Fleet Routing

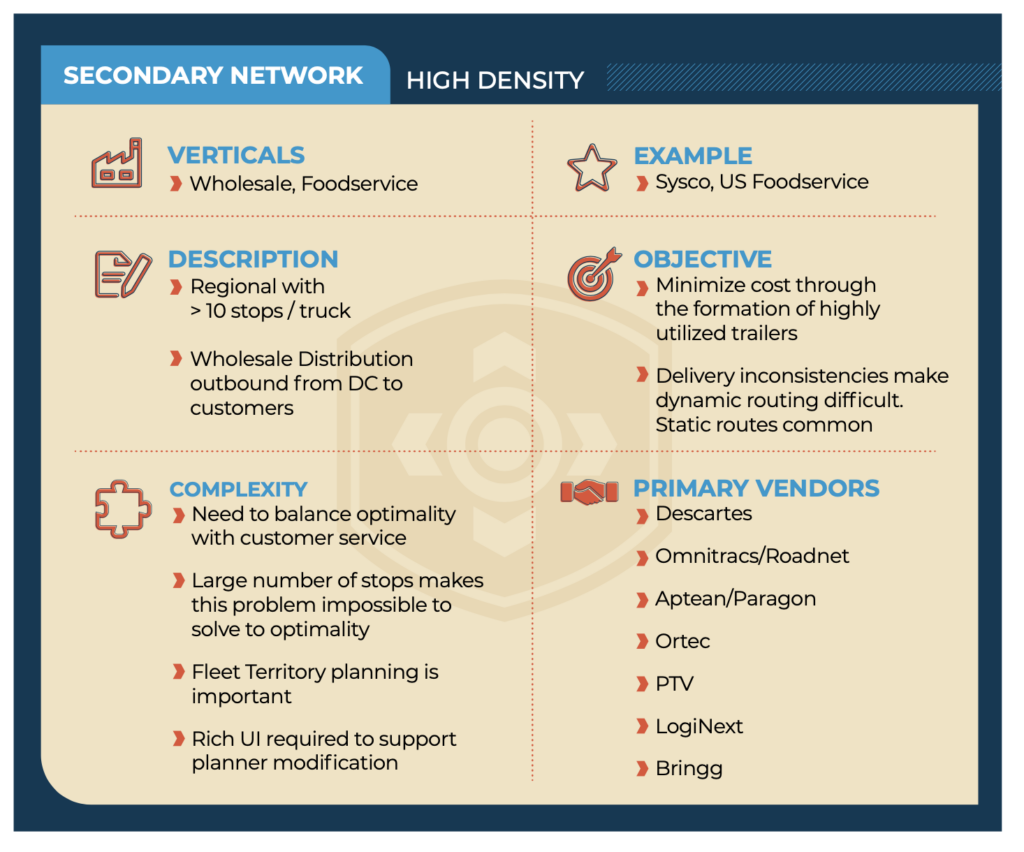

Over the past 35 years, technological advances have made fleet routing and scheduling solutions widely available and quite powerful. Legacy providers such as Omnitracs/Roadnet, Descartes, Ortec and Aptean/Paragon are now competing with up-and-coming solutions from providers like Bringg, LogiNext and Opsi systems.

- Both legacy and the new breed of providers have put a great deal of time and treasure into developing algorithms that can increase the productivity of their customers’ fleets. Some notable advancements include:

- Increased CPU power, which enables more scenarios to be evaluated during the routing process

- Cloud-based solutions that make higher-performing IT platforms and tools more readily accessible during routing

- More accurate mapping data that is used in both location geocoding and travel time/distance calculations

- More sophisticated heuristics that enable the creation of higher-quality solutions

Additionally, most routing solutions on the market today consume data from the fleet electronic logging devices and/or electronic proof of delivery (ePoD) solutions. These data can be used to identify discrepancies between what was planned versus what occurred in the field. They are then used to train the system so future planning runs “learn” from historical data, thereby increasing the accuracy of the models used during routing.

Secondary Network Routing

One of the most common uses of private fleets is to support final mile delivery of a company’s products. We call this the “secondary distribution network.”

The secondary network is defined as the movement of product from a distribution center to the end customer location and can be further broken down in subgroups categorized by stop densities. The focus of this paper is on High Density networks.

This type of network is commonly seen in food service, paper and beverage distribution businesses. It is characterized by routes with high stop counts (10-20 stops), dense delivery networks, vehicles that typically return to the domicile each day and the need to support a variety of delivery constraints, including customer time windows and vehicle size restrictions.

To service this network, these distribution businesses rely on a fleet of vehicles and drivers to deliver to their customers small yet frequent orders.

While the advancements in fleet routing technology have been impressive, drivers continue to complain about the solution quality generated by today’s routing packages.

"While the advancements in fleet routing technology have been impressive,drivers continue to complain about the solution quality generated by today’s routing packages."

Static Routing

Drivers question the routing sequence, day to day imbalances in route duration and other fundamental aspects of their routes. This has led to the widespread use of “static routing” by many secondary network fleet operators.

Static routing uses route templates to perform the initial build. Route planners then review and manipulate the solution to their needs before submitting the finalized route plan to the distribution center for picking and loading.

Static routing is the opposite of dynamic routing, which, in its purest form, builds loads based on a mathematical objective function (e.g. cost minimization, profit maximization) constrained by operational factors such as vehicle capacity, hours of service limitations and customer delivery preferences.

Routing and scheduling software providers sell their solutions to shippers based on the sophistication of their heuristics and the ability to save 10% or more on fleet costs by using dynamic routing.

However, in high-density secondary networks (versus low-density, which are epitomized by grocery and big box retailers), we continue to see dynamic routing be more the exception than the rule.

Even when dynamic routing is used, it is common for the routers to re-build the routes to their liking after planning, leaving little semblance of the original route solution in place.

Understanding the Challenges

Why does dynamic routing not work in high-density secondary network routing? A variety of reasons have been proposed for the failure of shippers to use mathematically based dynamic routing models in their operations. They include:

- Drivers prefer the consistency that static routing provides

- Drivers are more efficient when they service the same locations day after day and week after week

- Customers like the consistency of having the same driver arrive at close to the same time for each delivery

- Dynamic routing is highly reliant on accurate data, which can be an immense job to maintain. If these data are inaccurate, the heuristics will make bad decisions (GIGO)

- Shippers do not know how to tune the algorithm’s optimization parameters to meet the business needs

-

The complexity of a typical routing problem cannot be solved to optimality by today’s planning engines. Given there is no known formula to solve even a moderately sized problem, heuristics are used, which provide good, but not optimal solutions. (Note: A twenty-stop route has 2,432,902,008,176,640,000 potential sequences, of which only a very small fraction are evaluated during optimization)

Area 3 – Multi-faceted Optimization

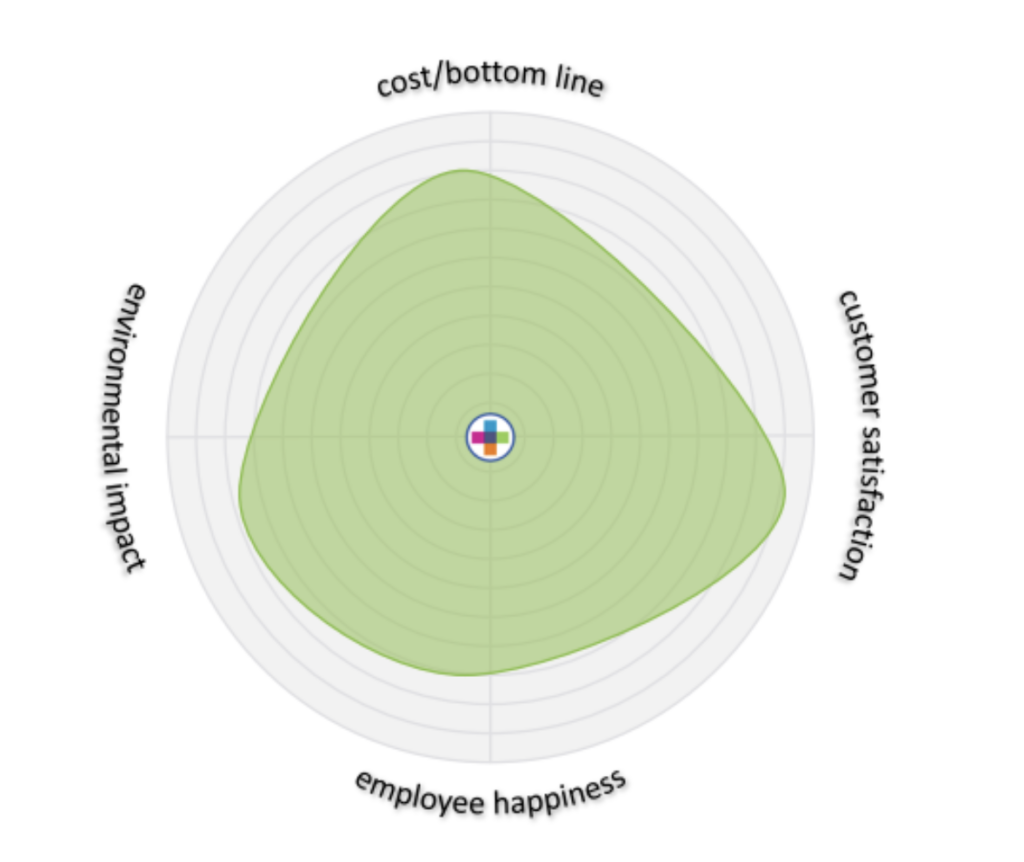

Solvers used in transportation planning typically employ cost minimization as their “objective function.” These solvers use advanced heuristics coupled with user-specific, configurable parameters that constrain the solution, such as vehicle capacity, time windows, and route duration.

These parameters are utilized to ensure the operational feasibility of the solution. However, the primary purpose of these heuristics is to minimize costs subject to user-specific constraints.

ORTEC has extended the legacy approach and moved from a purely financial objective function to a multi-faceted solution approach that, in theory, will yield better overall results.

ORTEC has defined 3 additional optimization areas that can now be considered during planning. Shippers can define how factors such as environmental impact, employee happiness, and customer satisfaction are quantified and weighted during the solve.

An example of how this can be utilized was presented during the product roadmap overview. An initial implementation of ORTEC’s routing solution led to a significant increase in the number of stops/route; this made management quite happy until 10 drivers quit. While the optimization worked well, the cost and impact of the subsequent driver attrition ate away the savings, negatively impacted driver satisfaction, and led to a decrease in customer satisfaction.

We believe that the ability to develop routing solutions that are cognizant of emissions, as well as customer and employee satisfaction, is a significant advancement over the somewhat myopic way solvers have historically worked. However, we are concerned that tuning the heuristics and understanding “WHY” the solver is doing what it is doing may become more difficult.

In the past, we have had some difficulty troubleshooting and tuning the sophisticated configuration parameters that ORTEC uses. We fear adding additional logic may make troubleshooting more difficult.

"ORTEC’s optimization engines are highly configurable, but custom solutions that understand the nuances of operating in different types of businesses will, in theory, provide greater value faster."

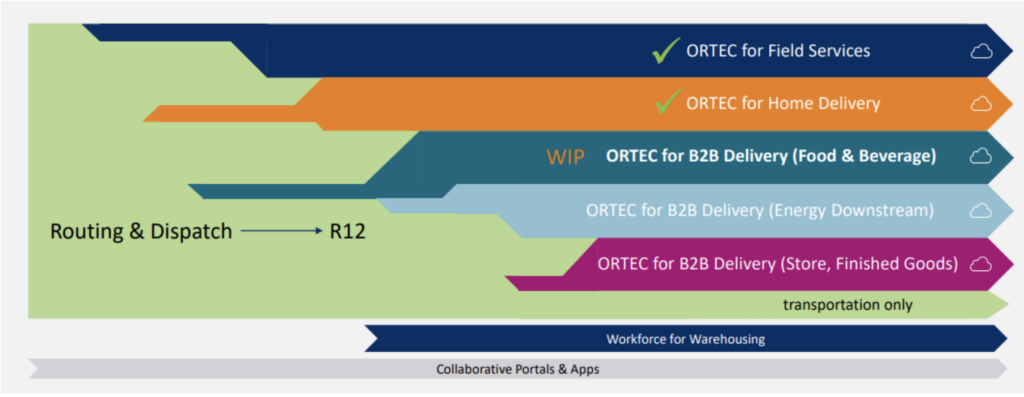

Area 4 – Industry-Specific Cloud Solutions

When speaking with routing and dispatching software providers, JBF typically asks what type of fleets their solutions are designed to support. We become skeptical when providers, especially those without track records, say they can handle any type of transportation fleet. We don’t believe they are lying. We believe they are ignorant of the significant differences in requirements across industries that operate fleets.

For instance, a courier may be routing sprinter vans with 70 stops while a grocer may average 2 stops /route on a tractor-trailer. Some longer-haul fleets may have multi-day routes and consequently look to optimize internal backhauls or sell capacity on the open market to generate revenue.

However, field service fleets may look at the problem differently and seek to maximize revenue per employee while also adhering to vehicle inventory, driver skillset constraints, and geographic proximity when assigning work to a driver/technician. Again, these are fundamentally different problems that require purpose-built solutions.

To address this need, ORTEC has undertaken the process of building specific routing and dispatch solutions to address 5 specific industries (see chart below) and the unique requirements each has. We anticipate that these solutions will enable faster implementations with quicker time to value for ORTEC’s customers, given the out of the box solution may be much closer to “go-live” ready than a generic solution that requires significant tuning.

While we think industry-specific solutions are the best approach, even more focused solutions will likely be required in the future. For instance, the Food and Beverage solution likely includes manufacturers like Tyson Foods, food service companies like Sysco Foods, and grocers like Kroger.

The requirements of each of these companies are vastly different from one another, so there would be little commonality in terms of what each business would require from their routing/dispatch system. That said, we know that ORTEC has to start somewhere, and the 5 categories that have been identified likely represent a logical breakdown of ORTEC’s current and future routing and dispatch customers.

Routing and Dispatch Solutions to Address 5 Specific Industries

Area 5 – Cloud and the AI Implications

ORTEC has long been known in the logistics software space as the “math” guys. Over the past 4 decades, they have differentiated themselves and stayed relevant by building sophisticated mathematical heuristics and models embedded within their software. This approach has driven customer value in both transportation and distribution to hundreds of customers.

While we find ORTEC both highly competent and humble (a rare combination for tech companies), we have been critical of their legacy, on-premise technology that was not cloud ready. In this conference, ORTEC put that concern to rest. They are now a cloud software company with all the benefits to customers that that implies (e.g. automatic upgrades, enhanced security and system maintenance, and performance tuning).

It also addresses an impediment to sales, given many ORTEC prospects have made the transition to SaaS as their preferred deployment model. Essentially, ORTEC had to move to the cloud or face an existential threat to their business.

However, a cloud solution provides additional opportunities for ORTEC to collect, analyze, and communicate both predictive and prescriptive information to shippers whose data had historically been hidden from ORTEC.

ORTEC’s new cloud data repository, called DnA, will now house these data, which provides some intriguing possibilities. While I was hesitant to bring up artificial intelligence in this analysis given the excessive hype we have seen since the release of ChatGPT, I do see ORTEC being one of the few mid-size technology companies that is positioned, from an internal skill-set perspective, to embrace these technologies.

By leveraging both customer-specific data and aggregated data across customers, ORTEC can provide basic benchmarking and other analytics but also provide AI-driven prescriptive recommendations as the solution identifies behaviors, trends, and other activities that imply lost efficiencies and/or potential opportunities.

ORTEC is in the early stages of their AI journey, but I appreciate that they are focusing not simply on the technology for the sake of the technology. Instead, they are focused on how the technology will help their customers. Their initial foray into predicting travel and stop durations is somewhat mundane and aligned with virtually every other TMS/R&S vendor we speak with; however, their vision to embed artificial intelligence and machine learning into their solution and workflows is what we liked seeing.

“We believe that the ability to develop routing solutions that are cognizant of emissions, as well as customer and employee satisfaction, is a significant advancement over the somewhat myopic way solvers have historically worked.”

Summary

At this year’s Optimus conference, ORTEC laid out a compelling vision that addressed our biggest concerns (i.e. technology and their migration to the cloud) while providing a compelling vision and product roadmap. Their project plans seem aggressive but achievable, and given the majority of JBF Consulting’s clients are in North America, we especially appreciated the company’s focus on North America as the key market for the business.

We look forward to seeing how the company progresses toward their ambitious plans and hope that some of the innovations discussed by ORTEC become commonplace across all logistics technology providers.

RELATED POSTS

5 Key Aspects of OTM Platform: 2023 Update

5 Key Aspects of BY’s New Luminate TMS Platform Reviewed

A Comprehensive Strategy for Selecting Transportation Logistics Technology Vendors

Desired End State – An Insiders Guide to Acquiring TMS Technology

Unpacking FourKites’ Vision for Connected Supply Chains: A Recap of the 2023 Visibility Conference

Detail Design of a TMS Implementation

ebooks/white papers

Buyers Guide to Transportation Management Systems (white paper)

Mike Mulqueen is a leading expert in logistics solutions with over 30 years managing, designing and implementing freight transport technology. His functional expertise is in Multi-modal Transportation Management, Supply Chain Visibility, and Transportation Modeling. Mike earned his master’s degree in engineering and logistics from MIT and BS in business and marketing from University of Maryland.

About JBF Consulting

Since 2003, we’ve been helping shippers of all sizes and across many industries select, implement and squeeze as much value as possible out of their logistics systems. We speak your language — not consultant-speak – and we get to know you. Our leadership team has over 100+ years of logistics and TMS implementation experience. Because we operate in a niche — we’re not all things to all people — our team members have a very specialized skill set: logistics operations experience + transportation technology + communication and problem-solving skills + a bunch of other cool stuff.

JBF Investor Advisory Services

JBF Investor Advisory Services provides due diligence guidance to private equity and VC firms. We bring decades of log-tech software expertise that has been honed by working closely with our shipper clients to evaluate and implement log-tech solutions.

JBF investment guidance Log-Tech focus areas:

- Transportation Management Fleet Management

- Yard Management

- Parcel Management Routing and Scheduling

- Logistics Modeling

- Digital Freight Brokerages Visibility / Analytics Transportation / 3PL Managed Services