since 2003, we’ve been helping shippers of all sizes and across many industries select, implement and squeeze as much value as possible out of their logistics systems. We speak your language — not consultant-speak – and we get to know you. Our leadership team has over 100 years of logistics and TMS implementation experience. Because we operate in a niche — we’re not all things to all people — our team members have a very specialized skill set: logistics operations experience + transportation technology + communication and problem-solving skills + a bunch of other cool stuff.

Related Reading

How Do Shippers Know When They Need Sophisticated TMS Optimization?

Desired End State – An Insiders Guide to Acquiring TMS Technology

A Comprehensive Strategy for Selecting Transportation Logistics Technology Vendors

The #1 Mistake Shippers Make When Implementing a TMS

Make This One Subtle Change to Greatly Improve Your TMS Implementation Outcomes

Insider Guides

Desired End State Insider's Guide

Buyers Guide to Transportation Management Systems

🔹 🔹 🔹 🔹 🔹 🔹

Subscribe to the The Digital Logistician

Sign up for our Monthly Email Bulletin

Follow the JBF Company page on LinkedIn

Download our white papers & ebooks